Analytics and data collection is a very broad topic and it can be quite overwhelming. How do you get started? Over the last seven years, we've onboarded tens of thousands of companies onto their first analytics setup and we're ready to share our simple method. This is your "install analytics in under two hours" quickstart guide.

Why analytics?

Let's start with the basics, what are we doing here? You install analytics for five core reasons:

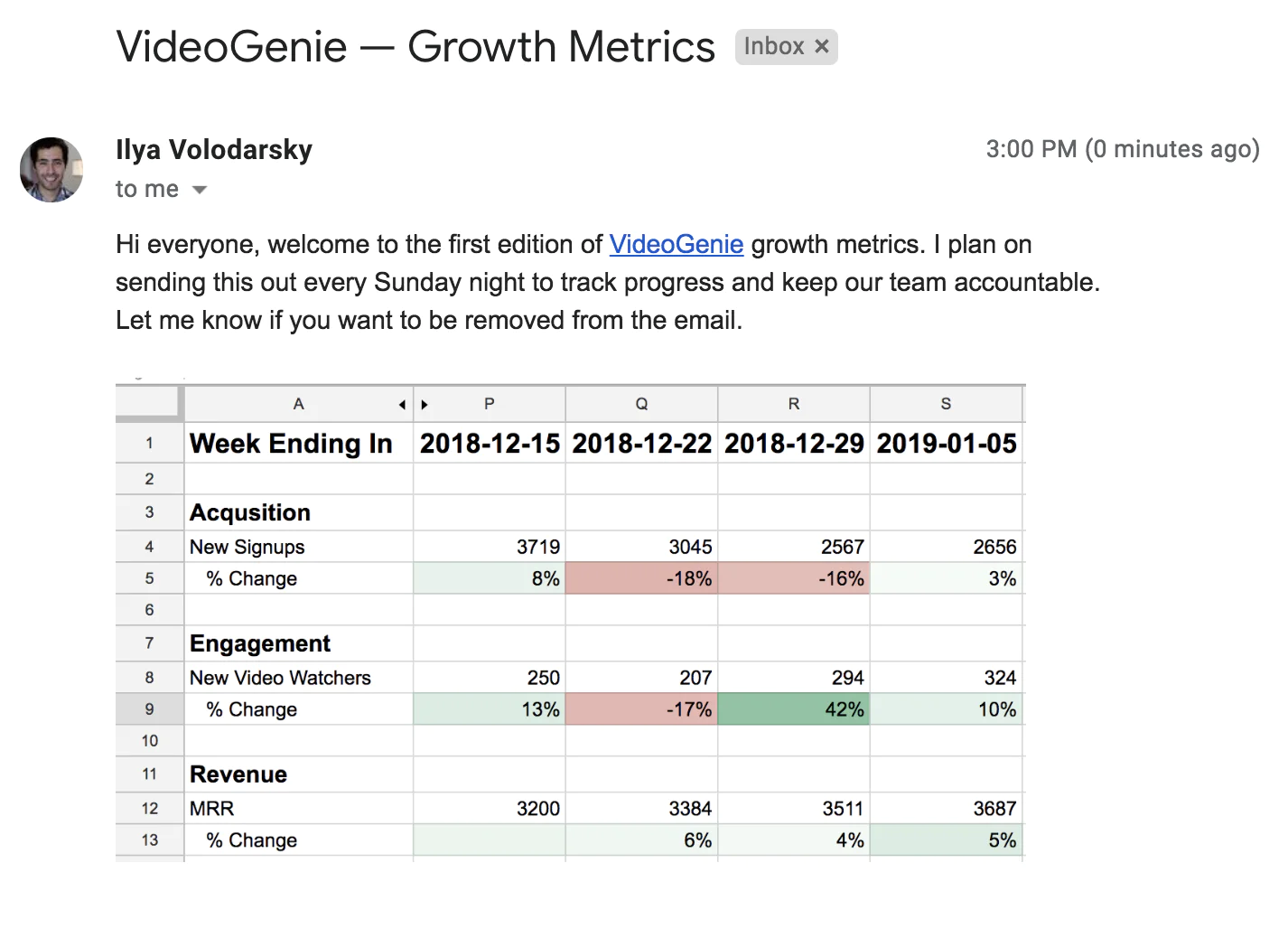

- To understand your business, your product, and your customers in a numerical way.

- Get a non-bullshit view into product market fit: are users getting value and coming back week over week?

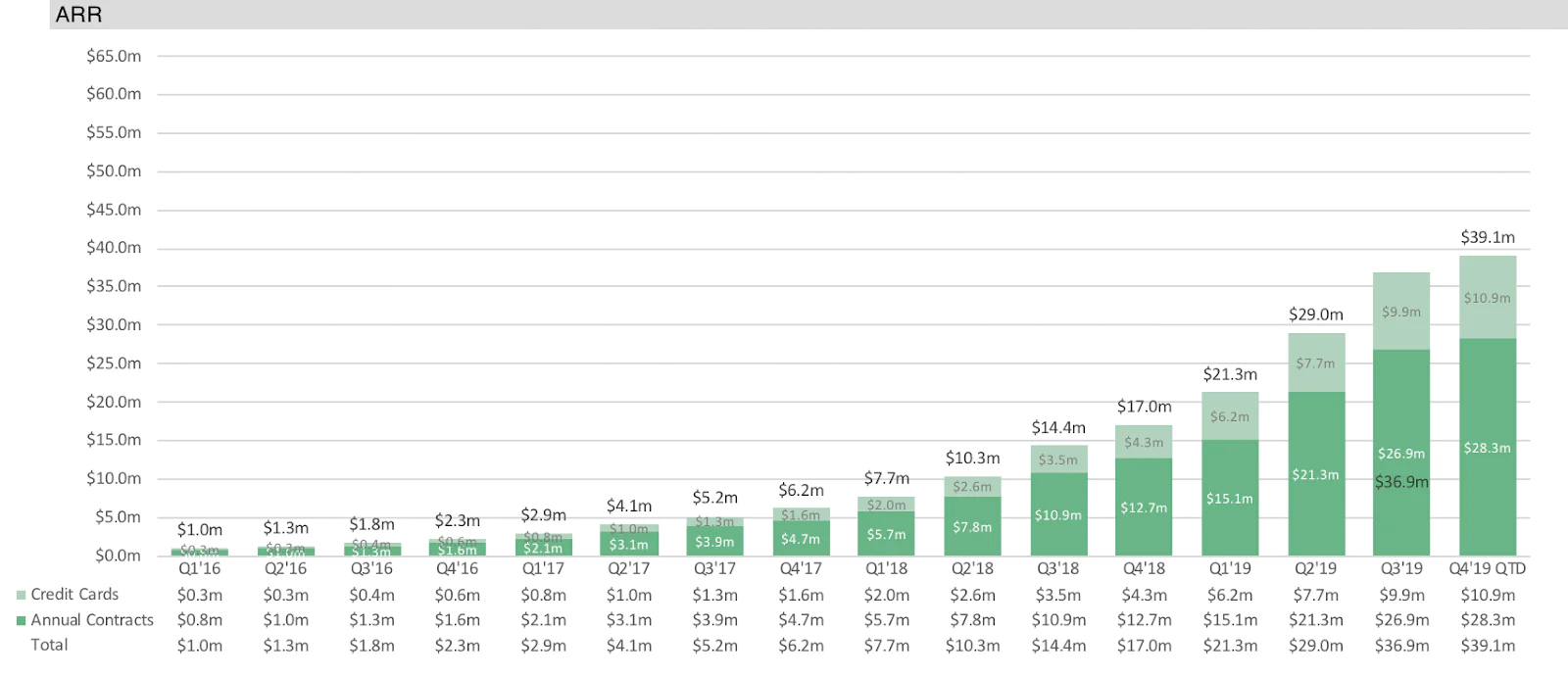

- Model your business as a funnel + core metrics: when your core metrics grow, so does your business.

- Learn the right place to focus: understand where the biggest funnel drop off is and focus your efforts there.

- Grow the business: grow the business based on the funnel focus area above.

But mostly because you can't (see) fix what you don't measure.

The quickstart

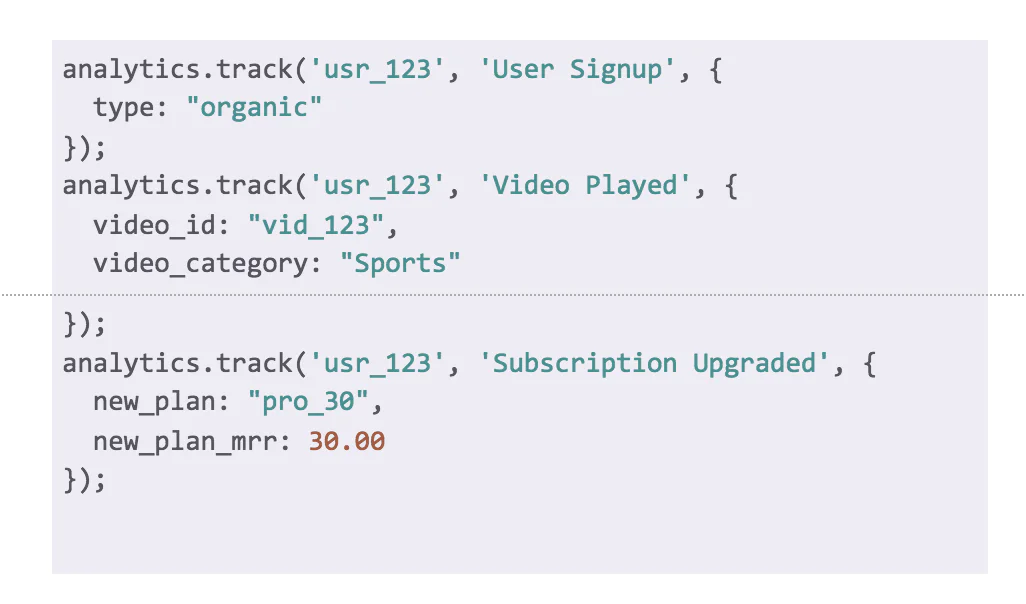

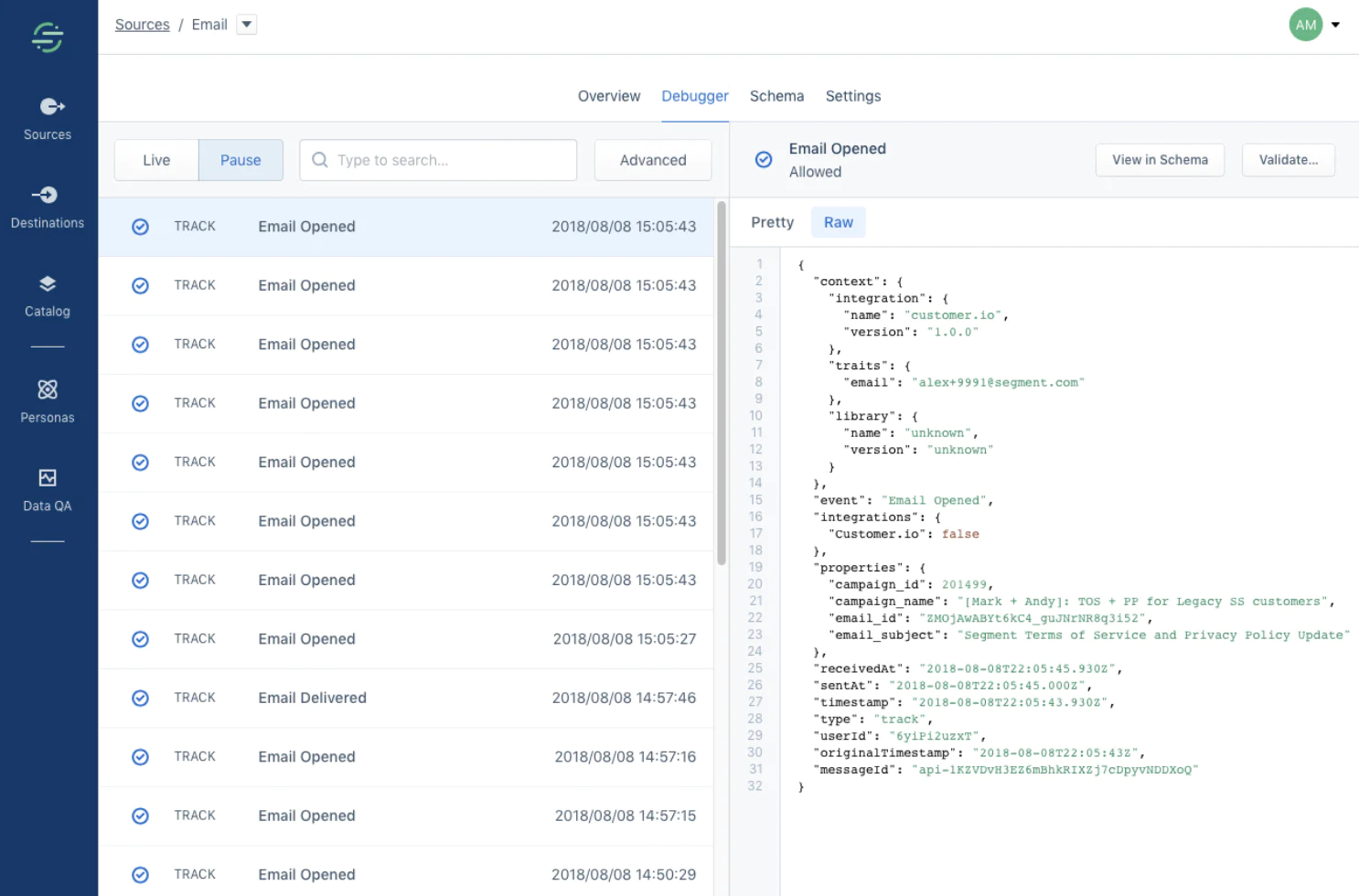

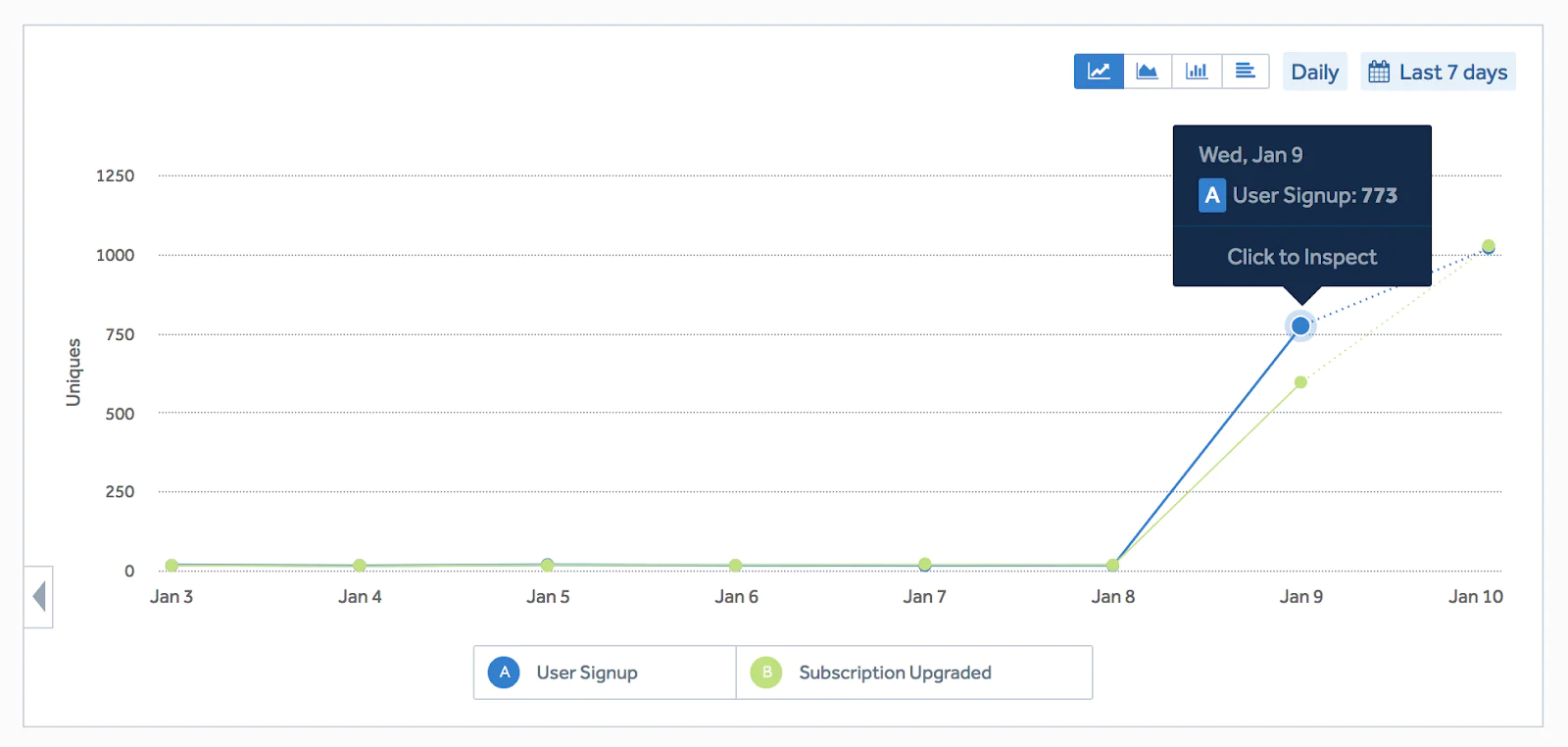

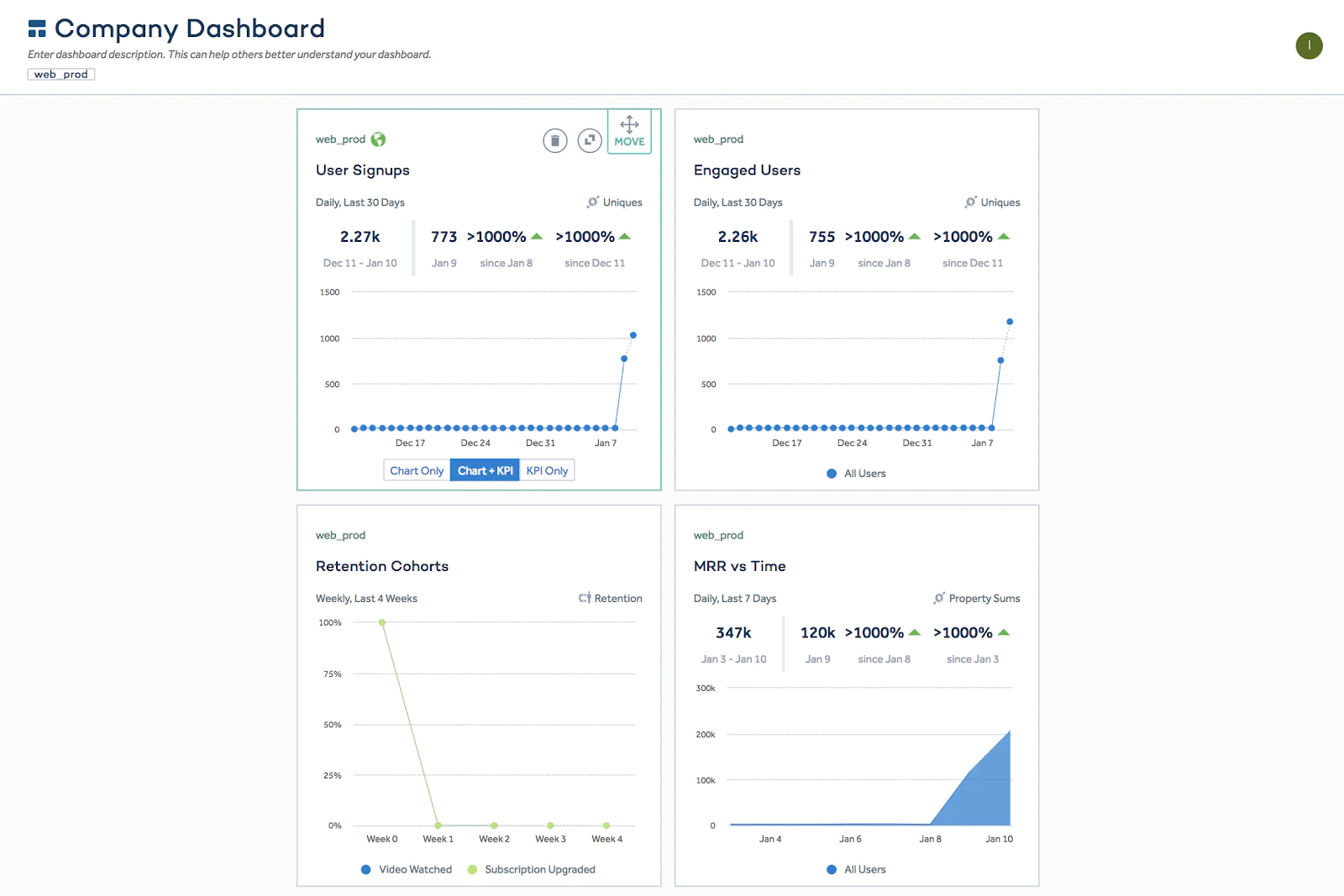

Here's the five-step quickstart process: 1. Business goals 2. Funnel 3. Collect data 4. Metrics 5. Dashboards

Let's do this!

Business goals

The first action item is to note your business goals. Your business goals focus your data collection and metrics plan around solving those objectives. Here are some common examples to get you started:

- I am launching a new product, and I need to understand and improve the following:

- I own an existing product and need to understand and grow the product/business.

- I own an existing product, but the existing analytics data is too messy to do an analysis.

- I want to use new analytics and marketing tools, but integrating new tools is too difficult and time consuming.

- I need to answer analytics questions faster.

- I need to standardize and clean up data across multiple products or business units.

If one or multiple of these should sound familiar, then you're ready for an analytics refresh. The next step is to define your product's funnel.

Funnel

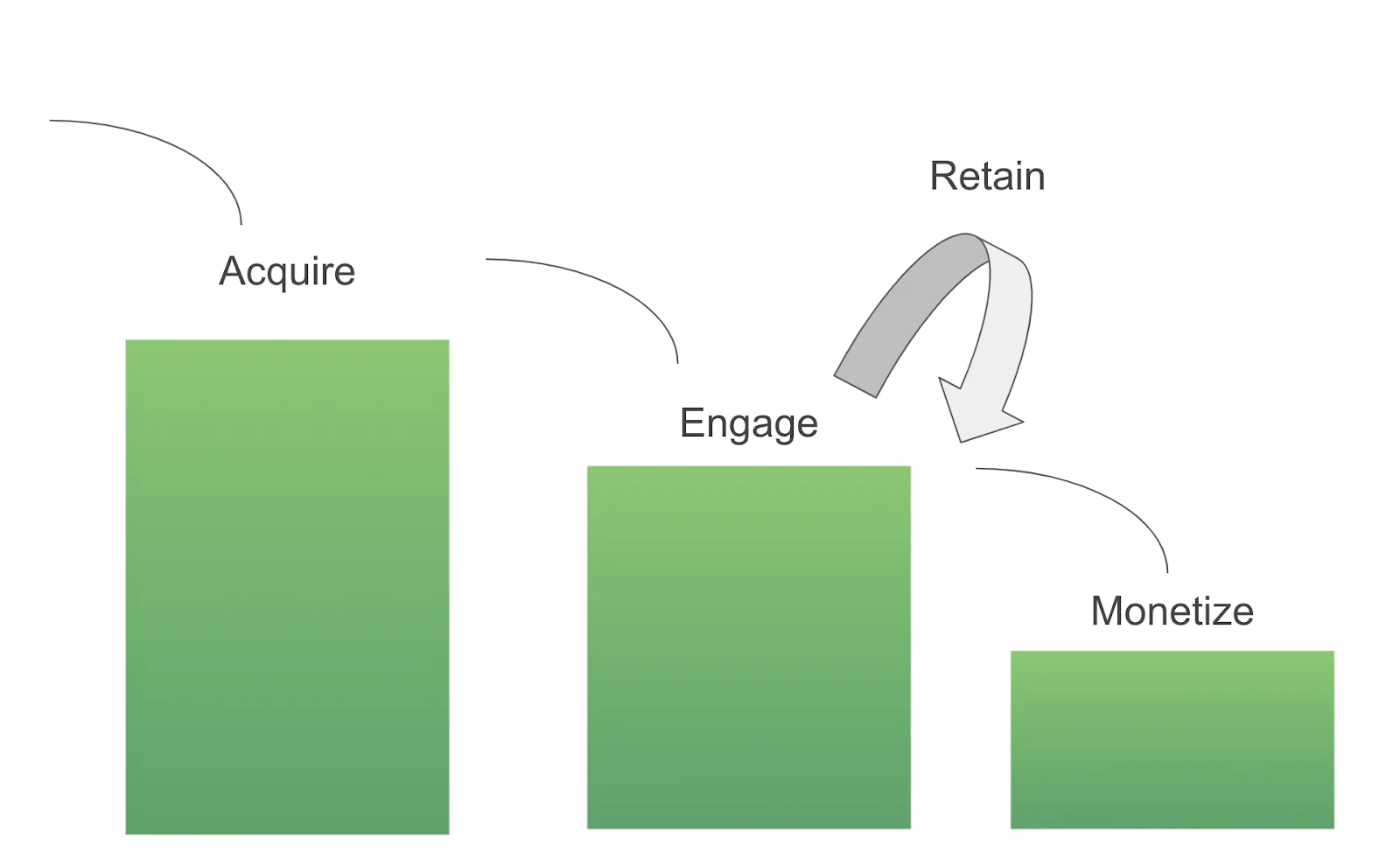

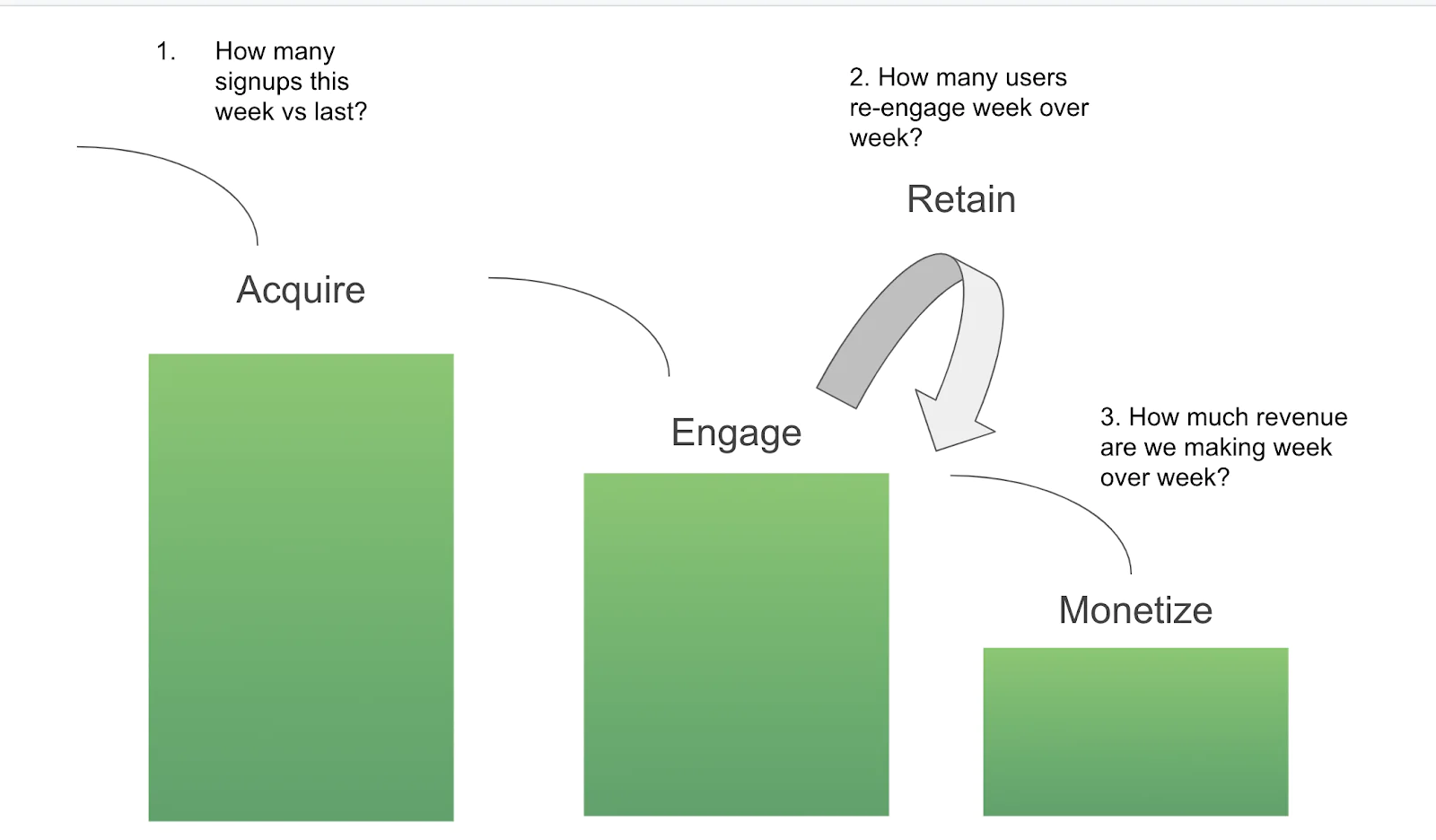

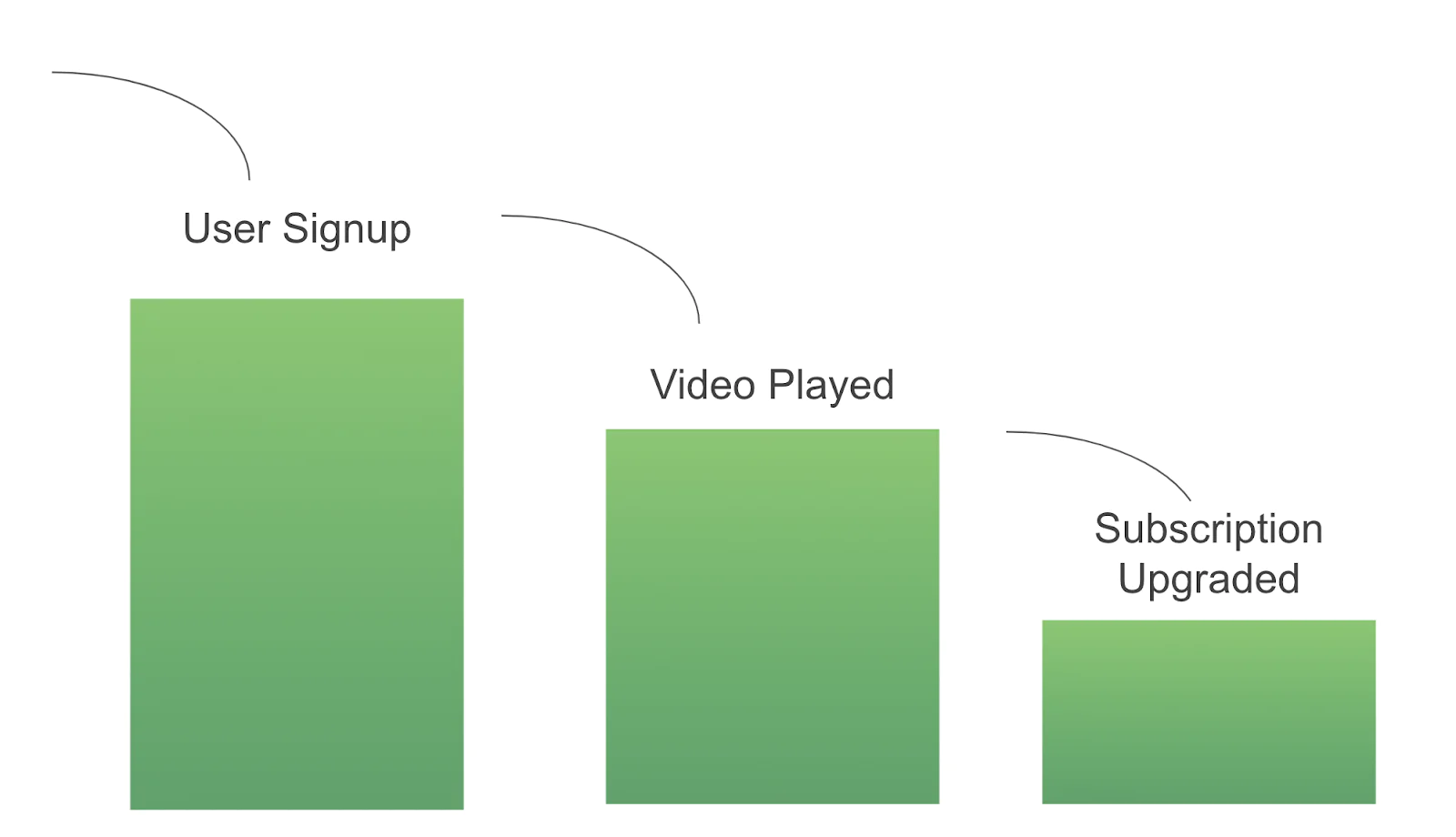

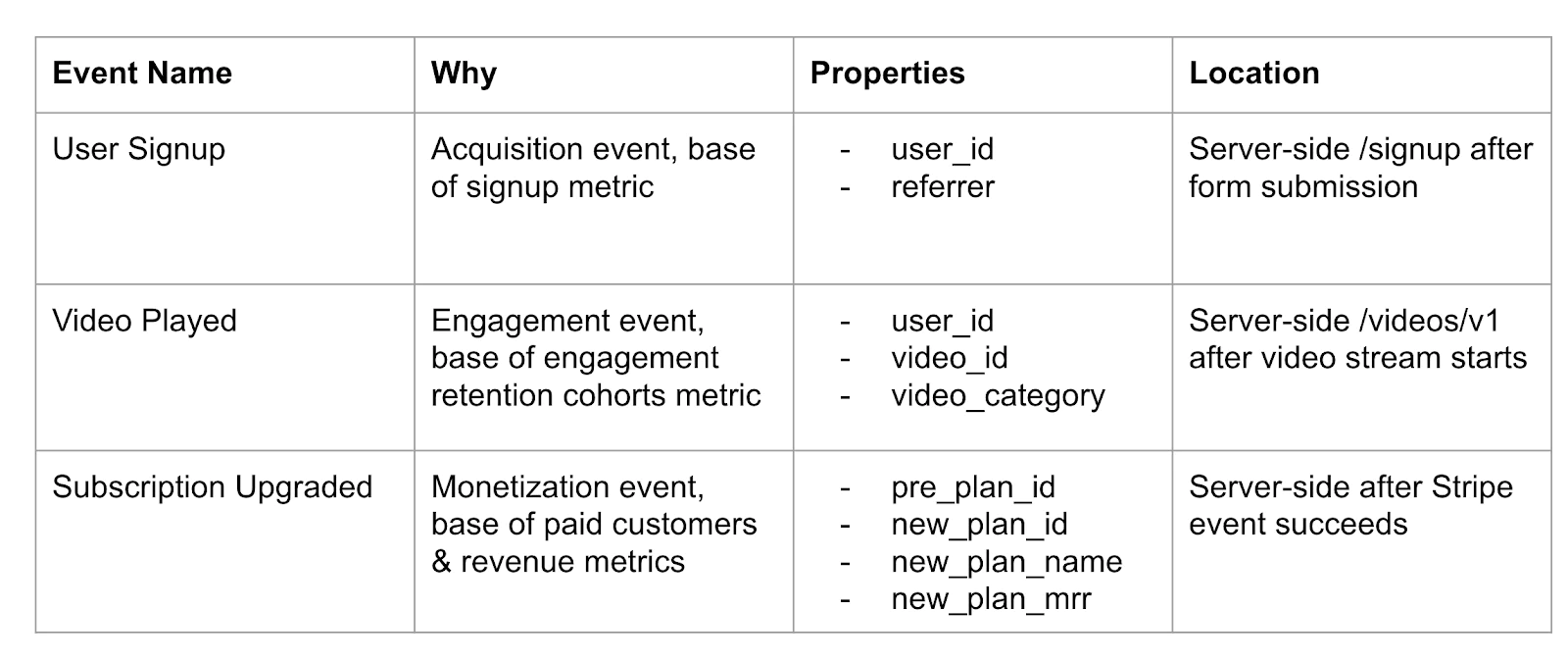

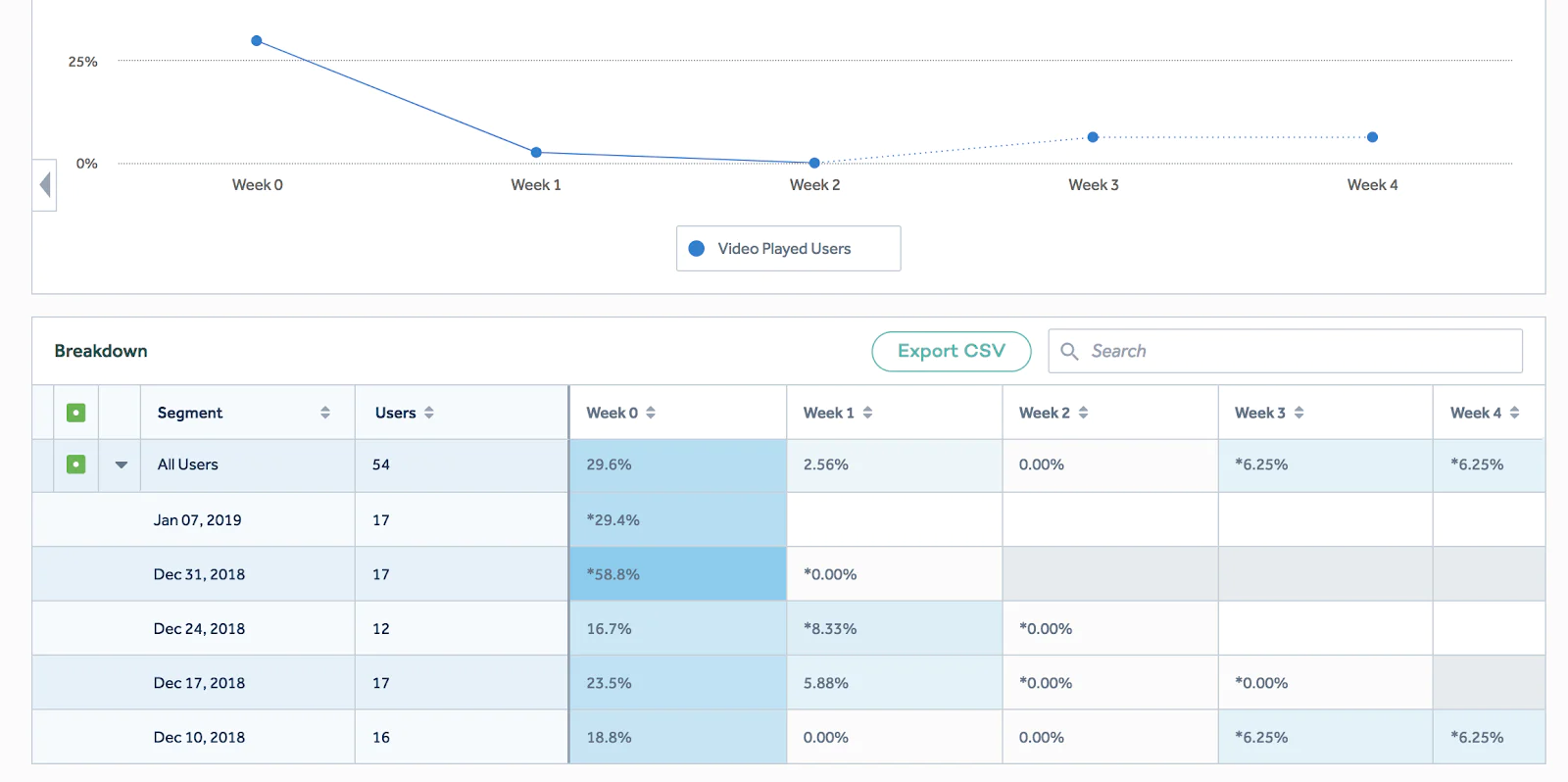

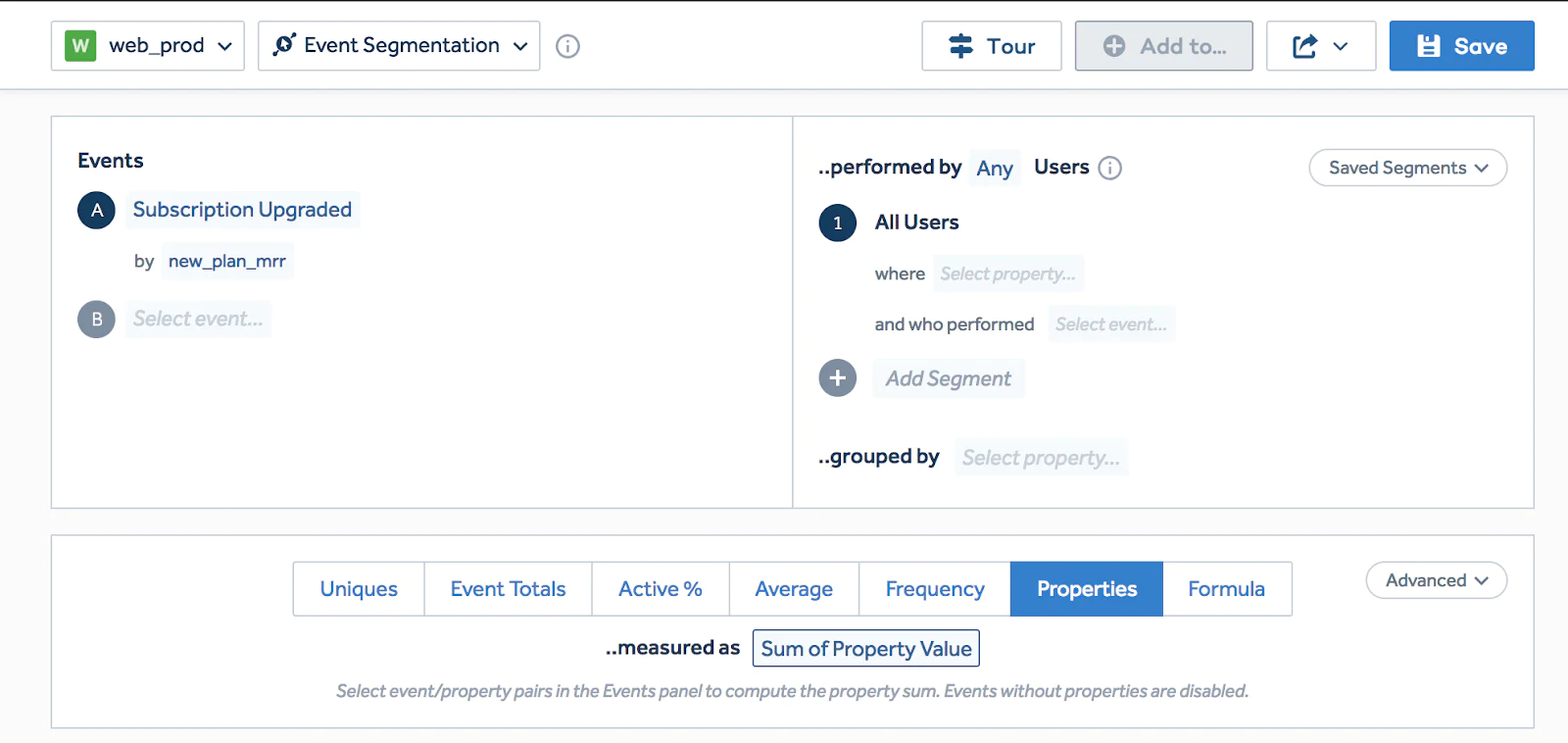

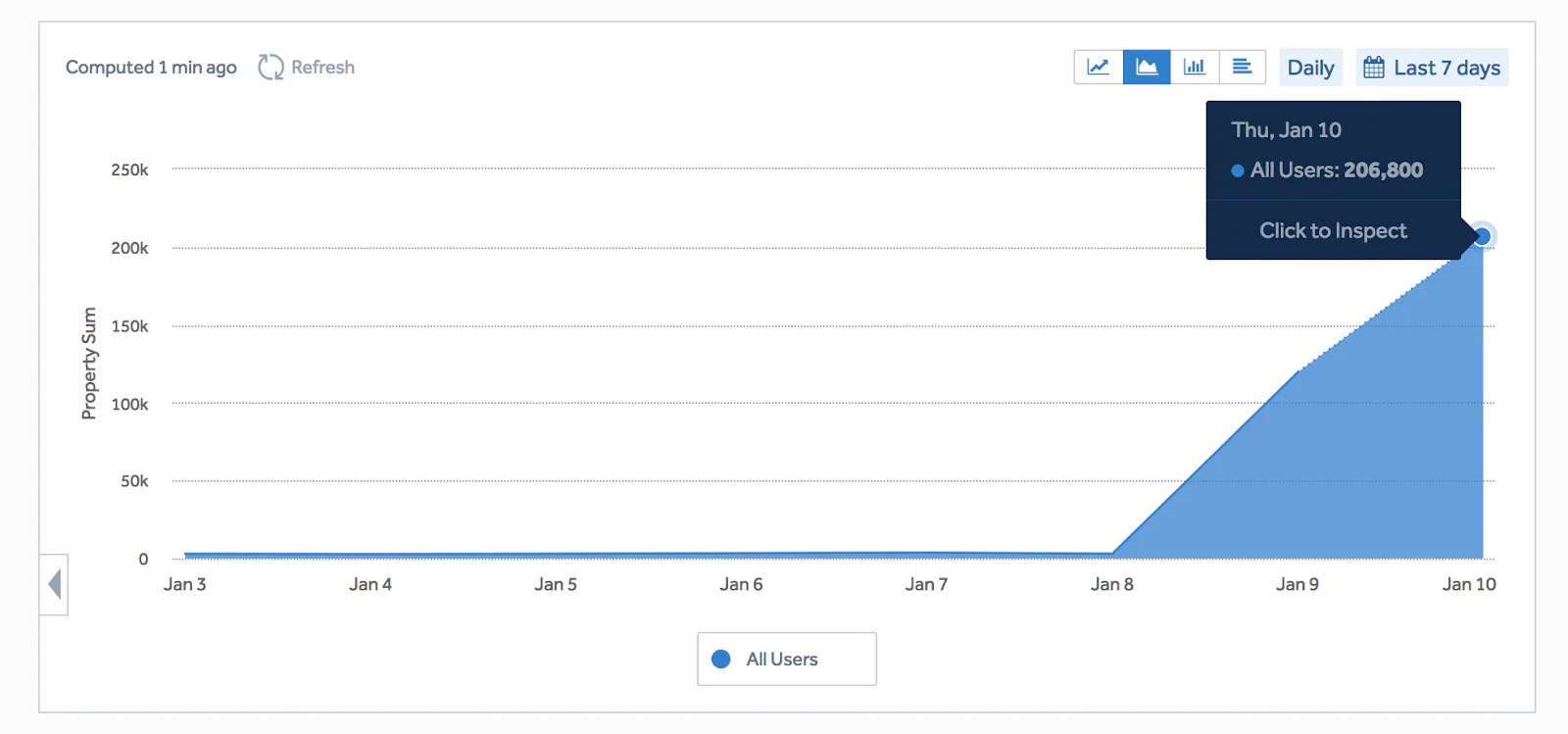

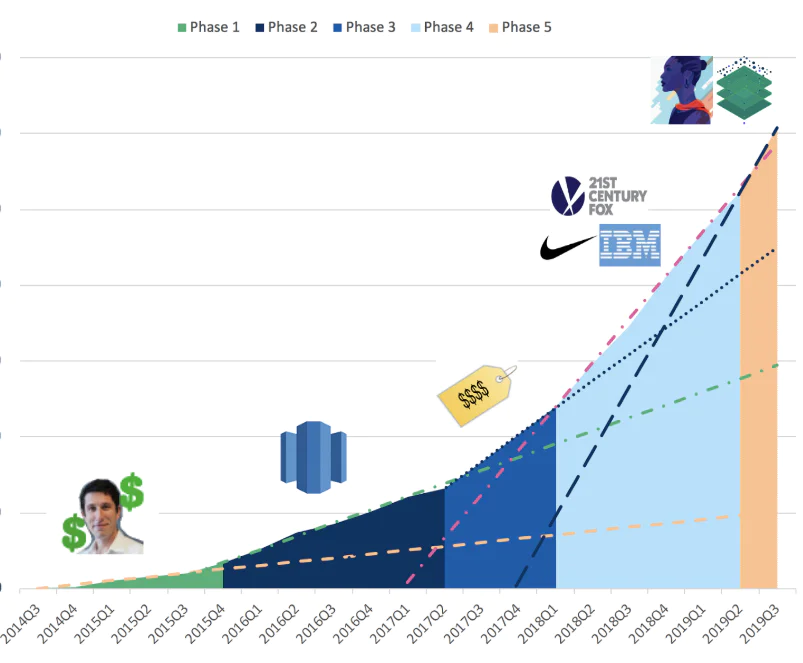

Pirate metrics AARRR (acquisition, activation, retention, revenue, and referral) define a product's full funnel categories. When starting out, we recommend to just think about the acquisition, engagement, and monetization steps of your customer journey.