Customer Acquisition Cost (CAC): A Guide for 2023

An overview of how to measure and optimize Customer Acquisition Costs (CAC).

An overview of how to measure and optimize Customer Acquisition Costs (CAC).

The “growth at all costs” mantra is starting to fall flat. This mentality seemed to grow out of the startup age, when we would see freshly founded companies rapidly reach unicorn status – their valuations stretching into the billions.

But in the last few years, we’ve seen the emphasis on growth start to steer companies wrong – if they weren’t also focusing on scalable, cost-effective operations. The VC firm, Fuel Venture Capital, warned as much back in 2020, in the early stages of the Covid-19 pandemic. They noted how businesses wrongly saw growth as a synonym for profitability, and that, “if you really want to succeed, efficiency is the name of the game.”

The same is true for more established businesses and enterprises. At the moment, everyone is grappling with the threat of a recession, a bottlenecked supply chain, and trimmed-down budgets. Companies are scrambling to operate in a more efficient way, which means one of their top priorities should be looking at how they can acquire high value customers – and knowing how much it should cost them.

How much money do you spend to win a new customer? That’s the question that Customer Acquisition Cost (CAC) answers. CAC is a measure of all the money you spend on sales and marketing to acquire each new customer.

Businesses track CAC to help identify their most profitable customer segments, determine which acquisition channels yield the most return on investment (ROI), project marketing budgets, and assess the viability of their business models. You answer these questions by comparing CAC to other business metrics like customer lifetime value (more on that later).

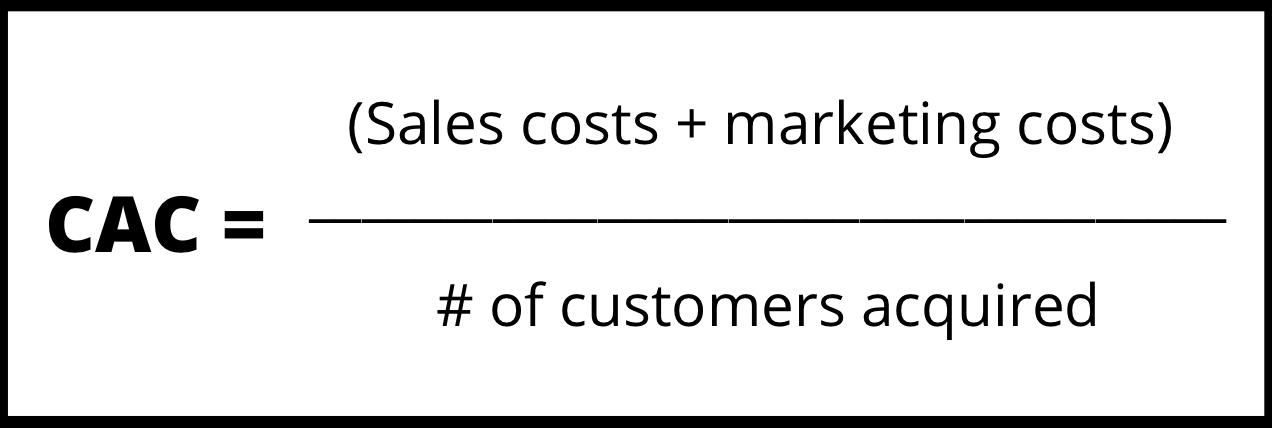

To know your CAC, add your sales and marketing expenses, then divide the sum by the total number of customers you acquired. Businesses typically calculate CAC on a quarterly or yearly basis.

Sales and marketing costs include:

Employee salaries

Production costs (e.g., cost of producing articles, videos, email campaigns, and events)

Software costs (e.g., marketing automation software, analytics tools, customer data platforms)

Paid media and publishing costs (e.g., Google Ads, sponsored content in a magazine, influencer promotion)

Say you spent $11,000 on sales and $13,000 on marketing from May to July – that’s a total expense of $24,000. In that same quarter, you acquired 1,000 customers. Divide $24,000 by 1,000, and you have an average CAC of $24 per customer.

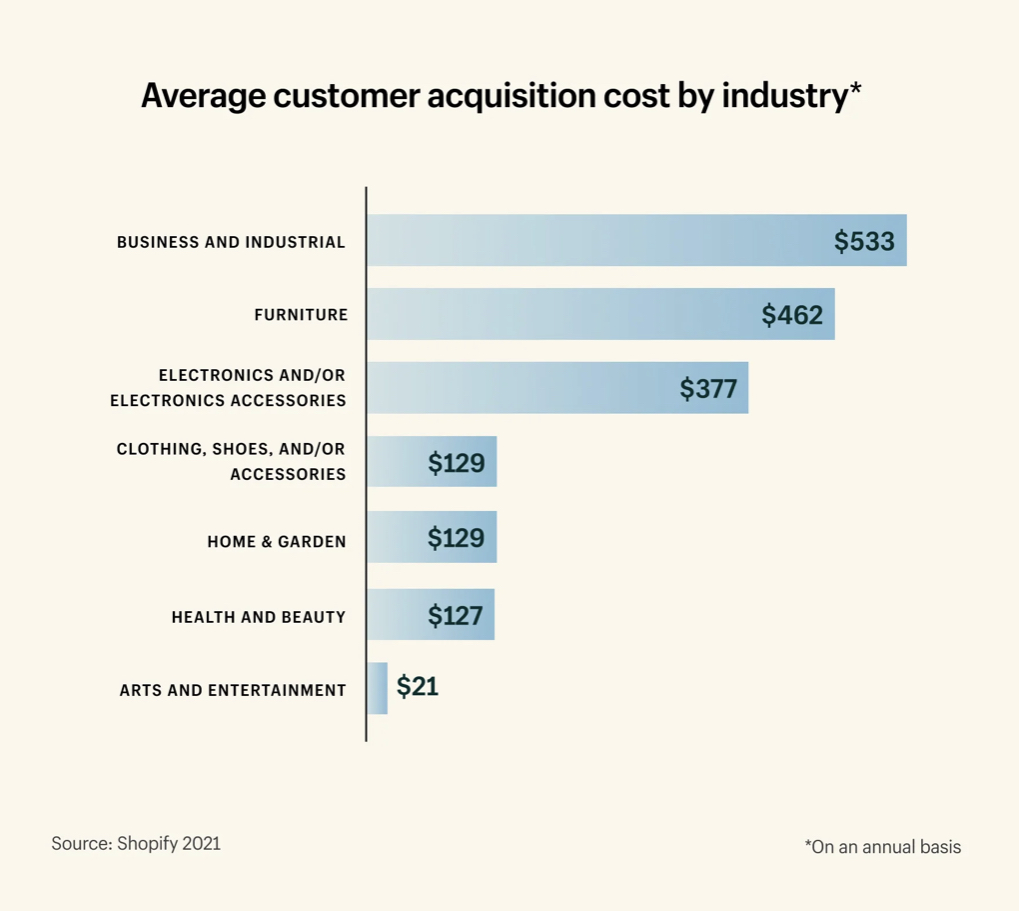

To know if your CAC is a “good” number, compare it with industry benchmarks. In 2021, Shopify surveyed 270 e-commerce business owners across various verticals to find out their average CAC. Here’s what they found:

Consider other business factors, too. If you’re a startup, you’ll have a high acquisition cost as you’re still setting up operations and establishing your brand. As you grow, you may gain more customer referrals or start to see the impact of previous campaigns (e.g. SEO, gated content, and so forth) which can all help lower acquisition costs.

Also, consider the price of your products, your sales cycle, and business model. For instance, a CAC of $1,000 sounds high, but not if you expect a customer to take an annual subscription worth $800 a year for the next four years. In contrast, a single-digit CAC isn’t great if your marketing strategies only yield customers who quickly churn. That’s why you don’t stop at simply knowing your cost of acquisition – you go a step further by calculating your LTV:CAC ratio.

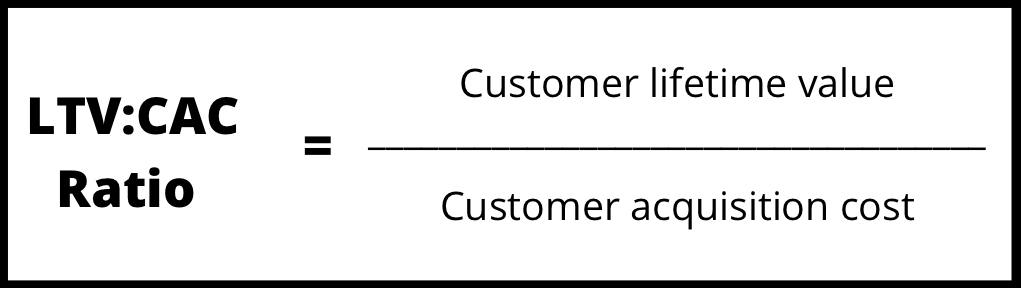

An LTV:CAC ratio is an important metric that compares how much you spend to win a customer compared to how much they’re expected to spend with your business in their lifetime (i.e., customer lifetime value or LTV). An oft-cited rule of thumb – particularly for growing SaaS companies – is for the LTV to be 3x your CAC, which means an LTV:CAC ratio of 3:1.

LTV – also known as CLV (or customer lifetime value)– is the product of three factors multiplied together:

LTV= average value of purchases × average # of purchases per year × average customer lifespan in years.

You get your LTV:CAC ratio by dividing lifetime value by acquisition cost.

Let’s say your customers spend $20 on average, twice a year, for two years. That’s an LTV of $80 ($20 x 2 x 2).

Divide $80 by your CAC of $24 from our previous example, and you get 3.33, or an LTV:CAC ratio of 3.33:1. That is, for every dollar you spend to acquire a customer, that customer spends $3.33 on your business.

An LTV:CAC ratio of less than 3:1 means you’re spending too much to acquire customers who don’t spend enough on you. Your sales and marketing ROI is low, and you need to examine your strategies to find what should be fixed. Problems that lead to a low LTV:CAC ratio include:

Overuse of expensive acquisition channels

Failure to identify and attract a high-value customer segment

Unconvincing messaging

Wrong pricing strategy

Too-high overhead costs

In contrast, if your LTV:CAC ratio is too high – say, more than 5:1 – you may be spending too little on sales and marketing and missing out on an opportunity to capture a larger market share.

“[Customer Acquisition Cost] needs to be measured in relation to customer lifetime value. This has become a top priority for CFOs as the digitization of business has forced businesses to build direct relationships with their customers.”

- Twilio COO, Khozema Shipchandler, Source

Many marketers in 2022 have found that it’s getting more expensive to acquire customers. In a survey conducted by CommerceNext in December 2021 and January 2022, 57% of retailers identified rising customer acquisition costs as a threat to their sales goals for the year. Another research study, conducted by social commerce platform SimplicityDX, revealed that eCommerce brands are losing $29 on average for every customer they acquire. Even direct-to-consumer brands that have attained cult status or gone public have crumbled beneath the weight of a CAC that keeps costing more dollars.

Tougher competition and privacy safeguards – including the phaseout of third-party cookies – are driving CAC up, especially for digital advertising. To balance out these costs, focus on the factors you can control.

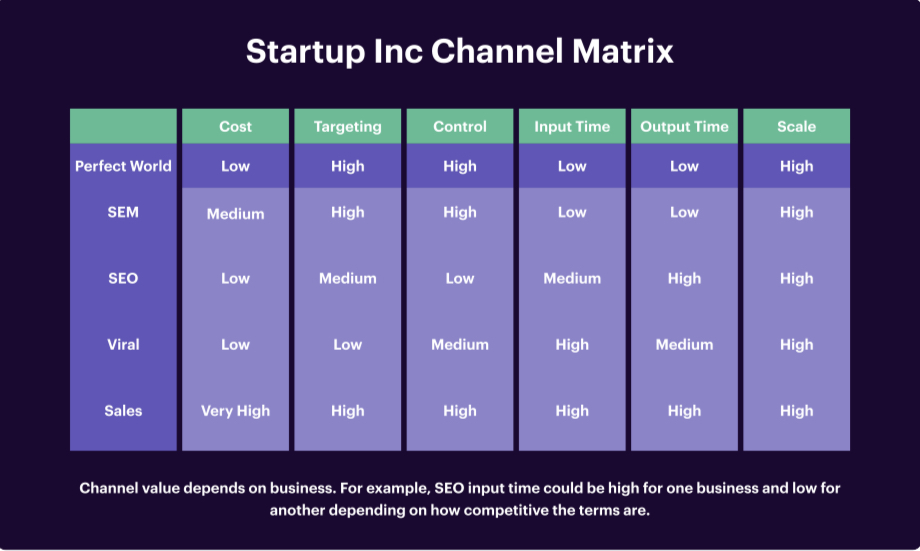

While you can’t control what channels your customers prefer, you can decide how much you spend on each channel. Use the most effective, low-cost channel for your product to reduce CAC and get more ROI for every marketing dollar you spend. The matrix below shows variables to consider alongside cost when choosing a customer acquisition channel:

Example of a channel matrix from Brian Balfour’s 5 Steps To Choose Your Customer Acquisition Channel

This advice comes with a caveat: Divert more marketing campaigns to lower-cost channels only if it makes sense to do so. One way to determine the most suitable channels to use is to figure out product-channel fit, a concept introduced by marketer Brian Balfour.

For example, a product made for B2B companies that comes with a high learning curve wouldn’t be a great fit for viral marketing because it takes a lot of time to explain and probably serves niche segments. It will require lots of educational articles and videos, so you’ll want to engage potential customers through SEO, email, and webinars.

Compared to B2B campaigns, an ad for a B2C product has a bigger chance of going viral. Think of Dollar Shave Club’s tongue-in-cheek launch video, which spread so fast that the company’s server crashed within an hour, and the company got 12,000 orders within two days. (Here’s where to watch the video. Imagine their LTV:CAC ratio in those first few days!)

Find out which parts of your marketing funnel are effective at converting leads and which parts you need to improve. Begin by mapping out the steps your prospects take in their journey to becoming customers. You do this by interviewing customers, getting Google Analytics data on how people navigate your website, gathering email and social media marketing data, or trying out the prospect’s experience for yourself – for example, browsing your site and pretending to be a customer.

Next, gather data using your analytics platform on how many people get to each step – and identify the steps that have the largest drop off. Heatmaps, surveys, testing for bugs, and segmenting customers by referring channel can all help provide insight into why people leave. Once you know what’s wrong, A/B test a solution and implement the one that’s most effective in reducing drop-offs.

The process described above can be complicated, but if you’re keen to try it out, you can consult this step-by-step guide on removing the funnel bottlenecks that are killing your conversion rate.

Figure out which customer segments are your best customers – the ones who will potentially meet your minimum LTV requirements based on your target LTV:CAC ratio and the ones who will like your product so much that they will recommend it to others.

To find these people, dig into your customer data. Find traits common to customers who fit your criteria – for instance, customers who purchase from you at least 3x a year, spend at least $100 a year, or share referral codes with their friends. Next, set up a lookalike audience on an ad platform like Facebook to find and target prospects who exhibit the traits that you’ve identified. That way, you have a higher chance of acquiring a high-value customer and offsetting your ad spend.

Discovering your best customers’ common traits is easier when you use a customer data platform (CDP) like Segment. A CDP is a centralized database for all your customer data, which may come from multiple sources. A CDP can identify the same customer across many channels and create a unified profile for that customer. It then identifies shared attributes to help you define your customer segments.

As your business grows, you’ll find it more challenging to scale manual sales and marketing tasks like creating lead scores, sending personalized emails, and determining marketing attribution. Use marketing automation tools to scale routine tasks and repetitive workflows so that manual tasks will take up less of your marketing efforts and costs. You’ll get a larger number of leads faster, too, by automating ad retargeting, email campaigns, landing page optimization, lead scoring, and other tasks.

For a deeper, more nuanced understanding of CAC and how to improve it, read our ebook, The Fundamentals of Customer Acquisition.

Connect with a Segment expert who can share more about what Segment can do for you.

We'll get back to you shortly. For now, you can create your workspace by clicking below.

Knowing your customer acquisition cost (CAC) helps you identify your most profitable customer segments, determine which acquisition channels yield the most ROI, better project marketing budgets, and assess the viability of your business model.

Cost per acquisition (CPA) is a metric that measures the cost of acquiring a customer action that leads toward conversion, such as signing up for a demo or registering for an account. Customer acquisition cost (CAC) measures the total cost of acquiring a paying customer.

It’s important to calculate the CAC of each marketing channel so you can identify channels that give you the most ROI. For example, you may find that it costs as much to advertise on channel F and channel T, but the latter yields twice as many paying customers. You can then adjust your marketing budget to focus more on channel T.

Twilio Segment helps businesses identify their best customers and discover that customer segment’s shared traits. Marketers can then use those traits to refine their ad targeting criteria by creating lookalike audiences. Twilio Segment also connects to marketing automation tools, enabling marketers to scale personalized campaigns.