Time to read: 5 minutes

The big win

Affiliate marketing had become the largest revenue channel at Earnest to date. Earnest had a goal to provide better incentives for their affiliate partners to promote and sell their products. But neither affiliates nor Earnest could see which campaigns were working, and which weren’t. As the analytics team worked to implement a new attribution model, Earnest quickly realized they didn’t have the right data infrastructure to support it.

Twilio Segment provided Earnest with a single user identity and consistent, granular customer data that the team needed to create the advanced, customized metrics to scale the affiliate program. By using Twilio Segment, Earnest can now create, track and monitor affiliate programs at scale without engineering help.

Earnest is a leading online Fintech lender that offers personal loans and student loan refinancing. Founded in San Francisco in 2014, the company has helped over 105,000 students refinance $8.6 billion in loans and counting, while saving them over $1 billion in interest fees.

Earnest offers three major lending products online: student loan refinancing, private student loans, and personal loans. To provide the best loan programs possible, it combines data science, streamlined design, and exceptional customer service to bring people a fast, low-cost, and hyper-personalized financial experience.

After using Twilio Segment, Amazon Redshift, and Looker to collect and manage the company’s affiliate data, Earnest grew loan volume over 10x, and saved its borrowers well over $100 million to date.

Tracking and monitoring affiliate programs at scale

Affiliate marketing has become the largest revenue channel at Earnest to date. It works with companies like NerdWallet, LendingTree, and others to build its brand and drive traffic, and customers, back to Earnest.

Earnest had a goal to provide better incentives for their affiliate partners to promote and sell their products. Affiliates at the time were paid through a mix of cost-per-click (CPC) and cost-per-action (CPA) attribution models, which made it hard to track and measure the success of each partnership. Neither affiliates or Earnest could see which campaigns were working, and which weren’t.

As the analytics team worked to implement a new attribution model, Earnest quickly realized they didn’t have the right data infrastructure to support it.

“We know that things change quickly. You never know what will be around the corner or next year. It’s super important for us to have flexible infrastructure. We’ve lost tons of deals because we couldn’t make it happen through the data side.”

The lack of visibility made it challenging to move partners from their current attribution model to a newer, more beneficial one deemed “cost per signed loan”.

“Moving to a cost-per-signed-loan model would be a better incentive for everyone involved. Earnest wants to provide the best rates and experience for new loan signers, and affiliates want to send their consumers to the best websites with the lowest cost.”

Lack of clarity into partner performance and spend

For any affiliate program, marketing success relies on the success of partners. Ultimately, Earnest wants to not only track performance, but also keep partners engaged and committed to the program.

In the current model, Earnest struggled to track important metrics, such as:

-

Traffic from affiliates

-

Lifetime value of referred customers

-

Percentage of active affiliates

-

Incremental revenue from affiliates

-

Contribution margin

This drawback forced Earnest to face two challenges:

-

There was huge variability in spend based on partner, and the company didn't know how to best allocate their spend.

-

Partners didn’t have visibility into the funnel, so they didn’t know which campaigns worked.

Earnest’s partners wanted greater detail and higher frequency in reporting to understand how they were performing. Ideally, Earnest needed a better way to track and manage data, and automate frequent reporting at the campaign level.

Investing in Twilio Segment to centralize customer data across the company

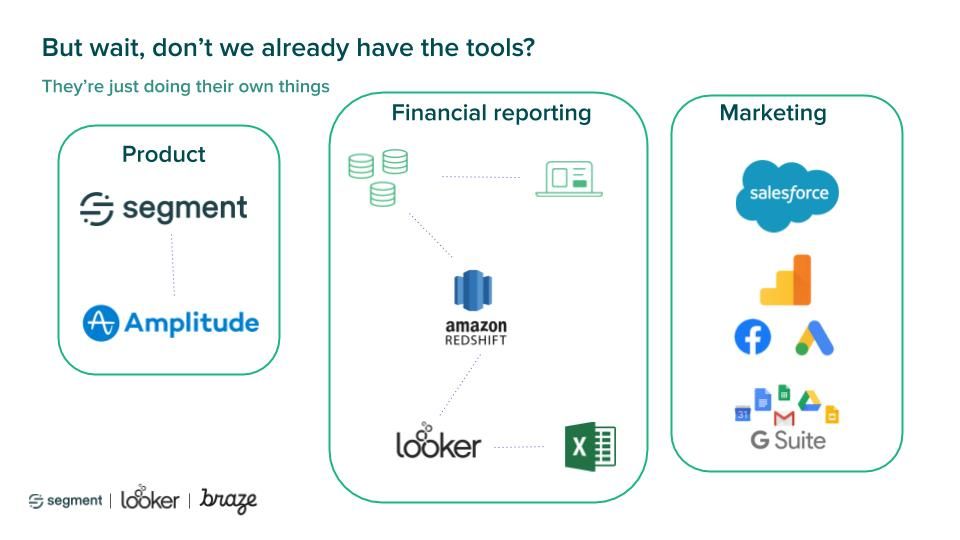

When looking for a solution that could help Earnest overcome these challenges, it looked at different out-of-the-box attribution tools. Earnest soon discovered that other teams in the company were already using the right tools, it just needed to bring them all together.

For example, Twilio Segment was already being used inside the product to help find where people dropped off in the loan application process.

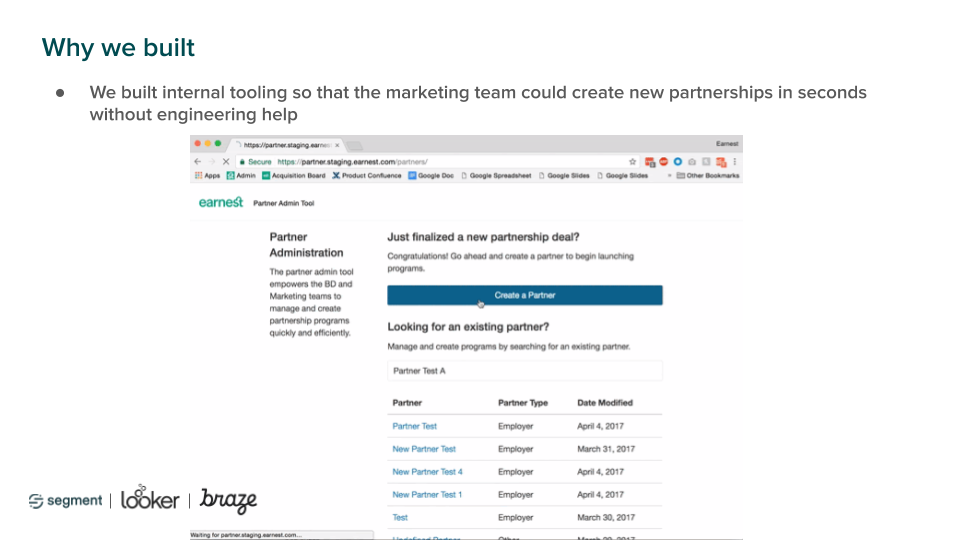

Goutham’s first initiative after purchasing Twilio Segment was to build an internal tool that would help scale affiliate partnerships. The tool helped build partner landing pages with a custom link that routed data into Twilio Segment. This custom link allowed Goutham and his team to create, track, and monitor affiliate programs at scale without engineering help.

“It was important to have no engineering dependencies when launching a new partner program. Marketing could create custom landing pages for affiliates with a link that tells Twilio Segment who this partner is and exactly what happens with them.”

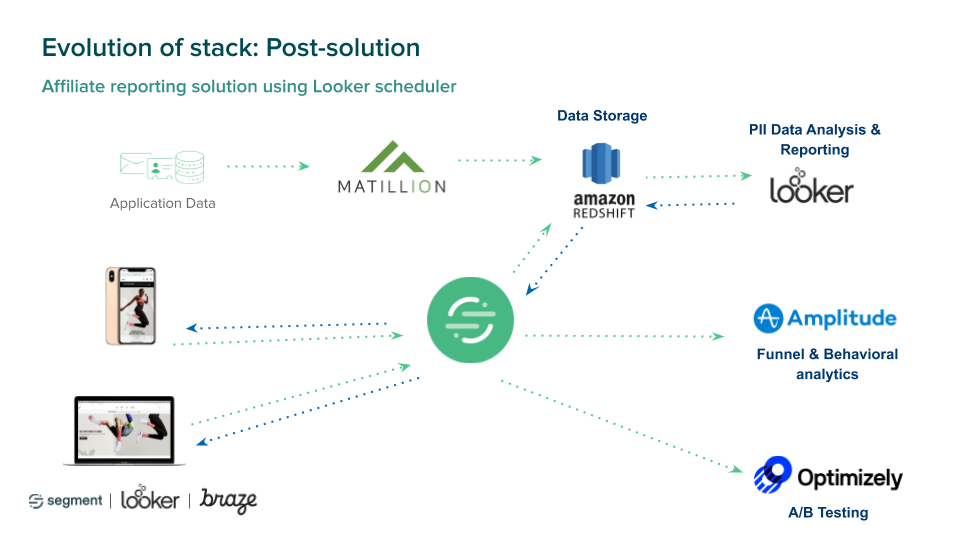

Earnest now collects events from mobile, desktop, and application data. The company can now track and store all user visits and cross-reference with conversion events. It can also see every drop off point in the funnel, helping it to find and tackle exceptions in the data quickly.

By bringing Twilio Segment, Amazon Redshift, and Looker into the same stack, Earnest was able to automate reporting to affiliate partners. Reports were calculated automatically and in-line with partner policies. Switching from manual spreadsheets to all code keeps the company compliant and accurate every report.

This also allowed the data analytics team to build a system of record to serve as a source of truth and help the organization handle all of its customer data.

Improved attribution and reporting to drive increase loan volume

With Twilio Segment, Amazon Redshift, and Looker, Earnest was able to improve attribution and reporting for its affiliate partners. By implementing this system, Earnest also achieved:

-

10x loan volume growth through affiliate channel since 2017.

-

Over $100 million in savings for borrowers.

-

Time savings with automatic payouts in line with affiliate agreement policies.

-

More reliable data sharing through Looker and a flexible platform for growth.

Interested in hearing more about how Segment can help you?

Connect with the team to learn how 25,000+ companies use Segment's extensible, scalable platform to turn customer data into revenue-generating experiences.

Thank you, you’re all set!

We'll get back to you shortly. For now, you can create your workspace by clicking below.