COURSE 4 • Lesson 4

Setting company strategy with data

How can you use data to set your company's strategy? We'll share how we think about this at Segment.

COURSE 4 • Lesson 4

How can you use data to set your company's strategy? We'll share how we think about this at Segment.

Before you set your company strategy for the next year, you'll want a healthy understanding of your business — both where you're doing well, but more importantly what needs to improve. To do this, it's critical for you to understand how your business works. Because we're most familiar with Segment as a business, we'll color this section with examples about Segment, which may be most useful if you're a SaaS business. That said, the general methodology can be applied to any type of business.

Disclaimer: What you see here is 100% dummy data.

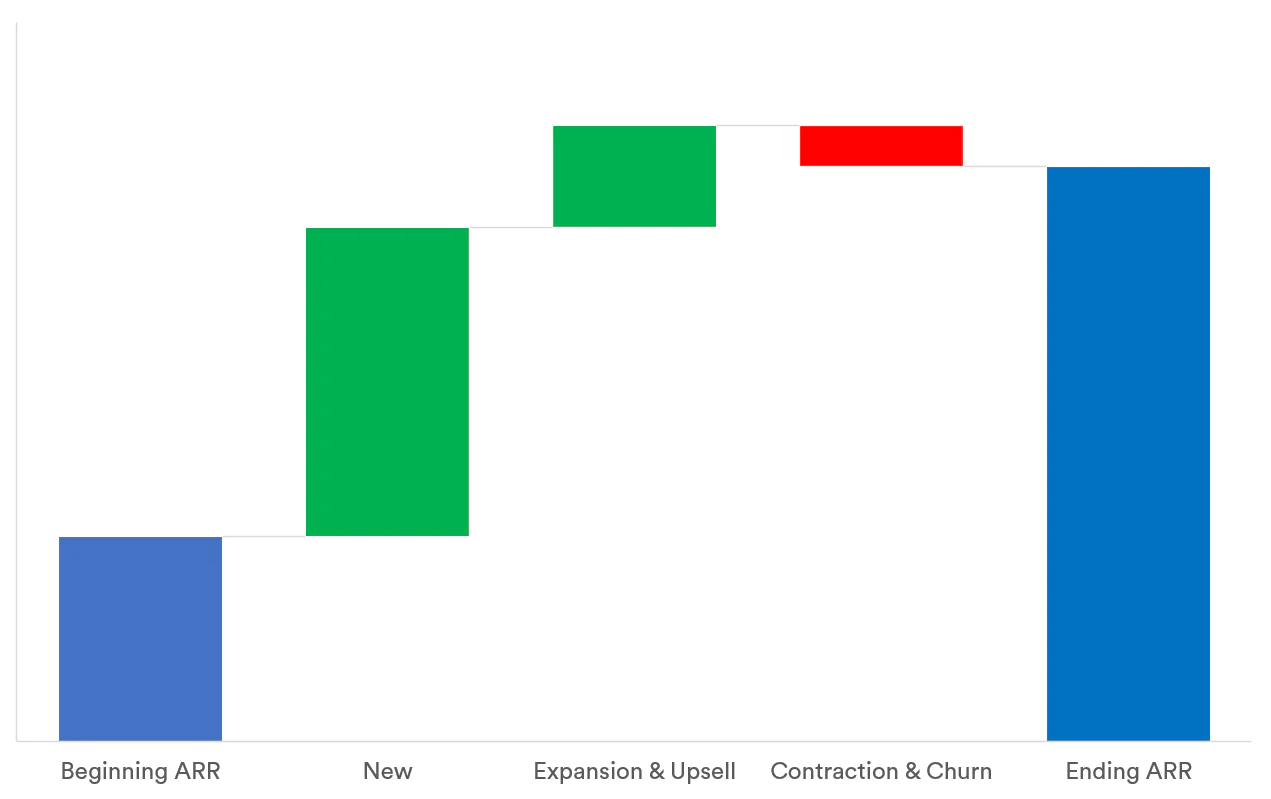

As a SaaS business, much of our revenue comes from annual contracts we have with our larger customers. We like to think about the growth of our business as an ARR Walk. We have three major drivers for how revenue we brought into a quarter can change. We have a certain amount of recurring revenue we bring into the quarter — from there we can expand/upsell within accounts, we can contract/churn within accounts, and finally we can acquire new customers.

For a long time, we just looked at how our revenue was changing over time, but it hides a lot of critical information about what our business is actually doing. For instance, really strong account expansion can hide concerning churn trends. Or really strong new customer acquisition can hide lack of ability to expand within accounts.

If your business is not a SaaS business, that's totally okay — this idea is probably still fairly relevant. Try to break down the main metric you care about (revenue, # of critical actions happening, MAU, etc.) into a better understanding of how you break down in terms of new customer acquisition vs. growth within existing customers vs. churn.

ARR Walks (or something similar) are probably the most important type of metric, since it helps you model growth of your most important metric. However, there are a number of other key financial metrics that it's critical you understand over time. If you have investors, they can help you through these in much more detail, but a few of these metrics include:

Year over year revenue growth

# customers / users

Gross margin

Cash burn / runway remaining

Capital efficiency

Key product metrics

Customer NPS / churn / satisfaction

Once you have this deeper understanding of your business, you're in a better place to set a strategy that makes sense. Obviously, you're looking to grow your business, but the ARR Walk will help you understand how you can go about doing this. If you have a churn number that makes you uncomfortable, you should invest in shoring up the main issues impacting customer satisfaction & NPS. If you have a business model that you believe is "land and expand," but you're not seeing that reflected in the upsell numbers, you may want to focus on product features and support structure that will help you expand. If you have a product whereby network effects can help you, you might want to work on new customer acquisition using network effects.

You may also decide not to work on ARR Walk / growth related metrics. For instance, if you have serious capital efficiency issues, you may want to invest in making your internal teams or the cost of your product/infrastructure more efficient. These decisions can only be made well once you understand all of the key drivers of your business, which is why it's critical you have this data if you want to set a great strategy!

One of our core values at Segment is Focus. And despite having that as a core value, we still always end up overcommitting. Recently, as a company with several hundred people, we started picking no more than three major undertakings to focus on each year.

At Segment, we generally like to focus at least two of our themes (and sometimes all three!) on the growth-related drivers, since this is the most important thing to our business. However, after we've invested a lot on growth-related ones, we generally pull back a bit and focus on either quality or efficiency metrics to shore up those metrics (which can go downhill if we only focus on rapid growth for too long).

Our biggest advice is: don't try to do everything at once! You can list everything you want to do from a strategy perspective, but you must whittle down that list and actually say "no" to some things. We recommend that for small companies having just a single theme and switching between that theme every quarter or two. For companies with a few hundred employees, having three themes across a year seems to work well.

Once we've set a focus area, we then want to really understand that area incredibly well. As a recent company strategy initiative, we decided we wanted to understand better how our customer acquisition works to see how it could go faster. We found a very interesting pattern — that our fastest sales cycles were happening with someone who was familiar with Segment from a former job. We dubbed such people as Segment champions.

Though it sounds obvious in retrospect, we hadn't made the connection that behind our Segment accounts were going to be our biggest advocates. Furthermore, we hadn't really realized that people hop between companies of different sizes all the time, so a customer using the free tier Segment for their startup could easily be leading a data team at a mid-market or enterprise company just a year later.

This caused us to launch a study — both qualitative and quantitative — to better-define Segment champions. We tried to understand the stories of a handful of people that we thought clearly were Segment champions and understand how they used Segment to see what they had in common with each other. We finally settled on a quantitative metric and have some exciting ideas about how we plan to attract new champions to Segment. We only have this clarity because of the deep-dive into the problem we're solving.

Once you have a clear understanding of what you want to do and the metrics you want to drive, you're ready for the next steps: Operationalizing Goals with Data.

Building a data driven company

Enter your email below and we’ll send lessons directly to you so you can learn at your own pace.