The same concept can be applied to set up a button that reads “Add Money Now” which appears only if has_funded_account = false; once a deposit lands, that space can promote “Explore High-Yield CDs” instead, driven by the “High-Value Funders” or “Single-Product” audiences. The CTA rules reference live Segment fields that HubSpot refreshes in near real time.

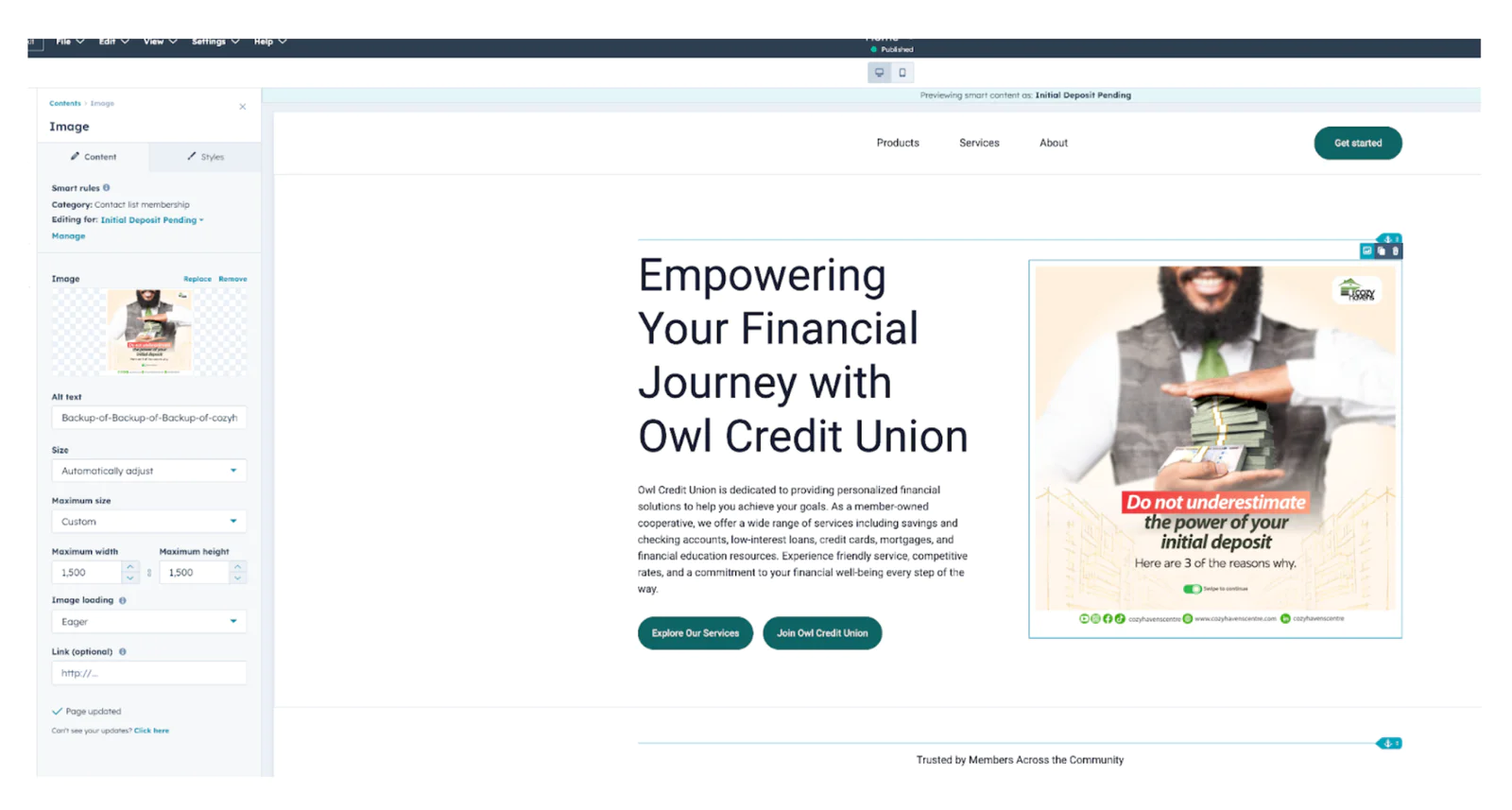

For members whose initial_deposit_amount meets the VIP threshold, conditionally display a hero banner celebrating their high opening balance and inviting them to an exclusive “Premier Savers” webinar while everyone else sees a simple “How to fund in three clicks” graphic.

HubSpot handles the presentation subject lines, layouts, smart sections, CTAs while Segment supplies the truth about each member’s latest behavior. The integration ensures every message, banner, and button is contextually perfect.

Before launching any automated program, decide where the journey logic itself should live. Segment Journeys excel at real-time, multi-channel coordination powered by real-time events, profile and warehouse data, while HubSpot workflows for quick-turn campaigns that leverage HubSpot’s own channels and object schema.

When to pick Twilio Segment Journeys

When to use:

- Critical, revenue-driving journeys (e.g., 60-day fund-and-direct-deposit sprint).

- Flows that span multiple channels (email, SMS, push, paid ads, in-branch CRM).

- Journeys requiring deep personalization from warehouse data and traits from customer profiles.

- Customer traits like predictive traits live at the profile core, so segments such as “High Propensity to Set Up Direct Deposit” can drive highly targeted branches.

Why:

- Single tool controls timing, branching logic, and triggers, no duplicate rules scattered across tools.

- State changes (a deposit posts, a DD lands) propagate to every destination in real time, keeping all channels in sync.

- Centralizing logic reduces duplicate, billable events inside downstream tools allowing for cost optimization.

When to pick HubSpot for Journeys

When to use:

- Campaigns confined to HubSpot-native channels (email, SMS via HubSpot integration, in-app banners, smart site content).

- Time-boxed or low-risk drips (welcome series, abandoned-application nudges, monthly newsletters).

- Initial branching handled in Segment based on real-time event qualifications and profile traits and activation level journey logic handled in HubSpot.

Why:

- Simple to manage when real-time, cross-tool coordination isn’t critical; hourly property sync is sufficient.

- Qualification and actions align with HubSpot’s native object model, workflows can trigger off built-in objects like Deals, Tickets, or the Product Catalog, making use-case setups (ex. cart-abandon recipes tied to the catalog) intuitive but more schema-locked to HubSpot.

Example “60-Day Deposit” journey

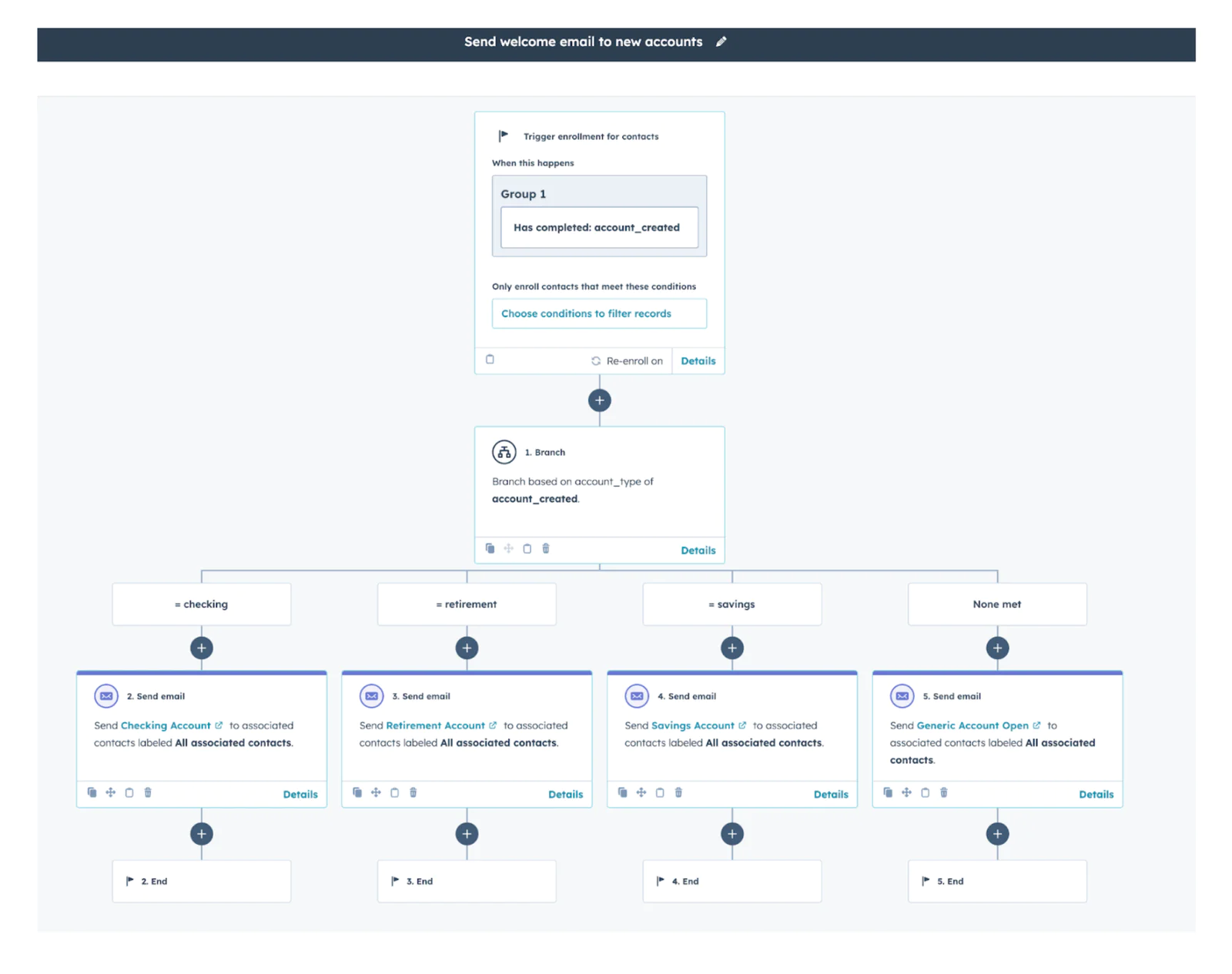

1. Entry Trigger - Member event Account Opened.

2. Funding Check Path

- Condition: has_funded_account = false → wait 48 hours, email “Fund Your Account.”

If still false after another 24 hours, SMS nudge. The moment a deposit posts, the trait flips, and the member exits this path automatcally.

3. Direct-Deposit Path

- 72 hours after has_funded_account becomes true, condition: direct_deposit_set = false.

Dynamic landing page “Route Your Paycheck, Earn $50.”

Trait flip to true ends the branch immediately; otherwise a final reminder fires at Day 30.

4. Cross-Sell Path

- A Journey wait node pauses until Day 60.

5. VIP Loop

- Members from Audience High-Value Funders (initial deposit ≥ $1000) detour to a quick “Thank-You” push and early invitation to a premium webinar.

Made by Safdar Jaffari

Made by Safdar Jaffari