Guide to Data Aggregation for Financial Services

Explore the benefits of data aggregation in financial services and how it can revolutionize the way these institutions and their customers manage and analyze data.

Explore the benefits of data aggregation in financial services and how it can revolutionize the way these institutions and their customers manage and analyze data.

Data aggregation is the process of combining and processing large volumes of data to identify trends and gain greater insight. Financial Services is a particularly interesting case study when it comes to data aggregation, as it’s both a highly regulated industry and one that’s absolutely dependent on consolidating data from multiple sources. (Everything from consumer trends, to geopolitical events, and even weather patterns can impact the stock market.)

When talking about data aggregation in financial services, we’re talking about the process of collecting, processing, and consolidating financial data from various sources to better understand client needs, identify economic trends, develop new products, prevent fraud, and more. Examples of financial data include credit card numbers, expense receipts, income statements, and more.

Banks and other financial service providers use data to optimize growth and create top-tier customer experiences. This can be done by improving customer service, reducing points of friction (e.g., expediting the loan application process), and preventing fraud.

Automation has several benefits, from faster workflows to a reduction in human error. Already, we’ve seen advances in FinServ as a direct result of automation, like:

Automated payment systems aggregating payment data and scheduling deposits.

Aggregated financial data streamlining compliance checks and auditing.

Automated credit score monitoring based on aggregate credit information.

Automating the process by consolidating data from various investment accounts, providing real-time portfolio updates.

And more!

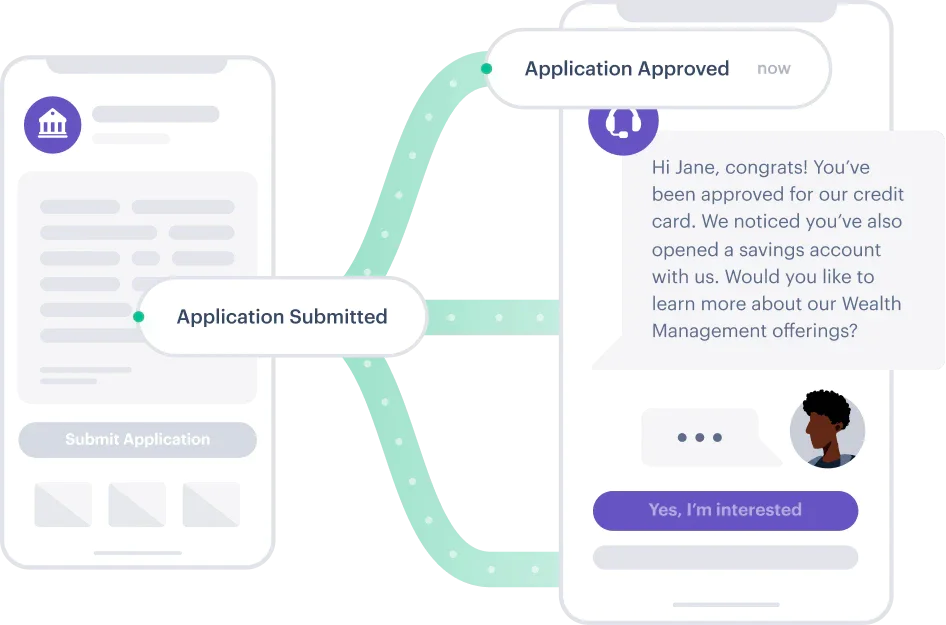

Customers are used to a high level of personalization, from music playlists tailored to their listening habits to product recommendations on their favorite e-commerce websites. Data aggregation allows financial service providers to recommend the right product at the right time, increasing customer lifetime value. For example, analyzing transaction data could predict that a customer is getting married, so a bank could proactively offer a mortgage.

Fintech trading platform Skilling used Twilio Segment to unify siloed customer data and analyze churn data to detect why some users were no longer engaging with the platform (and how to win them back). This democratization of data sped up the time-to-insight by 200% across the organization, while also decreasing the time engineers spent on integrating new tools by 100%.

Data aggregation plays a crucial role in enhancing fraud detection, by showing a holistic view of customer behavior and real-time monitoring.

By consolidating customer’s behavioral data from various sources, financial institutions are better equipped to spot anomalies (e.g., suspicious withdrawals or login attempts). With real-time data, these institutions can also act fast to prevent fraud before it escalates.

Aggregated financial data can help customers gain a holistic view of their finances without having to manually check each account. It can also help these customers improve their budgeting, investments, and overall spending.

Personal finance app Cleo aggregates a person’s bank account data and uses it to provide personalized budgeting tips, expense tracking, and even predictions of future spending habits.

Data aggregation also opens doors to products and services that are tailored to income level, stage of life, or unique financial goals. It allows financial institutions to analyze a person’s income and spending habits to suggest a new credit card or savings plan.

Additionally, aggregating financial data expands access to affordable loans. Consider a loan applicant who has recently moved to the US and has no credit history. This would make them ineligible for many low-interest loans. By granting access to their aggregated income or cash flow data, the borrower could qualify for a lower-interest loan because the lender could verify they have a regular income.

Data aggregation allows financial service providers to remain competitive in a market where customer expectations are constantly increasing.

Data aggregation positively impacts two factors that have a major influence on a customer’s decision to switch financial providers: digital experience and customer service.

Customers have become accustomed to seamless digital experiences. As a result, they get frustrated when they must upload PDFs to show proof of income or when they’re sent offers that are out of alignment with their goals. Financial data aggregation helps to support automation and eliminate points of friction like this.

Aggregating financial data also helps organizations meet customers’ ever-increasing standards for customer service and experience. It allows them to predict customer needs, identify conversion points, and understand how customers use their services on different platforms.

These insights can fuel personalized marketing campaigns and customer support that build loyalty. This is crucial now that customers have more choices than ever before when it comes to financial service providers.

While financial data aggregation already has many beneficial use cases, it could reach new heights with generative AI. The technology could enable financial services companies to quickly generate various reports, easily access data insights, and personalize marketing and customer service at scale.

In addition to AI, open banking APIs (application programming interfaces) are also changing the aggregation process. Data aggregators use different methods to aggregate data from various apps and financial accounts. One of these methods is called screen scraping, a process in which an aggregator uses the customer’s credentials to log into their account and “scrape” the data shown.

Screen scraping is controversial because it poses a security risk. Also, the customer has no control over which data they share with the aggregator.

In the future, financial organizations will move away from using screen scrapers. Instead, they’ll rely entirely on APIs, a type of technology that securely accesses a customer’s account and retrieves only specific data sets.

Some financial institutions, such as Fidelity Investments, have already shut down data access to screen scrapers, offering an API solution as an alternative.

By default, financial data aggregation involves collecting and sharing sensitive information, such as Social Security numbers and tax forms. Therefore, every data aggregator needs to pay special attention to security and privacy to prevent data breaches and privacy violations.

Most financial institutions partner with third-party vendors to carry out the aggregation process. As a result, they should look for vendors that encrypt data and implement regular security testing to keep up with evolving threats. They also need controls that limit who can access, manage, and process this data to ensure compliance with data privacy laws.

Instead of using screen scrapers, financial service providers should implement API solutions whenever possible to limit the practice of sharing user credentials. “Screen scraping has no fixed standards, and each third-party provider has its own approaches to and levels of security, which are not regulated,” says Rolands Mesters, co-founder and CEO of Nordigen (acquired by GoCardless).

Although some data aggregators may use both screen scraping and APIs to retrieve data, recent moves by the Consumer Financial Protection Bureau (CFPB) seek to limit the use of screen scraping. So, financial service providers that support data sharing through APIs will have a regulatory advantage in case screen scraping becomes heavily limited.

Keep in mind the following best practices for protecting user data, especially in a tightly regulated industry like FinServ:

Be aware of the regulations and laws that apply to your business (e.g., Dodd-Frank Wall Street Reform and Consumer Protection Act, FINRA, etc.)

Ensure that data is being encrypted both at rest and in transit.

Have clear data governance in place that defines what data is being tracked, why, and internal user permissions (i.e., who can access this data).

Prioritize rigorous product and security testing (e.g. pen tests)

Automate privacy and security features when possible (e.g., automatically classifying data based on risk level).

And more!

You can learn more about data security here.

Here’s how financial services companies in Europe and the US have used data aggregation to their advantage.

Taxfix is a Berlin-based financial services company that simplifies tax returns via a mobile app. They partnered with Twilio Segment to aggregate customer data from different sources in one customer data platform (CDP).

By centralizing their customer data, the Taxfix marketing team developed highly personalized campaigns. They also used real-time data for A/B testing and to track how customers were using their product. Ultimately, Segment’s CDP helped Taxfix double their revenue in the first quarter of 2022.

Fintech lender Earnest was able to 10x their loan volume after implementing Twilio Segment, Looker, and Amazon Redshift to gather and manage their affiliate program data. The implementation allowed Earnest to develop a new attribution model that could better track customer referrals and improve the success of their affiliate partners.

ClearScore, a London-based fintech company, had built an in-house system to gather customer data from multiple sources into one database. But this solution wasn’t scalable, so they implemented Twilio Segment’s CDP to collect data from their website, app, and other systems.

The implementation allowed ClearScore to cut costs and free up engineering resources since they no longer had to maintain the in-house system. Plus, real-time insights into ClearScore customers surfaced “any issues in the customer experience that might hurt monetization and has allowed us to make better business decisions faster,” explains Bruce Wood, former data principal at ClearScore.

As financial institutions collect more and more customer data, they need a scalable data infrastructure, and the ability to automate key aspects of data management (like security and privacy).

With a CDP like Segment, businesses are able to process and aggregate data at scale, while automating data governance (in the form of QA checks, data masking, automatic data risk classification, and more). Segment also offers hundreds of prebuilt integrations, and the ability to create custom Sources and Destinations to ensure there are no gaps in data collection or activation.

And with AI features like predictions, FinServ institutions can dig deeper into their data to understand the likelihood of future events. Learn more about why the IDC named Segment a leader in the CDP Market for Financial Services.

Connect with a Segment expert who can share more about what Segment can do for you.

We'll get back to you shortly. For now, you can create your workspace by clicking below.

Data aggregation benefits financial institutions by allowing them to combine everything they know about their customer into one place. Using these insights, they can personalize customer service and inform product development. Financial data aggregation can also be used to automate manual processes and reduce fraud risk.

Data aggregation provides customers with a more personalized experience across customer support and product offers.

Twilio Segment’s CDP helps financial services companies unify their customer data from online and offline sources. Aggregating customer data allows them to understand how customers interact with their products and services, provide personalized experiences, and make tailored recommendations.

Enter your email below and we’ll send lessons directly to you so you can learn at your own pace.