IDC MarketScape names Twilio a Leader in CDP Market for Financial Services

IDC, a premier analyst in the technology domain, recently published the IDC MarketScape report and named Twilio as a leader in the financial services industry.

IDC, a premier analyst in the technology domain, recently published the IDC MarketScape report and named Twilio as a leader in the financial services industry.

In a world where banking happens on smartphones and financial advice is a click away, how do financial institutions keep up and truly connect with their customers?

One such solution that has emerged as a game-changer is the Customer Data Platform (CDP). As financial services firms grapple with the complexities of multiple customer-facing channels, the role of CDPs in delivering unparalleled customer experiences has become mission-critical.

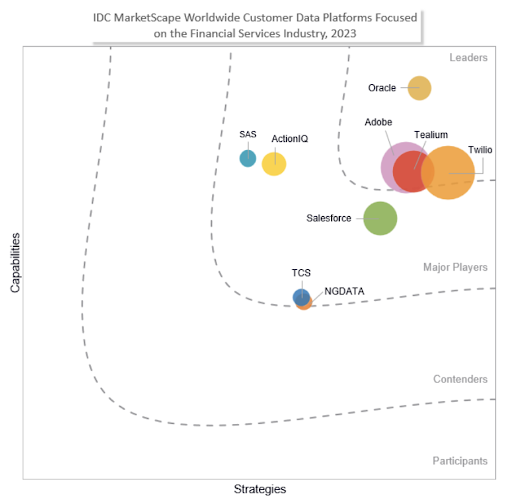

IDC, a premier analyst in the technology domain, recently published the IDC MarketScape report (Worldwide Customer Data Platforms Focused on the Financial Services Industry 2023) and named Twilio as a leader in the financial services industry.

IDC MarketScape vendor analysis model is designed to provide an overview of the competitive fitness of ICT suppliers in a given market. The research methodology utilizes a rigorous scoring methodology based on both qualitative and quantitative criteria that results in a single graphical illustration of each vendor’s position within a given market. The Capabilities score measures vendor product, go-to-market and business execution in the short-term. The Strategy score measures alignment of vendor strategies with customer requirements in a 3-5-year timeframe. Vendor market share is represented by the size of the icons.

The financial services sector – with its intricate web of customer interactions, regulatory compliance requirements, and customer privacy scrutiny – demands a seamless and integrated approach to data activation.

Here’s how a CDP harnesses data to elevate the modern customer experience:

Holistic customer view: At the heart of every successful financial institution is a deep understanding of the customer. CDPs provide a 360-degree view of the customer, collating data from various touch points to offer actionable insights. This holistic perspective ensures that every interaction is informed by the entirety of a customer's history, preferences, and needs.

Addressing the multi-channel challenge: Financial institutions often juggle multiple customer-facing businesses and engagement channels. Whether it's banking, insurance, or investment services, each segment has its unique set of challenges. CDPs act as the bridge, ensuring continuity and consistency across these channels. They enable firms to deliver a unified experience, irrespective of where the customer interaction takes place.

Leveraging AI: The integration of AI with CDPs like Twilio Segment is revolutionizing how financial services understand and engage with their customers. By predicting future behaviors and trends, institutions can proactively address customer needs, fostering loyalty and trust. This proactive approach not only enhances customer satisfaction but also drives significant improvements in market share and operational efficiency.

When utilized holistically, the CDP can serve as the linchpin that holds together the intricate tapestry of customer interactions, ensuring that every touchpoint is a step towards building a stronger, more meaningful relationship.

In a world where data is often dubbed as the "new oil,” its effective management and utilization become essential for financial institutions. CDPs play a pivotal role in this arena, ensuring that data is not just collected but also harnessed to its full potential.

Financial institutions often operate with a myriad of systems, each collecting and storing its own set of data. CDPs act as a central hub, pulling data from these disparate systems and creating a unified customer profile. This ensures that every interaction, whether it's with a bank teller, through a mobile app, or via a customer service call, is informed by the same set of data.

In the fast-paced world of finance, delays can be costly. CDPs ensure that data updates are reflected in real time across all systems. Whether it's a change in a customer's address, a new transaction, or an updated credit score, every piece of information is instantly available across all touchpoints.

One of the biggest challenges faced by financial institutions is the fragmentation of data. Different departments or systems might have slightly different information about the same customer, leading to inconsistencies. CDPs eliminate this issue, ensuring that every department and system has access to a single, consistent view of the customer.

Twilio, a name synonymous with innovation in the tech industry, has carved a niche for itself in the CDP space, especially within the financial services sector. Here's a closer look at what the IDC MarketScape highlighted as strengths of Twilio’s solution:

Twilio Segment CDP : Twilio was founded in 2008, before the CDP market existed. Today, Twilio operates in two business units — Communications and Data & Applications. Twilio's CDP, Segment, is a significant part of the Data and Applications business unit and was acquired by Twilio in 2020. Twilio Segment was ranked number 1 in IDC's 2020, 2021, and 2022 CDP market share documents.

Tailored for financial services: Twilio Segment CDP offers specific data schemas that are out-of-the-box for FSI customers via the Protocols feature. Twilio Segment recipes for banking, insurance, and securities and investments are used to enable specific industry use cases within each industry segment. Twilio has 17 installed and/or available use cases across all three FSI segments, all of which are real time.

AI capabilities: Twilio Segment CDP uses transparent, predictive AI models to analyze individual customer behaviors during real-time interactions, which can then be activated via audiences and segments or for real-time for personalization.

Whether it's a large financial institution, online banking platform, or an emerging fintech startup, Twilio's Segment CDP caters to all. Its scalability and comprehensive features make it a top choice for companies of all sizes.

Our annual look at how attitudes, preferences, and experiences with personalization have evolved over the past year.