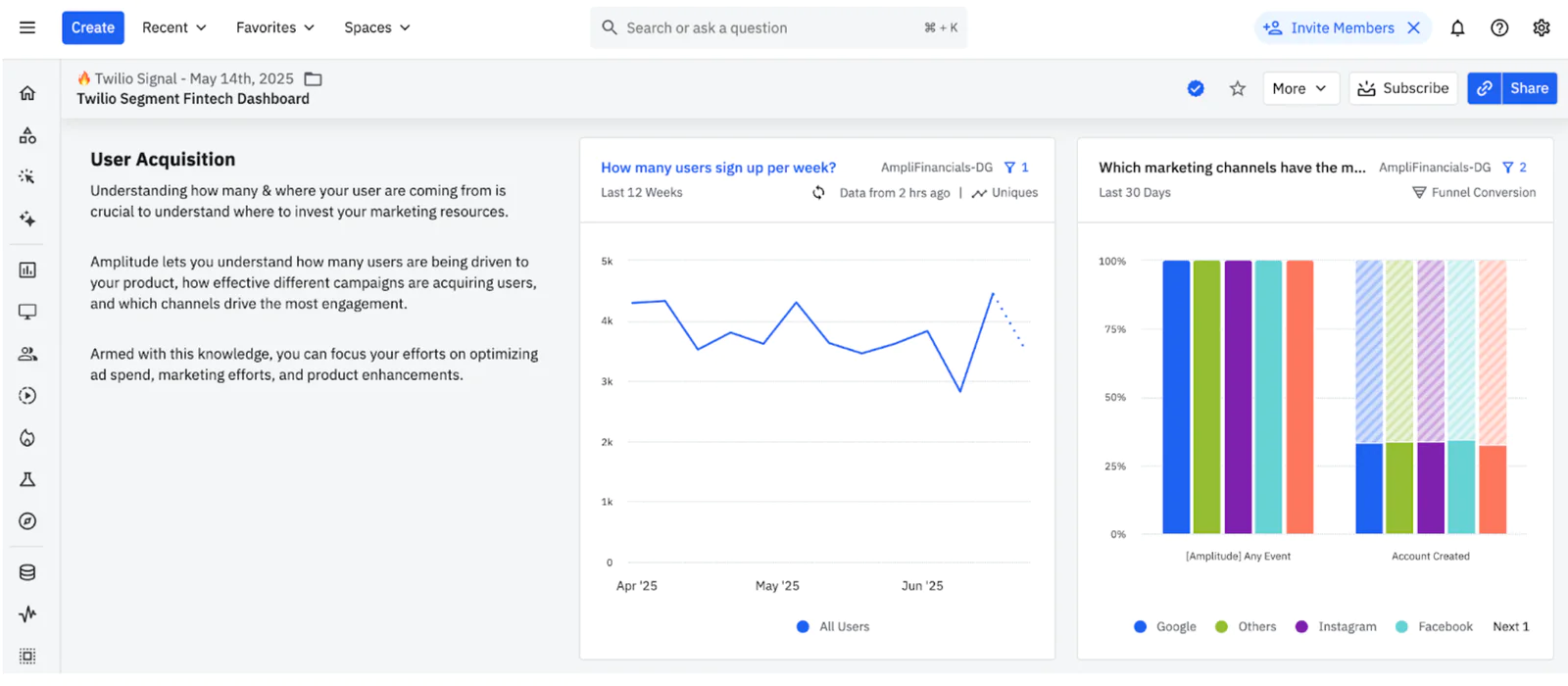

Streamline Fintech Onboarding with Real-Time Insight to Action

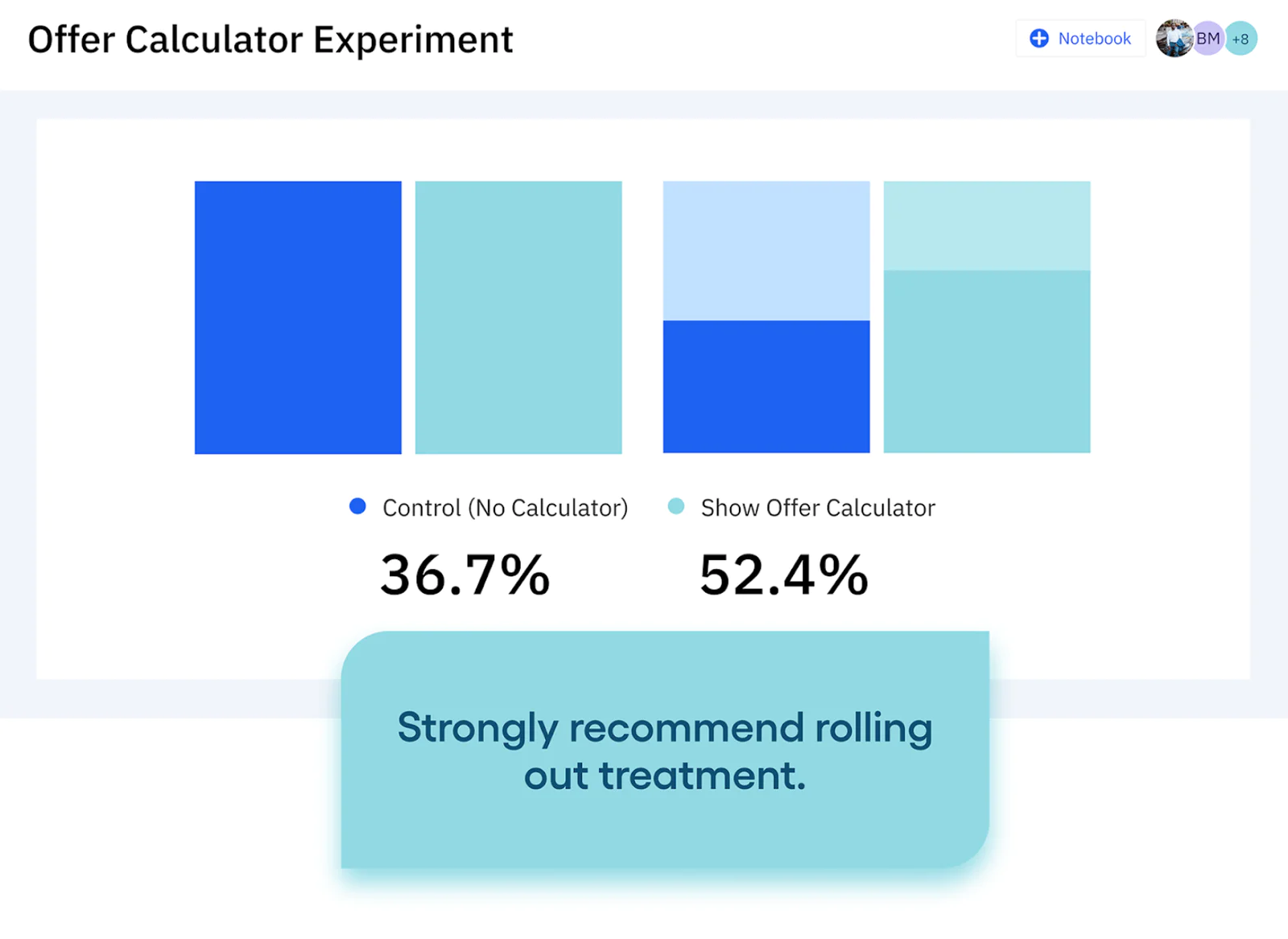

Acquisition and onboarding in financial services require more than just usability—they demand trust and fast value delivery. This recipe shows how Fintech teams can identify friction, optimize signup flows, and trigger personalized follow-ups.

What do you need?

-

Source: Amplitude

-

Source: Segment SDK

-

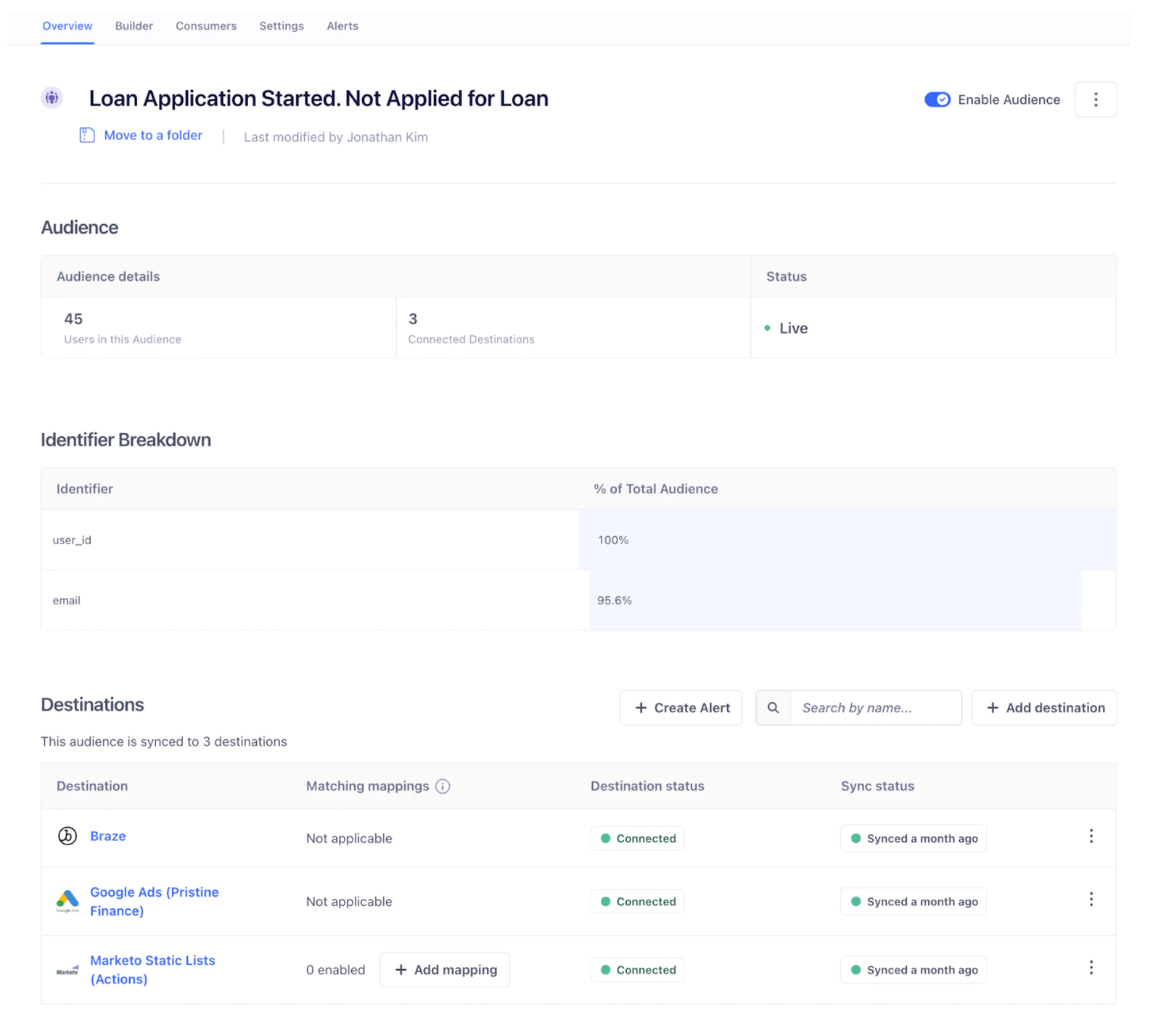

Destination: ESP (e.g., Braze, Iterable)

Easily personalize customer experiences with first-party data

With a huge integration catalog and plenty of no-code features, Segment provides easy-to-maintain capability to your teams with minimal engineering effort. Great data doesn't have to be hard work!