Customer Retention Rate: Main Drivers and Steps to Improve

We overview the relevant factors that will determine your customer retention rate and ways to improve it.

We overview the relevant factors that will determine your customer retention rate and ways to improve it.

Customer retention rate is a metric that tells you how many customers stick with your business over a given period of time. You track and analyze customer retention to gauge business health and find out what drives customer loyalty.

Retention rate is the opposite of customer churn rate, which measures how many customers you lose over a period of time. If you have 100 customers on October 1 and 15 of those leave by October 31, you have a churn rate of 15% and a retention rate of 85% for that month.

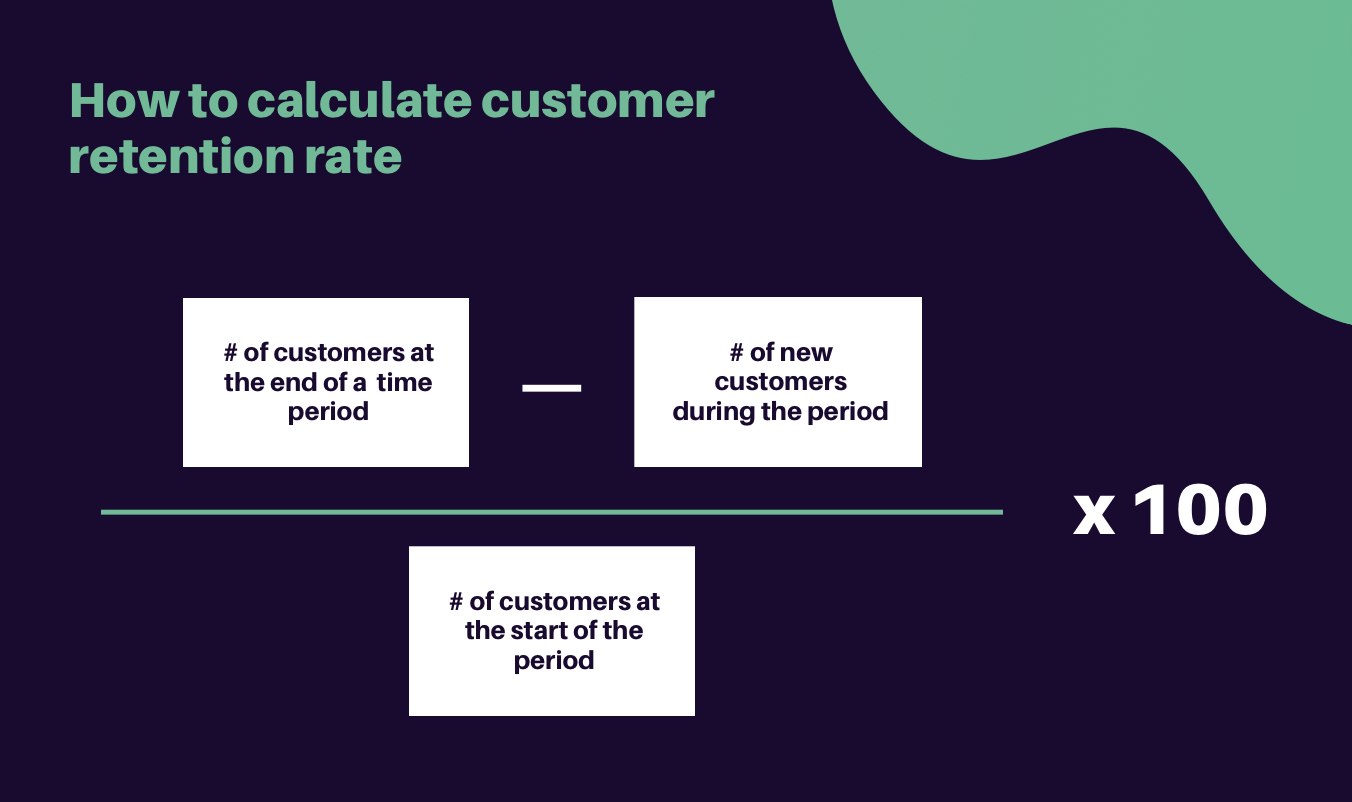

You can calculate customer retention rate for a given month, quarter, or year. First, prepare the following information:

Number of customers at the start of a given time period (e.g., Q2 2022)

Number of customers at the end of that period

Number of new customers gained during that period

Plug those numbers into this retention rate formula:

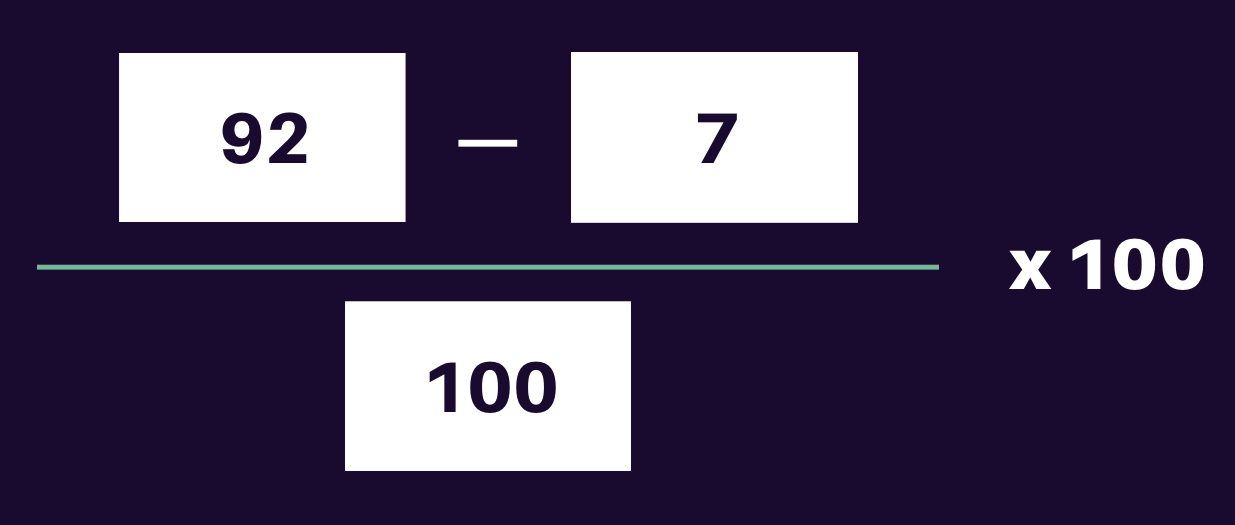

Let’s go back to our earlier example, where you started October with 100 customers. At the end of the month, you have 92 customers — but 7 of those are new customers you gained that month. Remove them from the equation, and you’ll see that you’ve retained 85 customers. Divide 85 by 100, and multiply the result (0.85) by 100 to express the number as a percentage. Your customer retention rate for October is 85%.

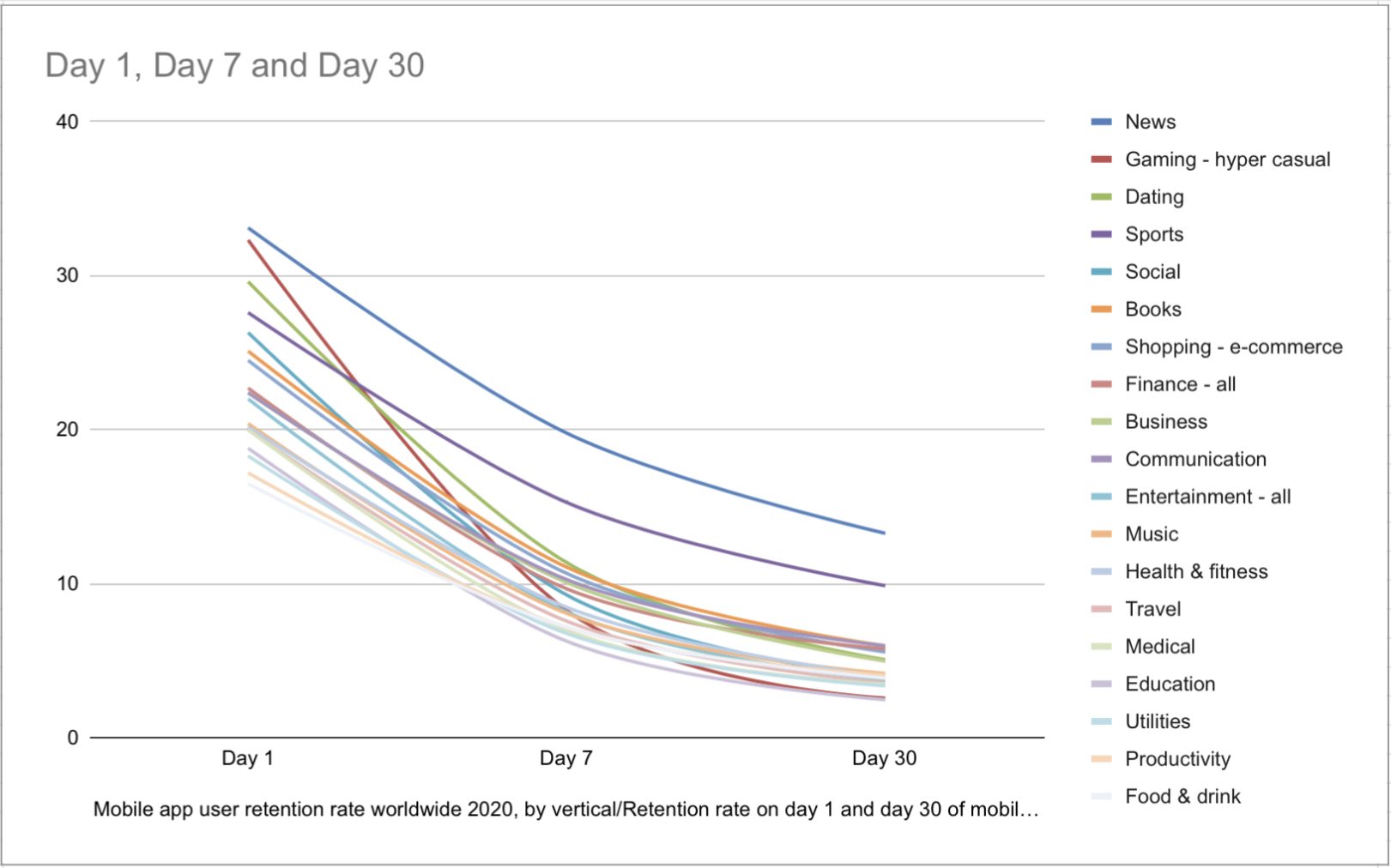

Keep track of how your retention rate changes over time, and plot those numbers on a graph. It’s normal to lose customers after you first launch your product or once you exit hyper-growth mode – see, for instance, how mobile apps lose users within 1, 7, and 30 days of installation:

This line graph is based on data compiled by Statista on the user retention of mobile apps within 1, 7, and 30 days of installation.

You want your retention curve to eventually flatten out or go up. You can achieve that by understanding why customers stick with your business and implementing a strategy for boosting retention.

To understand the factors that drive retention, look at your best customers and discover the details of their customer experience. Why did they stay with your business and expand their usage of your product? What actions do they regularly take with your product, and what value do they derive from it?

You’ll find that the answers typically have to do with:

Product-market fit – You’re providing the right solution for the right problem. Your product fulfills a real need or satisfies a real desire among your customer base.

Pricing and billing – Your customers can afford your product, find the price suitable for the value you offer, and are satisfied with your billing and payment options.

Stickiness – Your customers have built habits around your product and regularly experience its core value, making it inconvenient to switch to a competing product.

Customer satisfaction – When customers encounter problems with your product, you promptly answer their questions and solve their challenges.

Brand loyalty – You have a positive brand reputation, and you’ve lived up to customer expectations.

Have a plan in place for retaining customers, both old and new. With a detailed strategy, you can ensure a steady flow of repeat customers and promote customer loyalty over time.

Think of the products you use often. At one point, you performed actions or had an experience that transformed you from a tentative user to a regular one. Maybe you linked your bank account to your e-wallet in an e-commerce app, making it easy to add funds and pay for purchases. Or maybe you started using the app’s buy now, pay later (BNPL) service to personalize your payment plan.

In that scenario, two high-value product actions marked a turning point in your customer journey:

Linking your bank account to your e-wallet on the app increased your longevity and frequency as a customer

Signing up for the app’s BNPL service increased your value as a customer

As a marketer, you need to identify those high-value actions – also called “activation metrics” or “aha moments” – that make customers stick with your product. (Appcues has a great guide for how to find your product’s aha moment). Get new users to take those actions early in their customer journey by using in-app prompts, emails, or product tutorials during the user onboarding process.

Once customers have experienced your product’s core value, get them to build habits around it. If you have a SaaS product, make important product features more accessible to users wherever they are on your app. Create helpful content related to high-value product habits, and use case studies to show what other customers have achieved. You can even create a community or share user-generated content around your core product features – something that Notion does well with its gallery of templates created by users.

Getting customers to repeatedly experience your product’s core value will also make them more engaged and satisfied with your product and more likely to spend money on your business. That’s why customer retention rate is best tracked along with other growth marketing metrics like lifetime value.

Watch for decreases in overall product usage. Look at engagement, not just activity. Track not only how often customers return but also how often they use your product’s most valuable features.

Back to our e-commerce example: if the customer stops taking high-value actions – adding funds to their e-wallet on the app and using BNPL – they’re likely to shop less often and spend less on the e-commerce app.

Create a retention campaign that gets triggered when a customer’s behavior matches churn indicators. For example, set up a push notification to remind the user to replenish their e-wallet or offer rewards points that can be unlocked only when the customer makes a purchase with BNPL.

Don Dodge, a developer advocate at Google, says there are two types of products: "vitamins" are nice to have, while “painkillers” are products you can’t live without. Convert your product from a "vitamin" to a "painkiller" by understanding the value your product gives your customer and communicating that value regularly.

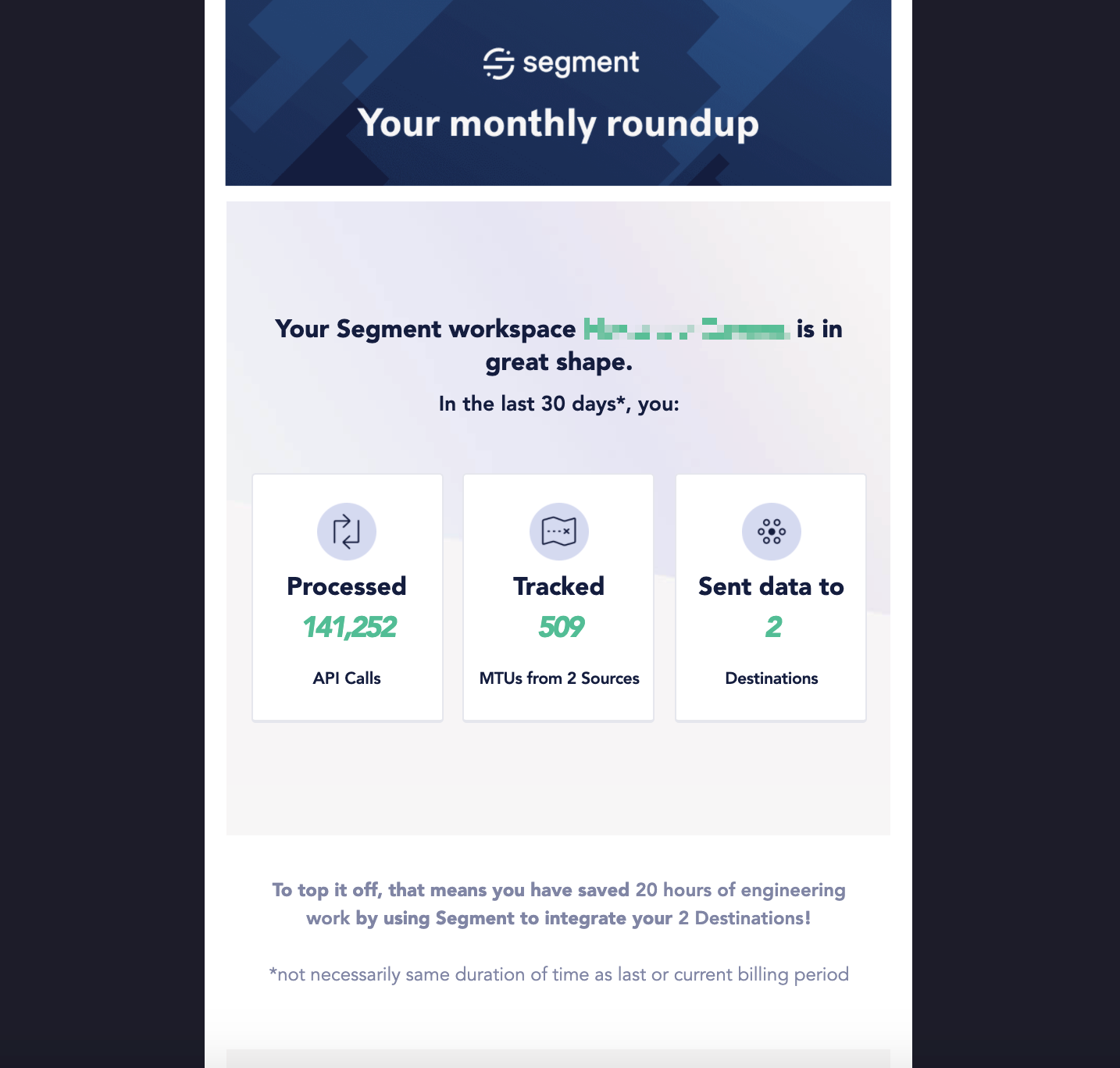

For example, at Segment, we send users personalized emails that estimate how many engineering hours they’ve saved by using our platform. This type of messaging communicates our product’s ROI and helps us position our product as a vital tool for our customer’s business.

Interview your customers to learn exactly how they’re gaining value and reaping ROI from your product. Chances are, you’ll discover product benefits you hadn’t considered.

Have you ever tried to cancel a social media account? Featuring several pages and multiple calls to action, the cancellation flow is engineered to make churn a last resort. You’re presented with alternatives to canceling, like pausing or downgrading a subscription. Some products’ cancellation flows even include offers or discounts as incentives for a customer to keep their account.

It’s important to retain the customer’s goodwill, though, so when they do reach the final stage of your cancellation flow, thank them for using your product and wish them well.

Build exit surveys into your cancellation flows. Provide space at the end of the survey for the customer to elaborate on their reason for churning. You can even email a customer to learn more about their experience.

Use the insights gleaned from those surveys and conversations to identify cohorts who are especially prone to churn, and prevent those customers from leaving by addressing their concerns. Say that customers who typically spend $200 a month on cosmetics have been deleting their e-commerce accounts because they’ve been overspending. Identify existing customers who fit that cohort’s profile and show them content related to personal budgeting and keeping track of BNPL spending. You can send alerts a week before BNPL payments are due and even roll out product features like letting users set a monthly personal spending limit.

It may even be possible to reclaim churned customers using lessons learned from customer feedback. For example, if limited payment options are a common reason for churn, add more payment channels to your app. Communicate those changes not only to existing customers but also to those who’ve left.

Eleanor Dorfman, former Head of Commercial Expansion at Segment, once shared in a podcast that churn and retention start at the beginning of the sales cycle. You need to target the right customers in the first place – the customers who need the solutions you’re offering and have the budget, capacity, and interest (or at least incentive) to use your product.

For B2B sales reps, this can sometimes mean recommending someone else’s product to a potential customer if yours isn’t a good fit. For marketers, it means refining your ad targeting criteria not only to reach your ideal customers but also to exclude people who are most likely to churn the fastest and spend the least. To help with profiling and targeting, dig into your customer data to discover the shared characteristics and behaviors of different customer segments along your retention curve.

All the tactics we’ve shared require customer data. The different tools that sales, marketing, product, and support teams use can help you gather the data you need – think software for surveys, product analytics, and support tickets.

To identify customer segments based on disparate data sets, centralize your customer data in a customer data platform like Segment. With accurate segmentation, you can tailor retention marketing campaigns to each customer’s needs and challenges.

Connect with a Segment expert who can share more about what Segment can do for you.

We'll get back to you shortly. For now, you can create your workspace by clicking below.

Your retention curve should either flatten or go up over time. Look at your competitors’ customer retention rates, the average retention in your industry, and your historical performance to set a benchmark for your business’ customer retention rate.

Aside from customer retention rate (CRR), you should track revenue churn, customer lifetime value (LTV), acquisition rate, LTV:CAC (customer acquisition cost) ratio, and Net Promoter Score (NPS). Depending on your product or service, you’d also want to track repeat purchase rate, average order value, or average session length (for apps or software), or feature adoption rate.

Identify behaviors you want to drive with each customer retention strategy. For example, one retention campaign would focus on getting new users to perform high-value product actions within their first two weeks of using your product. Another would focus on reactivating customers who are at risk for churn.

Twilio Segment is a customer data platform. It centralizes your customer data, lets you set guardrails for maintaining data quality and accuracy, and helps you map customer journeys through identity resolution and customer segmentation. With accurate customer segments, you can personalize retention campaigns based on each customer’s needs and challenges.