COURSE 4 • Lesson 2

Driving team performance with metrics

In this lesson, we'll share some of the challenges we've faced and the wisdom we've learned while operationalizing our funnel metrics to drive go to market strategies at Segment.

COURSE 4 • Lesson 2

In this lesson, we'll share some of the challenges we've faced and the wisdom we've learned while operationalizing our funnel metrics to drive go to market strategies at Segment.

Now that we've reviewed how to set the company strategy with data and develop appropriate OKRs, let's dive into how to operationalize the metrics to drive team performance.

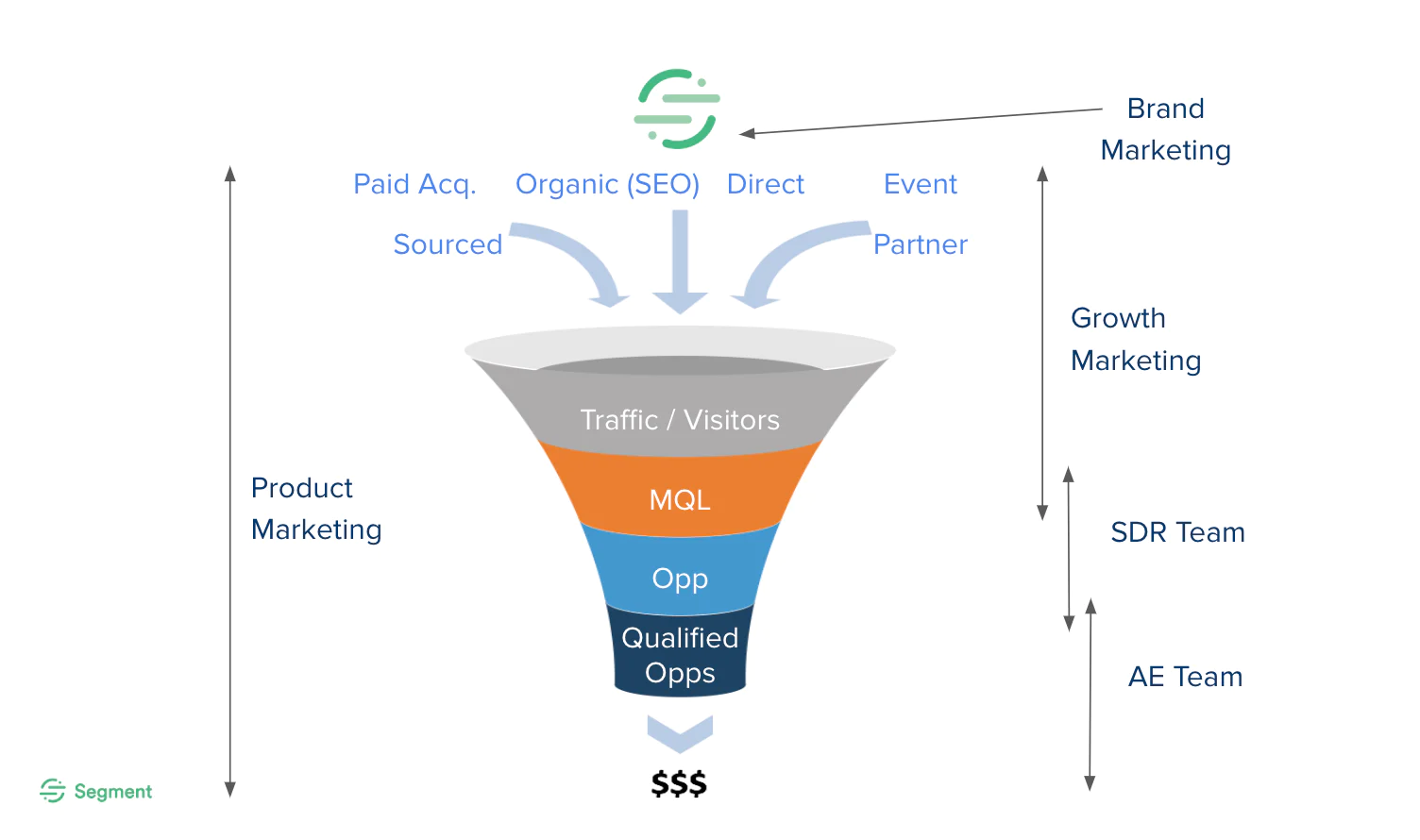

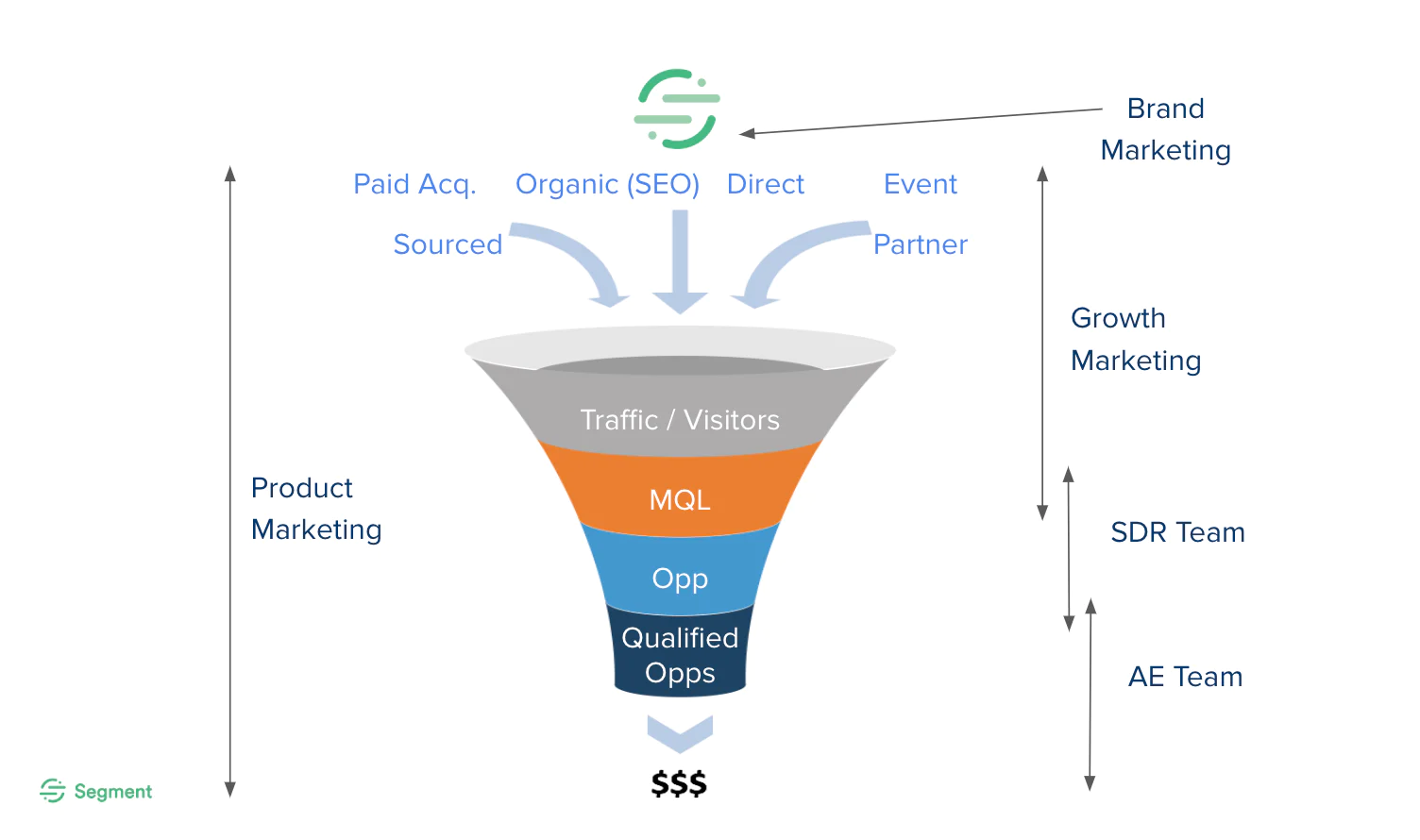

As a B2B SaaS company, Segment structures the go to market team around the marketing & sales funnel (illustrated below).

At the very top of funnel, our marketing team drives Segment brand awareness and generates leads through various paid campaigns, SEO optimizations, partner referrals, and events. The north star metric that rallies the various marketing functions is the Marketing Qualified Lead (MQL), which is defined as leads qualified for sales development team to follow up.

When prospects reach MQL stage, our sales development team (SDR) reaches out to set up conversations and evaluate their business need and expected budget. Prospects who pass the first qualification are handed off to our Account Executive (AE) team as Opportunities. Our AE team then work with Solution Architects to engage in a full on demo and set up proof of concept workspaces to help prospects evaluate Segment's product. During the negotiation and evaluation process, Opportunities move through various sales stages and eventually into Closed Won deals.

Each team is responsible for a certain set of metrics by which their success is measured. These are:

Marketing: MQL Volume

Sales Development : Qualified Opportunities (QOs)

AEs: Closed Won Revenue

These metrics are also held as quarterly and annual OKRs for respective teams.

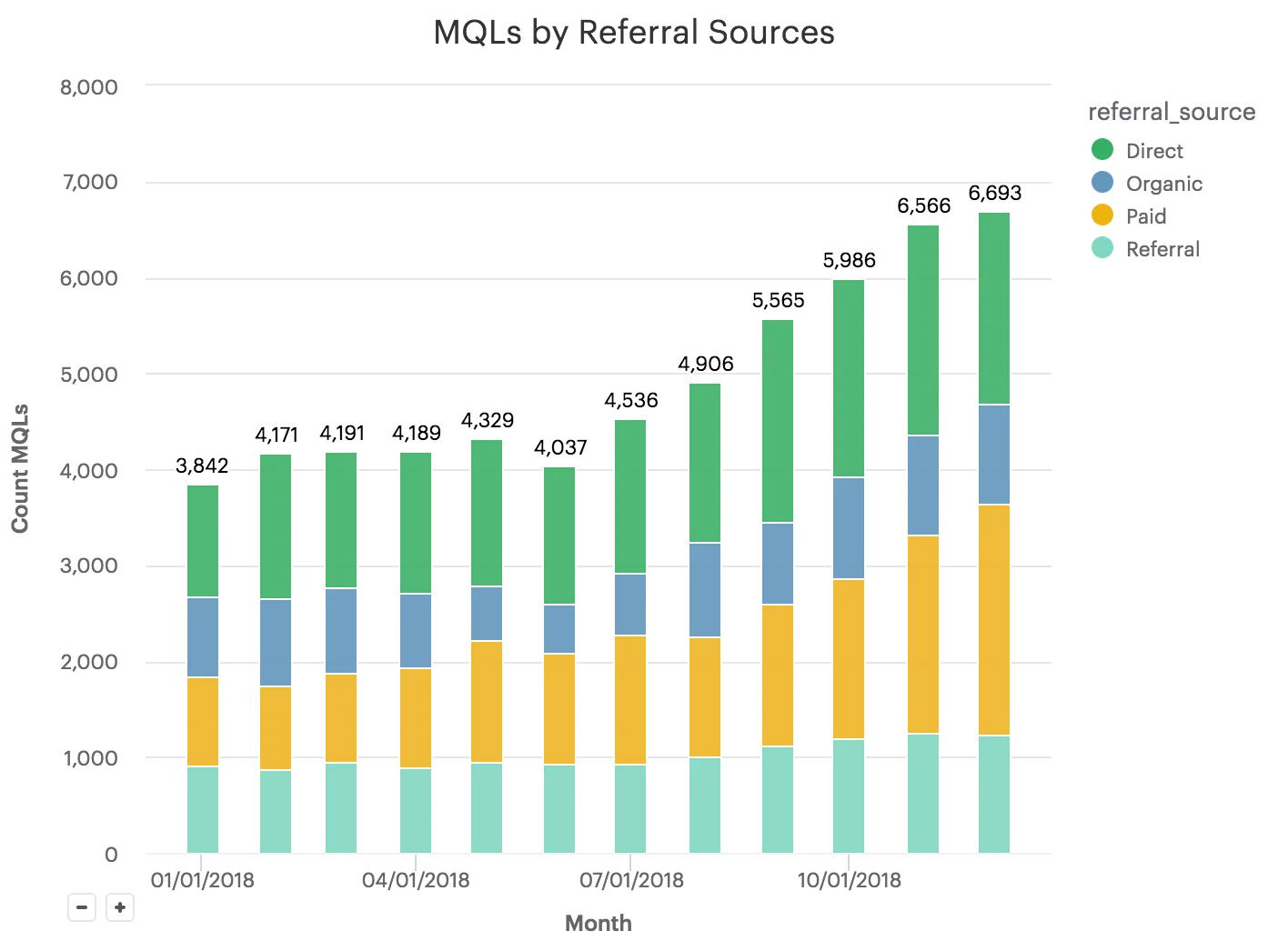

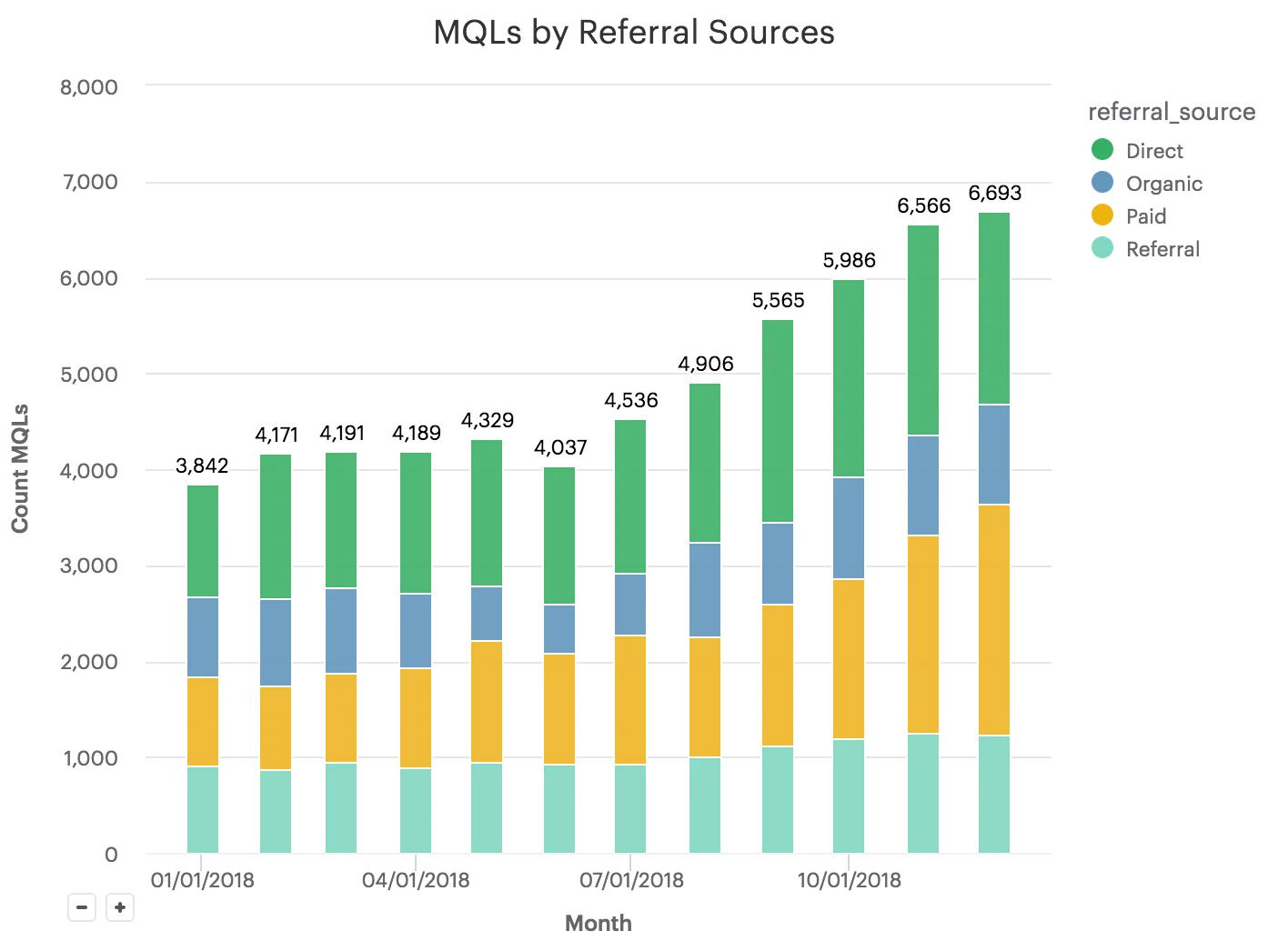

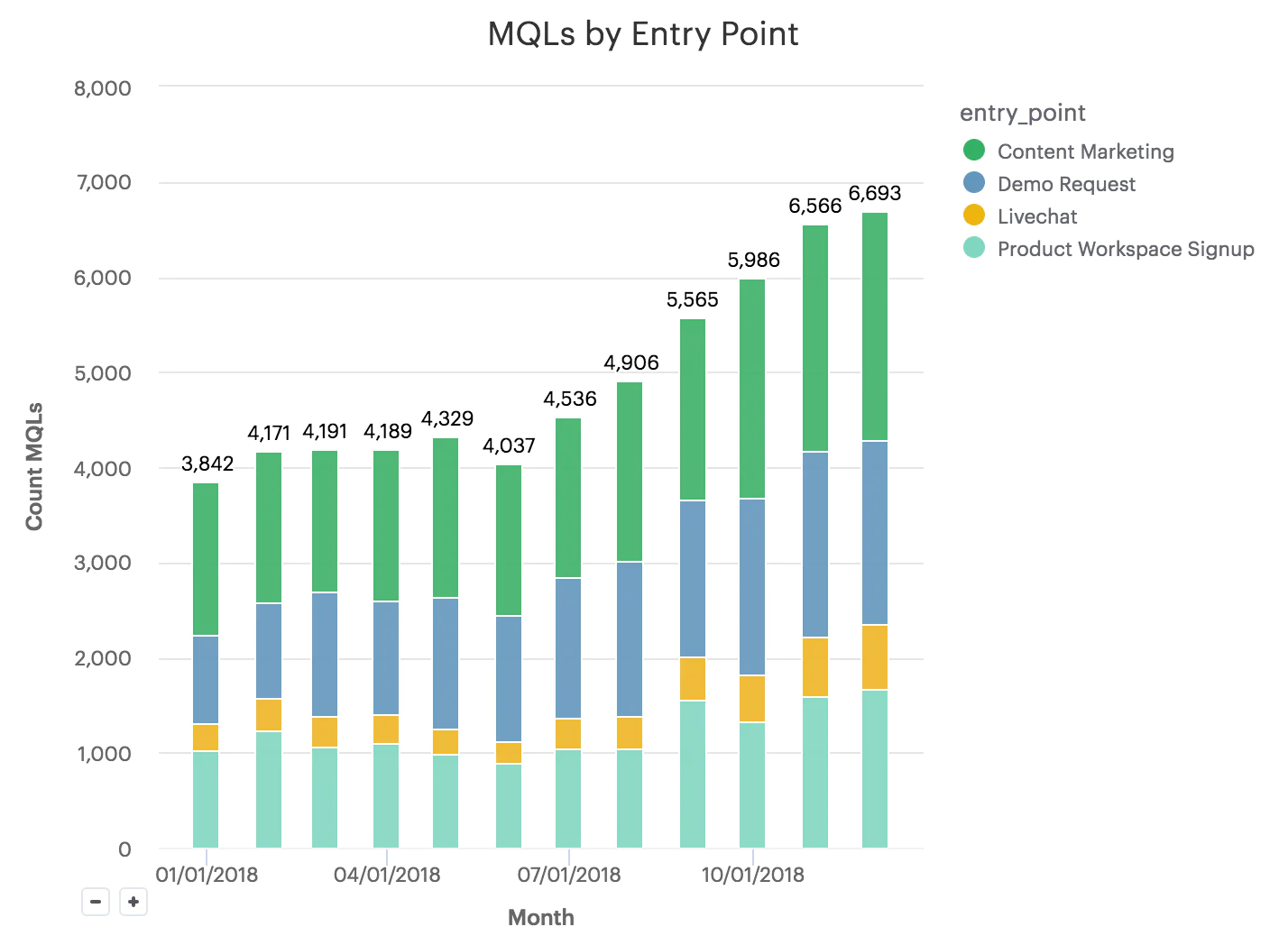

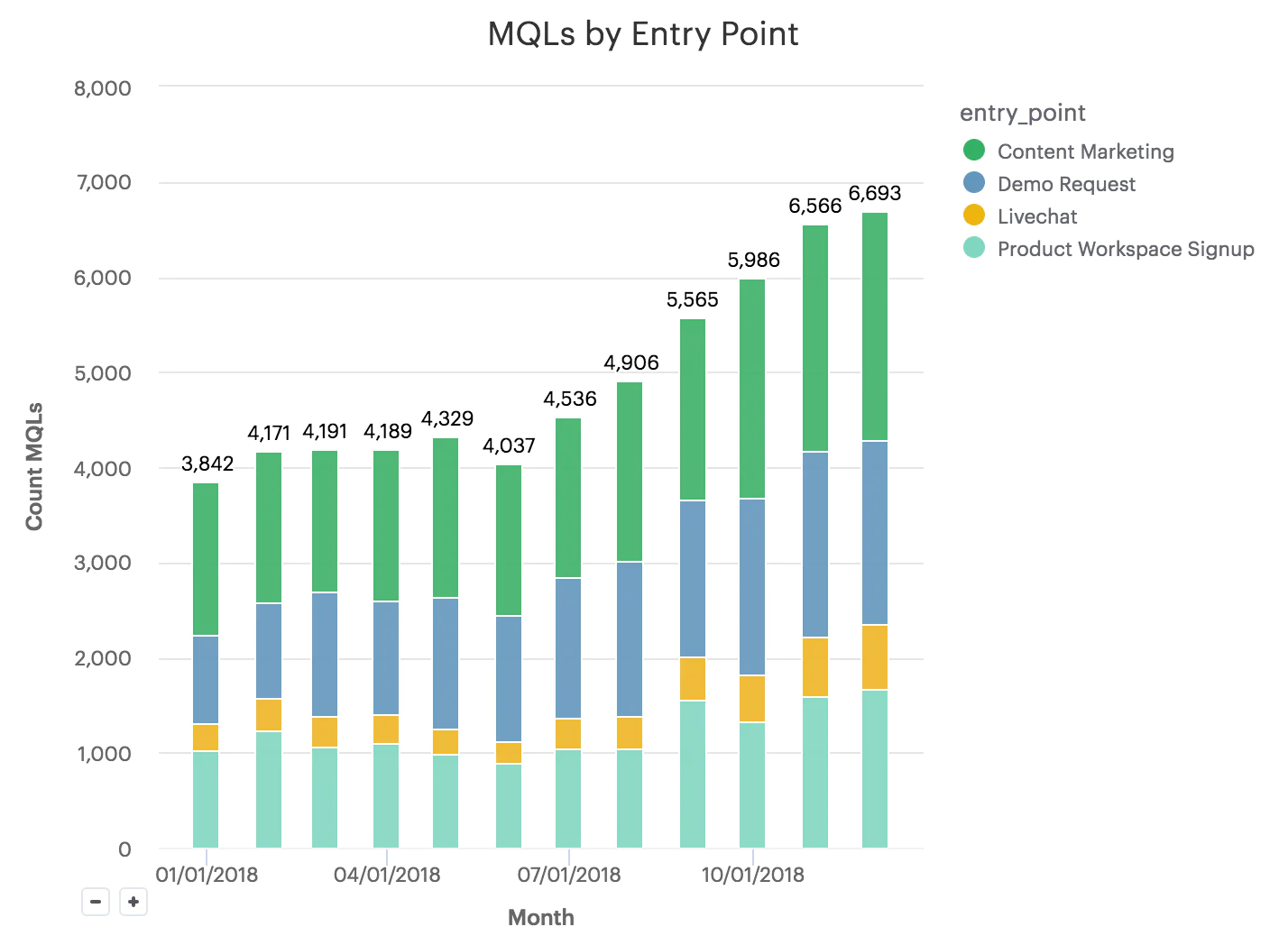

MQL volume by itself is an aggregated metric that's too high-level to be tied closely to specific business decisions. Therefore we break it down by two dimensions: referral sources, and acquisition entry points.

Referral Sources are typically categorized as:

Paid Acquisition: Google Paid, Facebook, LinkedIn, etc.

Direct Traffic: Direct to site

Organic Search: Google, Bing, Yahoo, etc.

Referral: Hacker News, TechCrunch, partner websites, etc.

Acquisition Entry Points are specific to Segment's lead generation approaches:

Lead via Demo Request Form

Lead via Content Download

Livechat

Product Workspace Signups

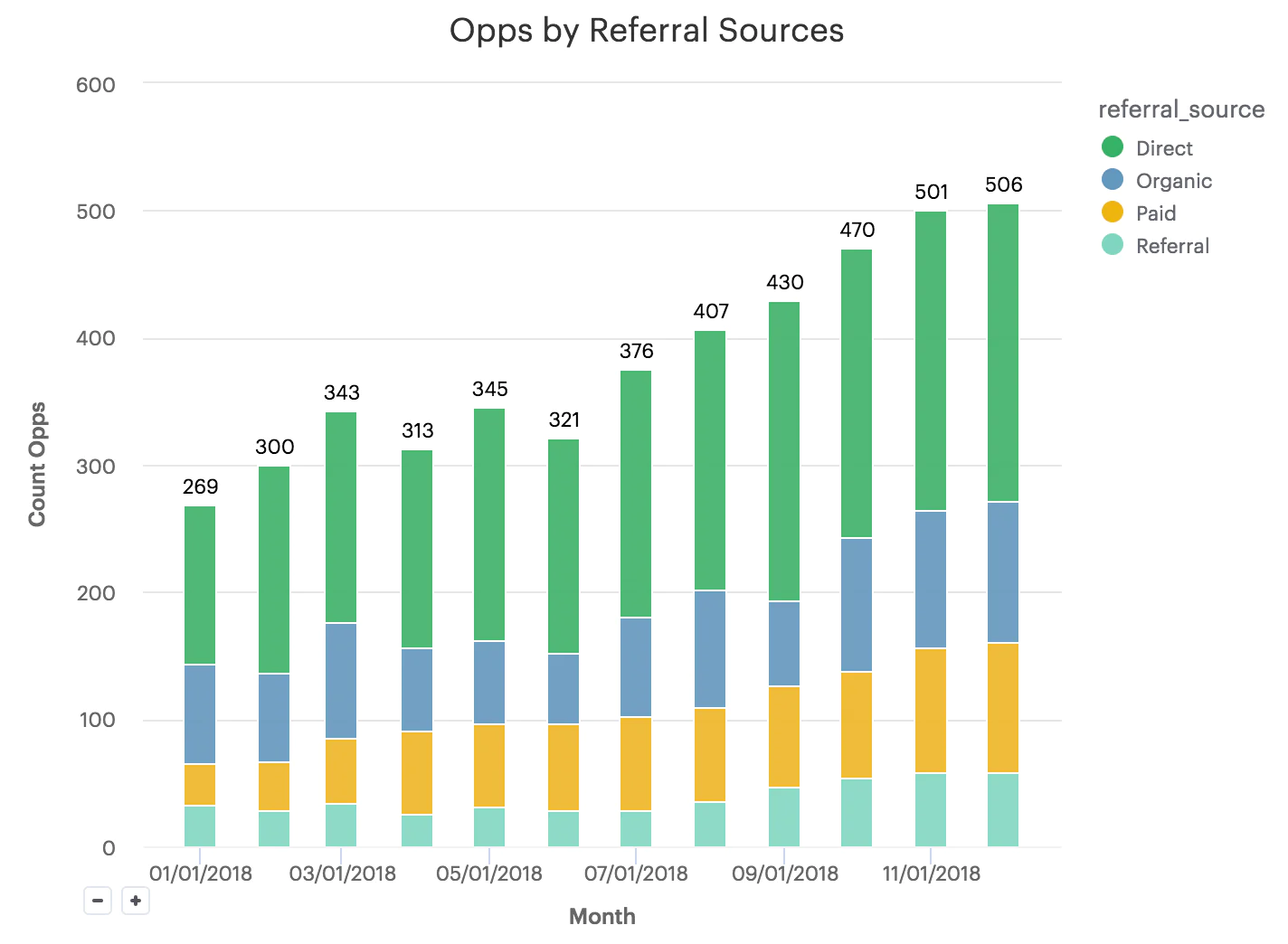

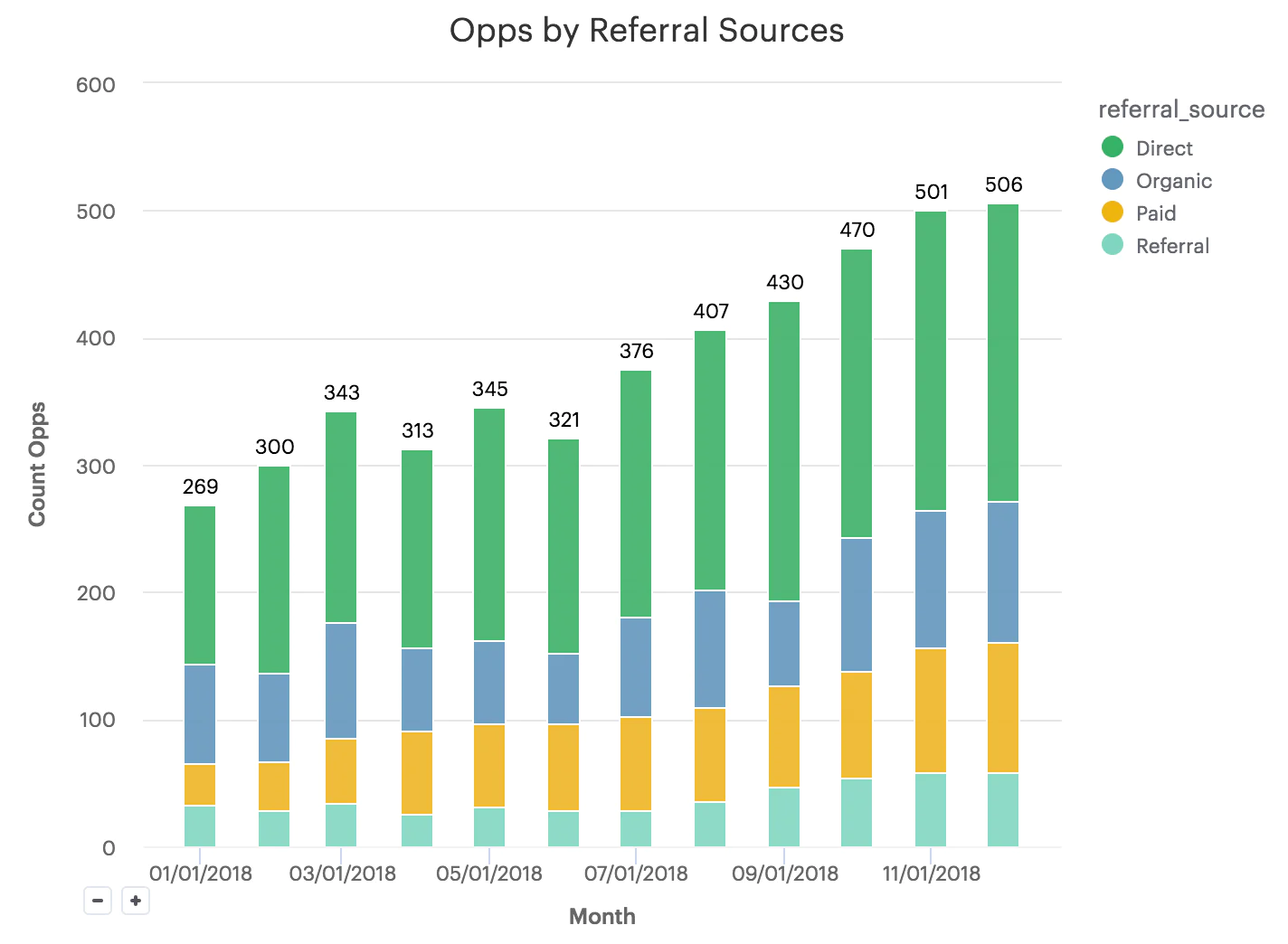

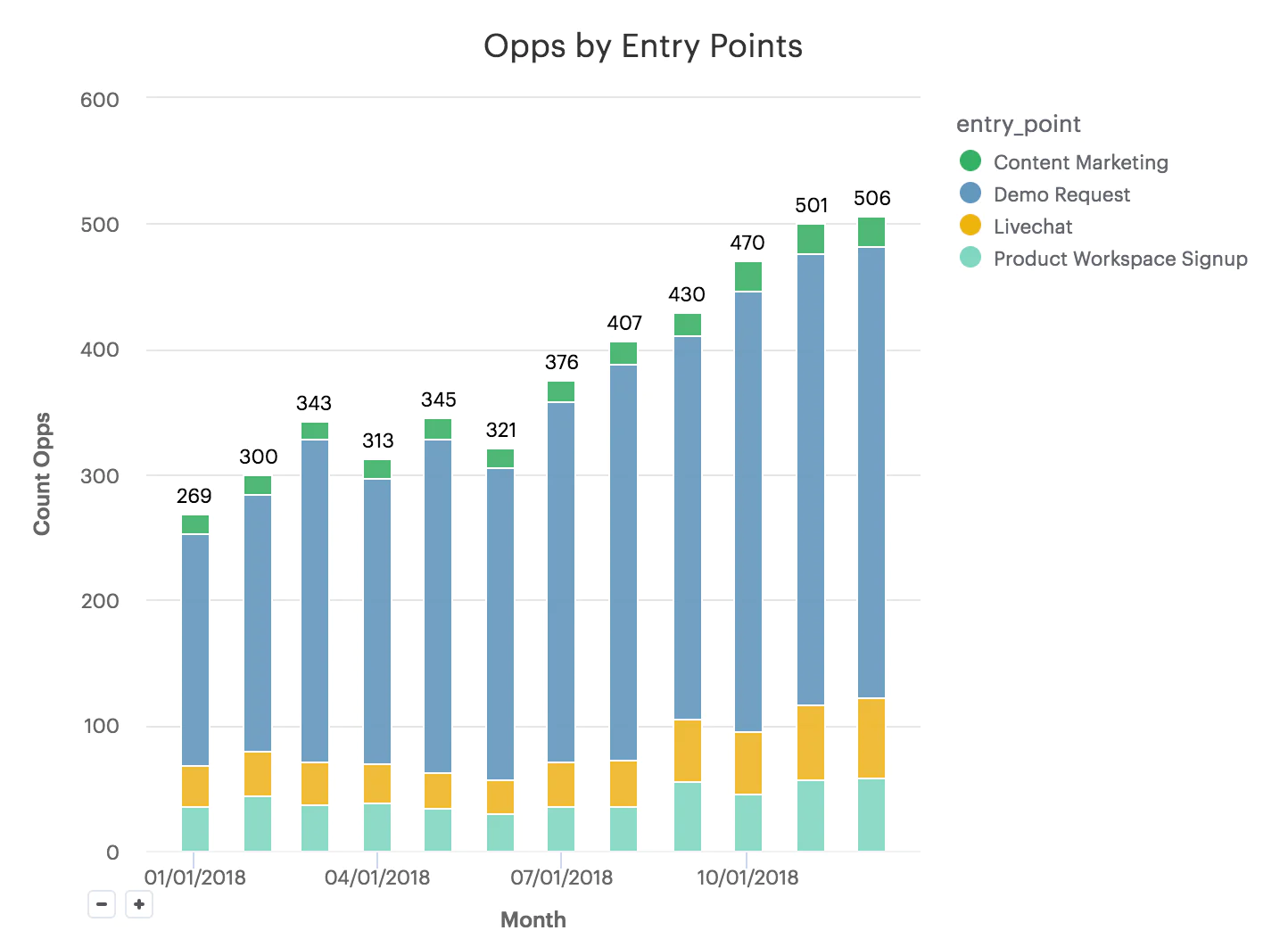

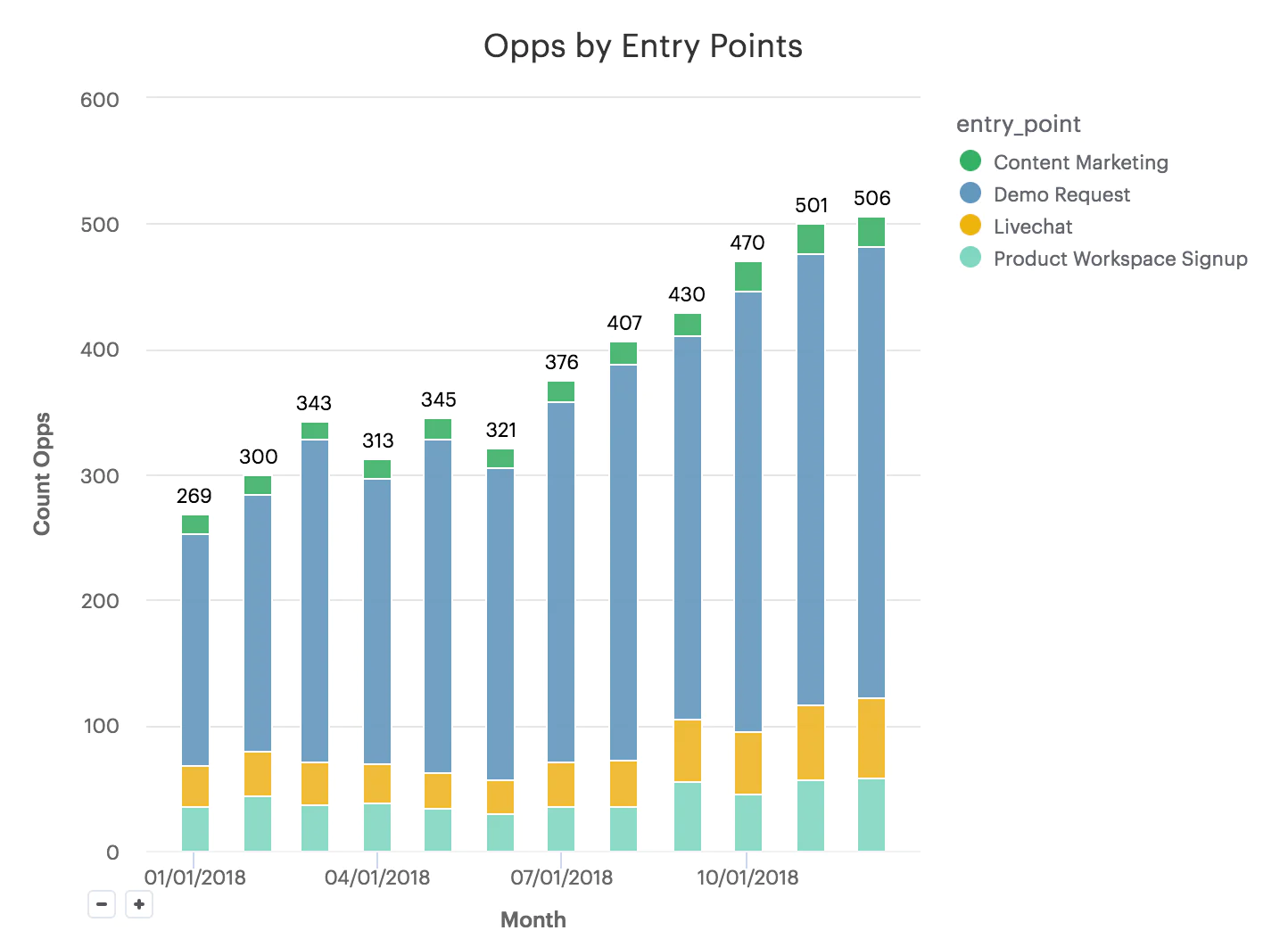

Similarly to how we break down MQLs, we measure Opportunities by by Referral Sources and Entry Points as well

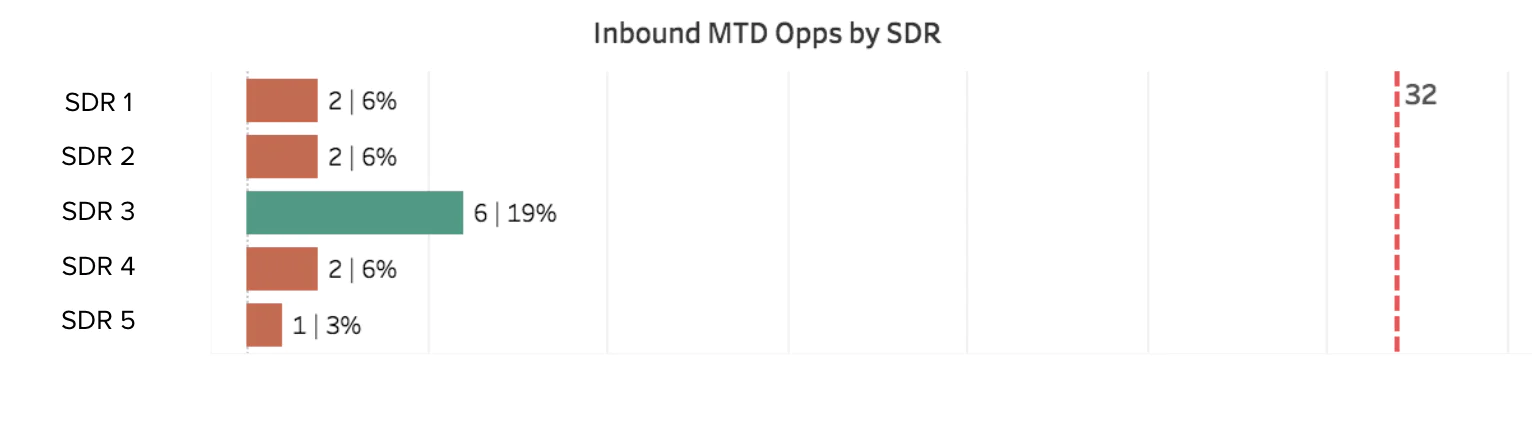

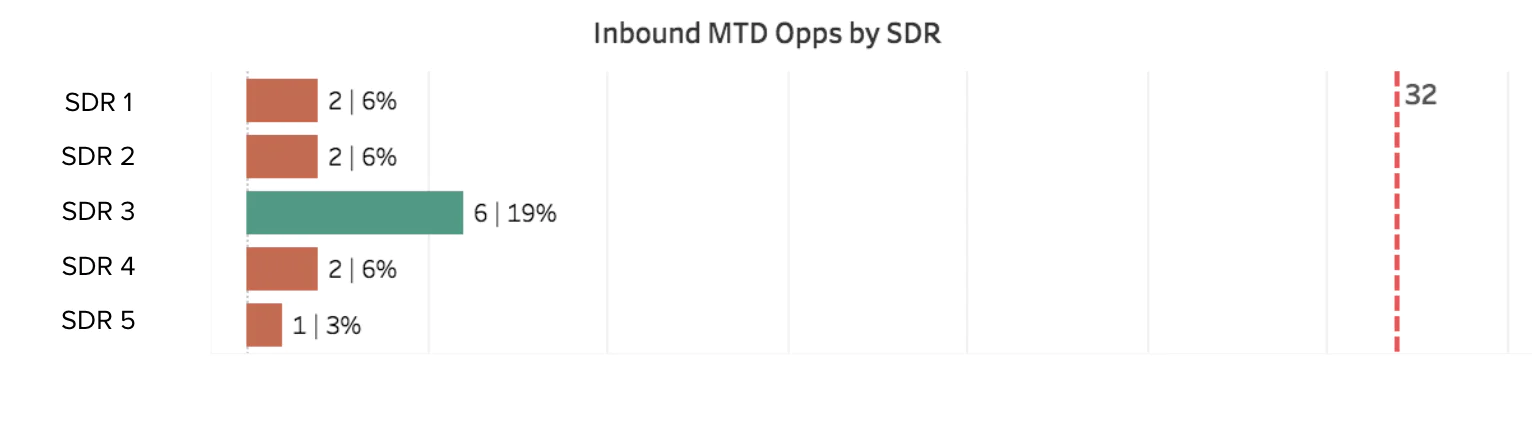

Additionally, we also provide sales leadership with regular insights on how reps are performing throughout the month.

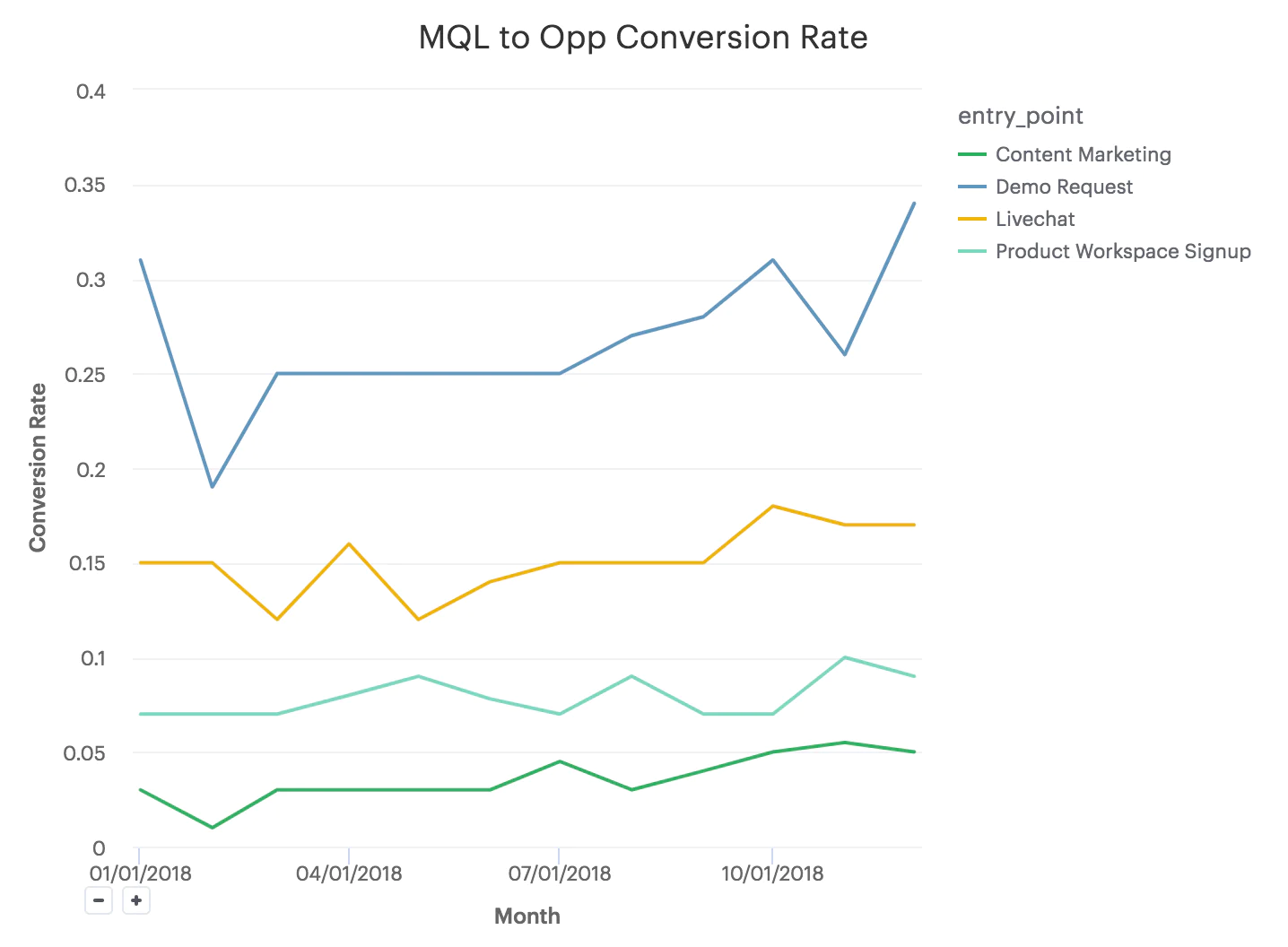

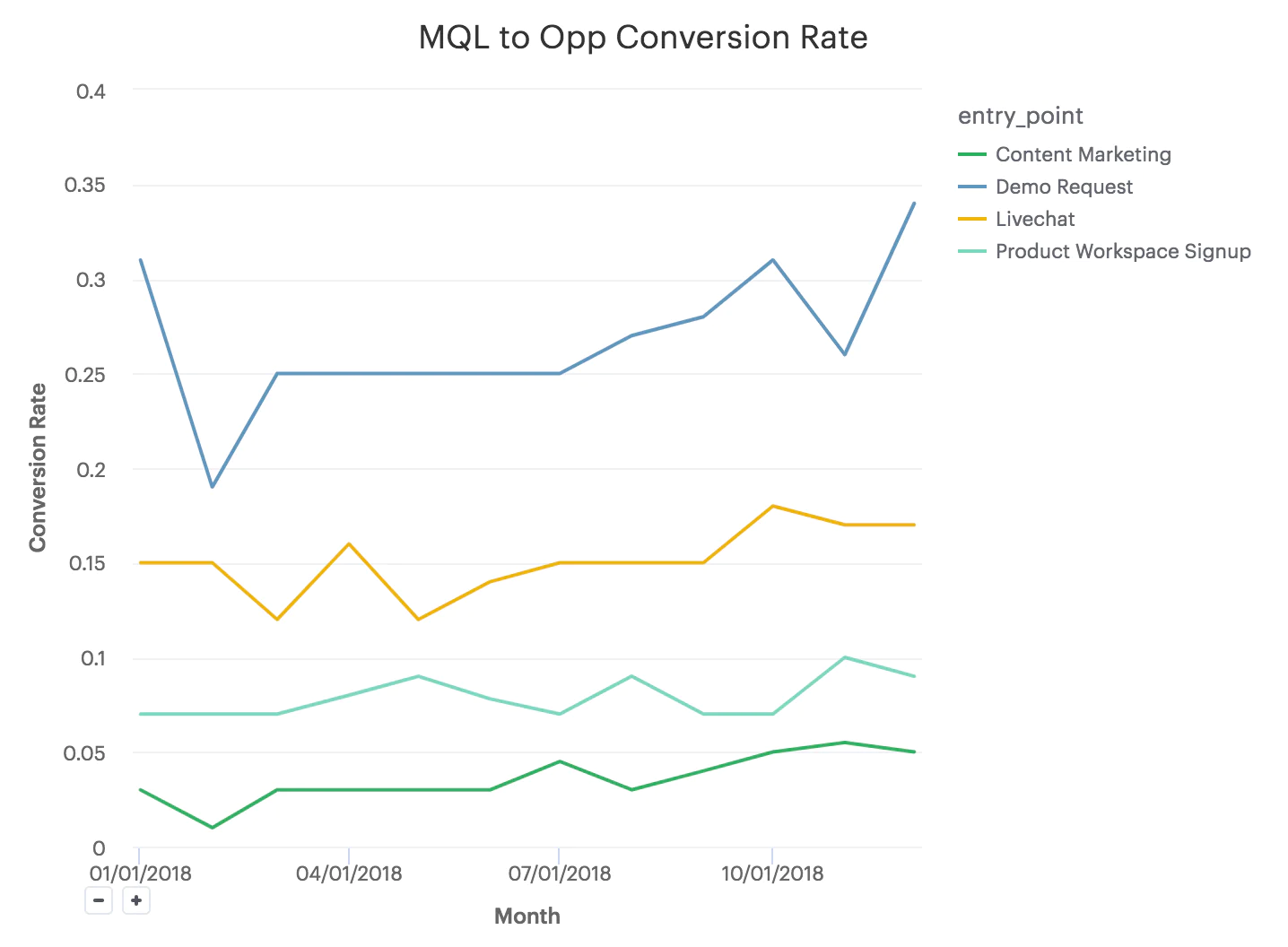

We monitor Lead -> Opp conversion rates by acquisition channels to ensure lead quality is consistent for each channel. An unusual dip in the metric indicates broken processes / systems or a new campaign which might bring in lower quality leads.

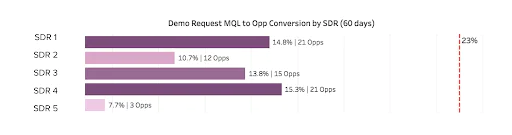

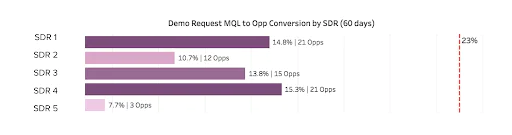

We also monitor conversion rates for each rep to make sure new SDRs are ramping fast to convert leads as effectively as experienced SDRs.

We'll start with how Segment sets OKRs using the funnel metrics then dive into some specific examples of how we operationalize these metrics to drive key business decisions including: optimizing marketing spending, allocating SDR resource, and improving funnel efficiencies.

At Segment, we have formed a cross-functional Top of Funnel (TOFU) initiative between marketing and sales teams to ensure close collaboration. Below is a snapshot of one of our TOFU quarterly OKRs.

Each quarter we keep three consistent Key Results (KRs):

Driving MQL growth

Improving Conversion Rate

Driving Opp growth

The growth rates are calibrated based on our top down financial plan as well as bottom up feedbacks from each sub team who owns specific MQL and Opportunity sources. With these metrics as the guiding post, each team member develops individual OKRs and actionable projects which contribute to the overall OKR.

Business Decision:

One of the most critical decisions our growth marketing team make day to day is to decide which paid campaigns to double down and which ones to pull back. Although traffic and clickthrough rates reported within ad platforms like Google and Facebook are important, these metrics are not "down the funnel" enough to have a predictable and measurable impact on revenue. Therefore we monitor MQLs generated by each paid advertising campaign and use Cost per MQL to gauge campaign efficiencies instead of just cost per click (CPC).

Challenge:

Earlier last year, we ramped several Google Display Network and Google Paid Search campaigns focused on machine learning which brought in a ton of traffic to our site. However, we quickly realized the MQL volume attributed to these campaigns were not growing nearly as much as our advertising investment.

After a bit of digging, we came to the conclusion that the concept of machine learning is too broad and hard to tie back to Segment's product value proposition, therefore the campaigns were not attracting enough high intent prospects fitting our MQL criteria. As a result, we shifted the focus on campaigns more specific to Segment's product value proposition. We also found that leads with personal email addresses convert much worse compared to those with corporate emails hence we adjusted our MQL scoring model to reflect that.

Takeaways:

Don't just rely on cost per click to measure campaign efficiency

The metrics we drive should have significant impacts down the funnel

Business Decision:

In order to plan for SDR team growth, we adopt a typical bottom up capacity planning model. First we forecast how many MQLs we can generate, then we divide that by the workload each SDR historically handles to get the number of SDRs marketing leads can support. During the process, however, we have realized using MQL numbers aggregately can be misleading as certain high-intent MQLs convert much better than low-intent MQLs and we need to make separate capacity assumptions for each segment.

Challenge:

Despite our best efforts to set MQL criteria based on firmographics data (company size, company web traffic) and behavioral data (product signups, web activities), we still find MQLs are not all created equal. In fact, MQLs from high-intent entry points like Demo Request form and Livechat convert to Opps > 5x better compared to those from low-intent channels like Content Marketing or Signup.

The conversion rate distinctions are important in this case where we evaluate if marketing can supply enough volume of leads to the SDR team. After reviewing our Q3 OKRs last year, we overachieved MQL volume by more than 50% while still underachieved in Opportunities. In fact we need to split out MQLs into high-intent vs. low-intent ones and measure each separately to evaluate if the supply is meeting SDR demand. In fact, our sales development has been re-organized into reps who handle high conversion demo requests leads vs. reps who handle low conversion (yet high volume) content and signup leads.

Takeaways:

Design metrics which best reflect business realities and fit into end users' workflows

When in doubt, always break the metrics down into subgroups to separate out the drivers. Avoid aggregated metrics which can mask deeper problems or opportunities.

Business Decision:

To drive revenue at bottom of funnel, we can either grow the volume of MQLs feeding the funnel, or we can improve the conversion rate. Our SDR team constantly improves their time allocation, outreach sequence, and messaging to increase the conversion rate. Originally our Product Workspace Sign-up leads didn't get much attention from the SDR team because these leads were assigned to all teams in a round robin fashion and each SDR rep would rather prioritize leads from high conversion channels like Demo Requests.

After assigning dedicated specialists just focusing on the Sign-up channel, we have seem dramatic improvement in Lead -> Opportunity conversion rate and the Opportunity volume from the Sign-up channel.

Challenge:

Here the challenge lies in the chicken and egg problem: the Sign-up channel historically had low conversion rate therefore SDR team deprioritized this channel, which further led to lower conversion rate. Instead of being stuck in the analysis paralysis, we decided to get out of this loop by experimenting - assigning dedicated resources to work these leads. The Lead -> Opportunity conversion rate comes in handy here because it directly measures how well a channel is converting. We can tie the movements in this metric directly back to the SDR team's shift to specialist approach.

Takeaways:

Make hypotheses and experiment to get out of analysis paralysis

Develop metrics to not only measure end goals (e.g. Opportunities) but also measure "progress metrics" that impact the end goal (e.g. Conversion Rate, Time to Respond, etc.)

Building a data driven company

Enter your email below and we’ll send lessons directly to you so you can learn at your own pace.