Problem: The Deposit Outflow

In the face of the ever-changing economic landscape, banks play a crucial role in ensuring financial stability and providing essential services to individuals and businesses. However, recent times have presented significant challenges to banks worldwide. One of the key issues haunting the banking sector today is the relentless struggle with deposit outflows (see more below). In this recipe, we’ll shed light on how banks are grappling with this phenomenon in the current economic climate and how Twilio Engage can solve these problems.

What is a Deposit Outflow?

Deposit outflows occur when customers withdraw funds from their bank accounts at a faster rate than new deposits are being made. This situation can arise due to a multitude of factors, including economic uncertainty, market volatility, changes in interest rates, and customer sentiment.

The current economic climate is marked by increased volatility, uncertainty, and a growing sense of financial unease among individuals and businesses. Factors such as geopolitical tensions, trade disputes, and the ongoing global pandemic have all contributed to a sense of insecurity, leading to an environment where deposit outflows become more prevalent.

Why do Deposit Outflows happen?

Economic uncertainty: Uncertain economic conditions create fear and prompt individuals and businesses to hold more cash or seek alternative investment opportunities, leading to a decrease in deposits held in banks.

Low interest rates: In response to economic challenges, central banks often lower interest rates to stimulate economic growth. While this can benefit borrowers, it reduces the incentive for depositors to keep their money in banks, as the returns on savings diminish.

Changing customer behavior: Technological advancements have revolutionized the way individuals manage their finances. The rise of digital banking, payment platforms, and fintech startups has provided customers with more choices, making it easier to switch between financial service providers and reducing customer loyalty to traditional banks.

How does this affect the bank?

Liquidity challenges: Deposit outflows can strain a bank's liquidity, as they need to maintain a sufficient amount of cash to meet customer withdrawal demands. If a bank experiences a sudden surge in outflows, it may struggle to maintain adequate liquidity, potentially leading to financial instability.

Profitability pressure: As deposits decrease, banks face challenges in generating revenue through lending and investment activities. This decline in profitability can impede their ability to provide loans to individuals and businesses, hampering economic growth.

Reputation and trust: Frequent and substantial deposit outflows can damage a bank's reputation and erode customer trust. If depositors lose confidence in a bank's ability to safeguard their funds or fulfill their financial obligations, it can lead to a further decline in deposits and create a negative spiral for the institution.

What can the bank do about it?

Enhancing customer communication: Banks need to proactively communicate with their customers to address concerns and provide reassurance during times of economic uncertainty. Clear and transparent communication can help mitigate deposit outflows by building trust and confidence in the bank's stability.

Embracing technological advancements: Banks must adapt to the digital age by investing in advanced banking technologies. This enables them to offer innovative products, improve customer experience, and compete with emerging fintech players. Embracing digital transformation can help attract and retain customers, mitigating the impact of deposit outflows.

The current economic climate has created a challenging environment for banks, with deposit outflows becoming a persistent issue. To navigate this landscape successfully, banks must focus on building trust, diversifying revenue streams, and embracing technological advancements.

For most finance-related applications, there is a sequence of steps you’d expect new users to take to achieve an ultimate goal of conversion. The first step is to create a list of key conversion events in a notepad or spreadsheet. The end goal is to approve a loan to a customer, but the steps leading to the approval must be done correctly! While individual cases may vary slightly in the detail, here are a few generally-helpful tips we’ve found:

Track impressions as well as events. You want to see how many people filled out your form, but also how many people got there in the first place. Make sure you are making page calls or tracking events when a user first enters a funnel step as well as when they leave it.

Take it slow. Don’t agonize over getting individual steps in your funnel exactly right. What's most important is that you have a definition of the funnel that you can iterate on over time.

Minimize the effort of each step. The best funnels we’ve seen balance the value the user gets from the cost to complete that step. If the cost is too high, users will drop off.

Now that you’re tracking the right events, you will want to send funnel events into Segment. Ensure you have Javascript or mobile sources created within Segment that are tracking your key goals and metrics and the steps leading up to it. If you don’t know what your key goal or metric is, we suggest reading our article on choosing the “one metric that matters.”

Whatever yours is, make sure it ties to some meaningful part of your businesses’ revenue. Examples of common conversation events could include applications submitted, account funded, or users signed up. Once you have the one metric that matters, make sure you’re tracking the 3-5 steps which lead a user to that point.

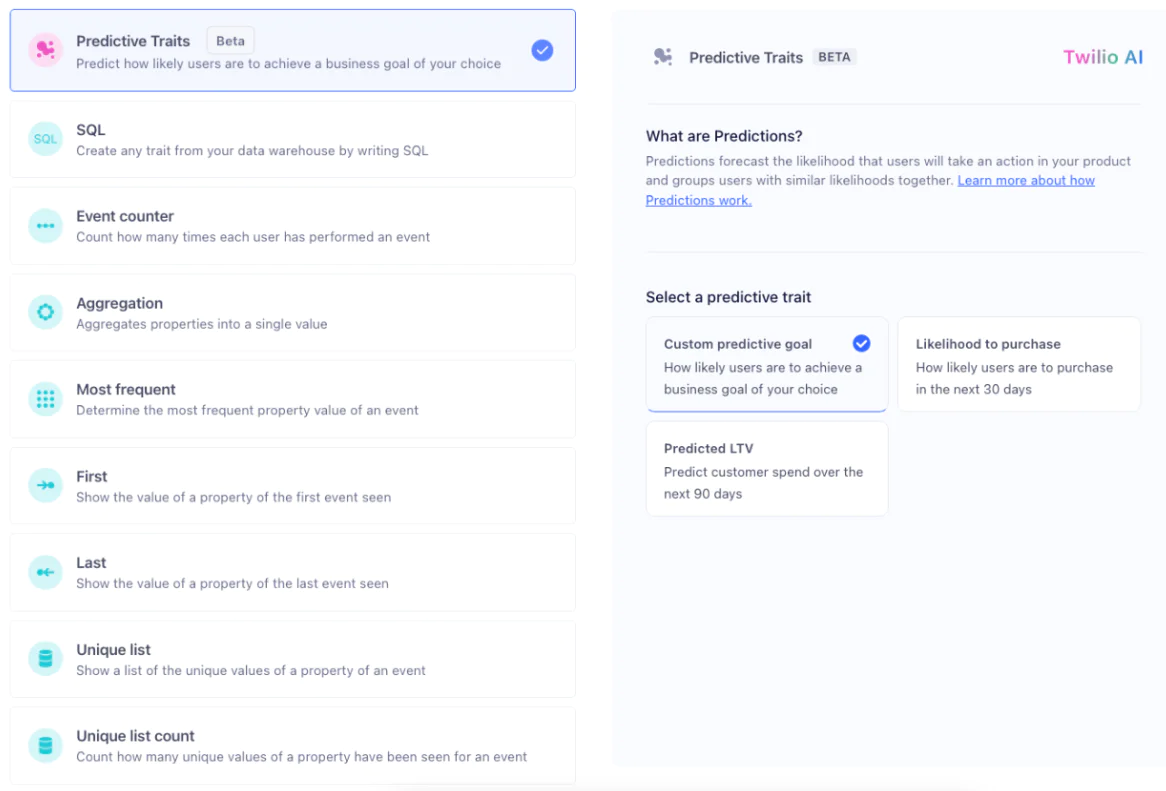

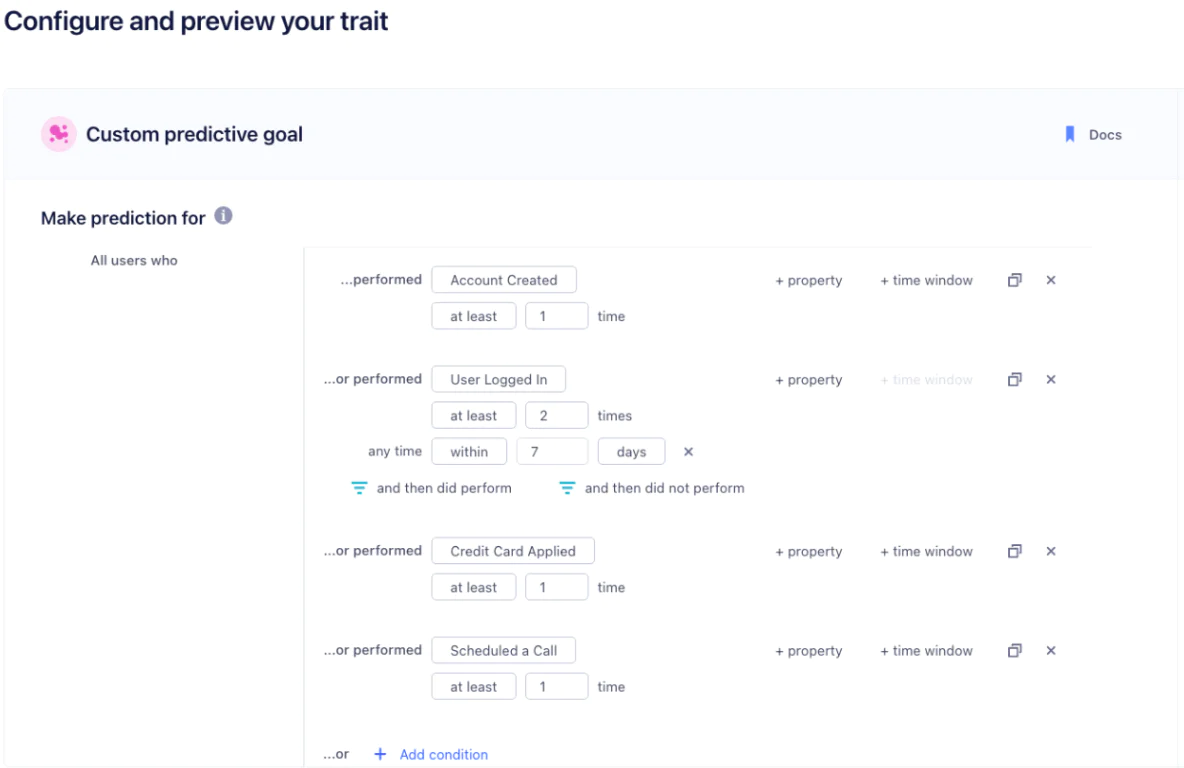

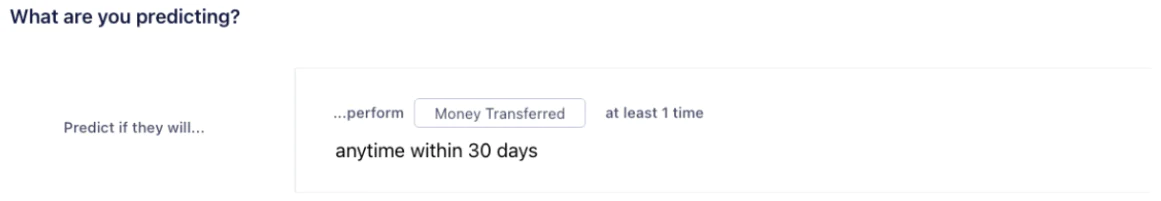

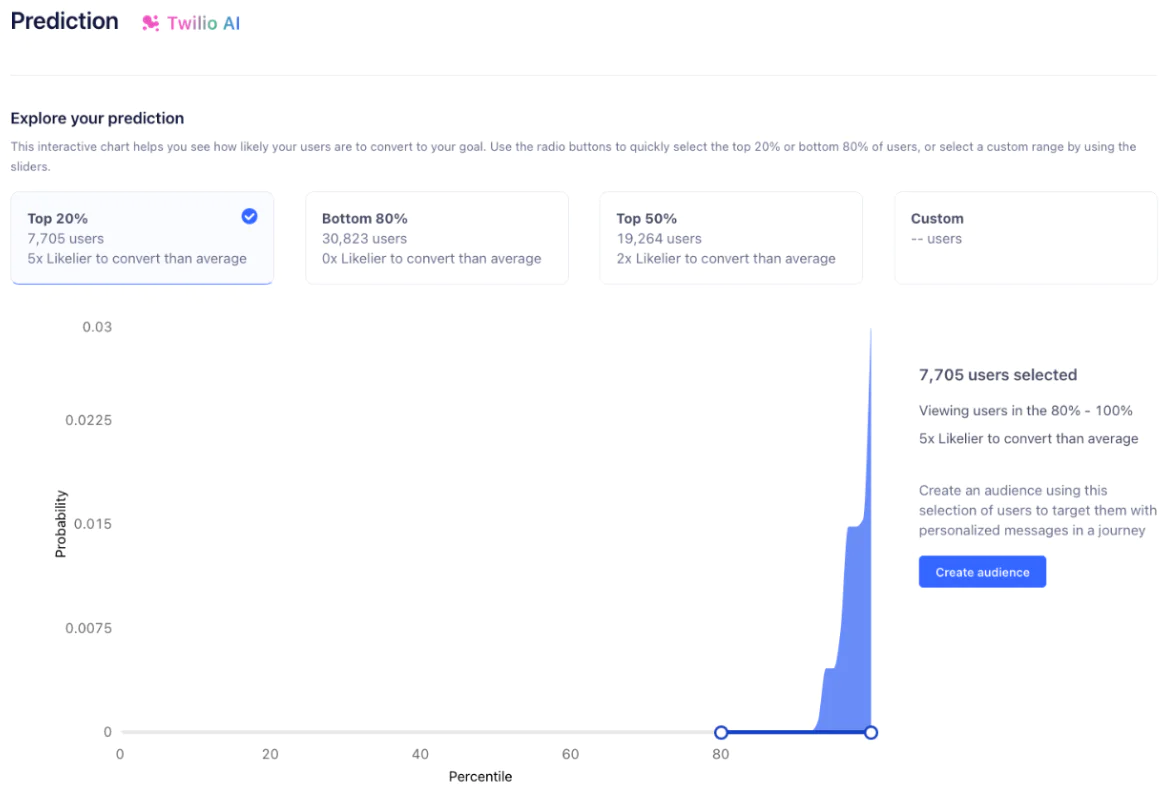

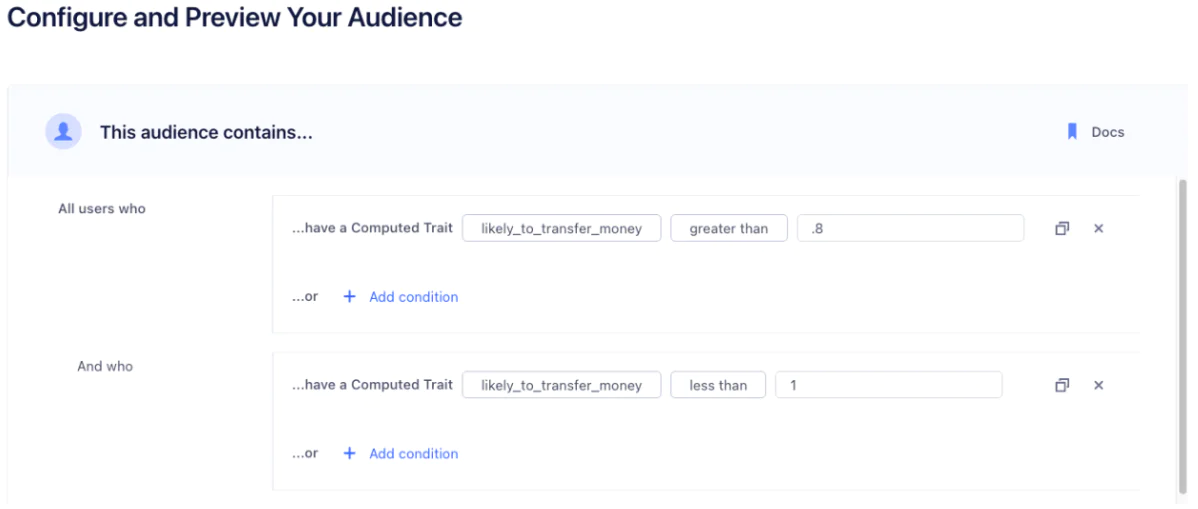

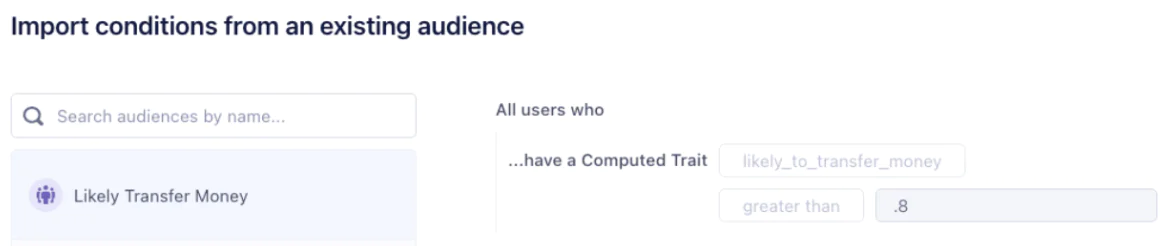

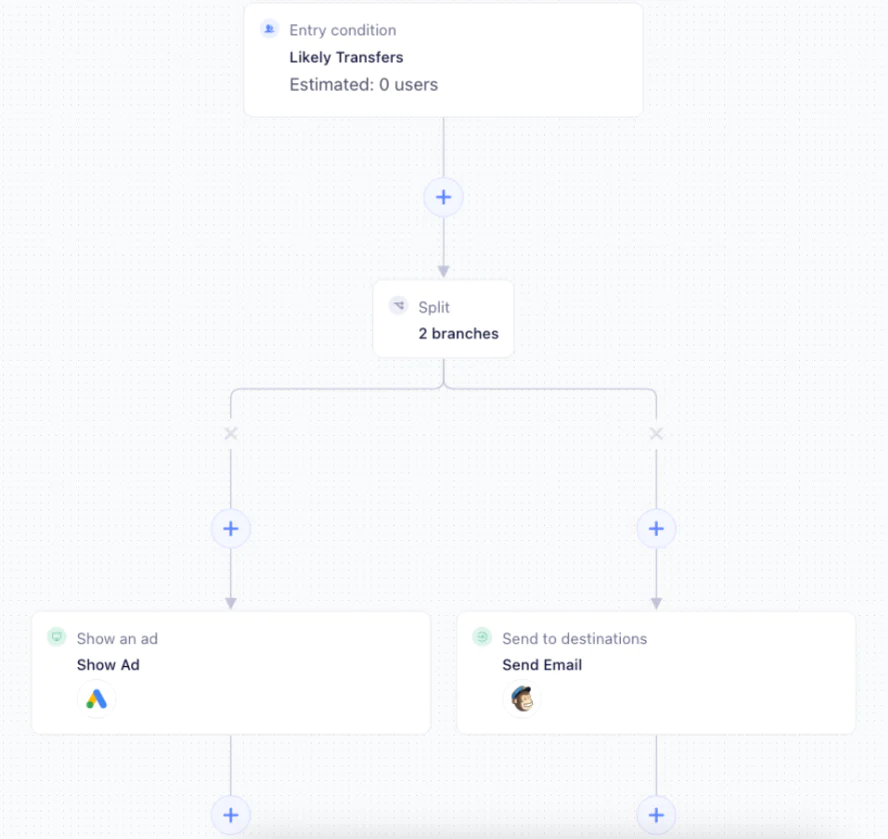

Navigate to Compute Traits within Engage and Create a new Computed Trait:

Made by Justin Baghai

Made by Justin Baghai