COURSE 5 • Lesson 4

What is a Growth Model? + How to Identify Your Company’s

This lesson walks through what a growth model is, some great examples, and most importantly how to identify and build your own growth model.

COURSE 5 • Lesson 4

This lesson walks through what a growth model is, some great examples, and most importantly how to identify and build your own growth model.

All large successful companies have "growth models"--that is to say, key feedback loops that drive sustained customers, acquisition, and business growth.

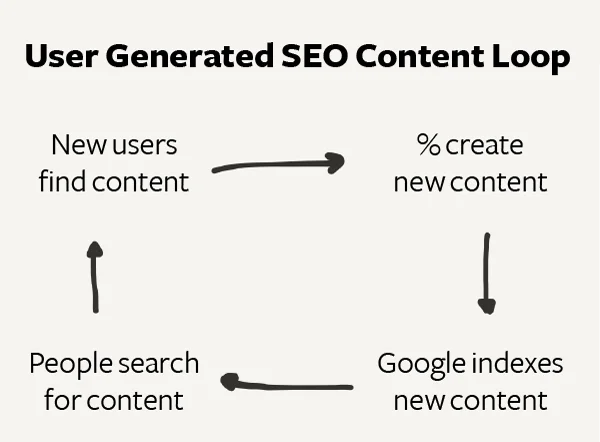

The concept of a growth model, or growth loop as it's often called, is relatively new, and has been popularized by leaders in the growth community, like Andrew Chen, and programs like Reforge. At its core, the idea is very simple. What are the ways that your business acquires customers? They're called loops because they should be circular and compounding. Some common examples of growth models include paid acquisition, viral invite, two-sided marketplaces, and user-generated SEO content (see image below).

Defining your company's growth using a model helps identify high leverage "inputs" (areas of your business that you have control over) that can amplify compounding growth over time. Additionally, these high impact growth models help you choose which metrics to measure—and set goals against—to get a clear understanding of your growth progress.

We'll dive into four common models and show how to derive a set of high-signal metrics for each one:

User-generated content (e.g., Yelp, Stack Overflow, Genius)

Viral invite loop (e.g., Venmo, Snapchat, Zynga)

Paid acquisition (e.g., Handy, New Relic's campaigns)

Two-sided marketplaces (e.g., Uber, Lyft, Airbnb, Segment)

A growth model is a visual representation of the acquisition model a business uses to grow and sustain its customer base. A business’s growth model will depict the inflow of new customers, the methods used to create this inflow, and the expected growth generated with these methods.

Before looking at the four growth models, let's quickly walk through the steps to determine the key metrics:

Identify your growth model

Create a mathematical model in a spreadsheet with assumptions

Deduce key metrics by conducting sensitivity analysis on your spreadsheet

Identifying your growth model requires thinking holistically about each cohort of your users and how they can acquire the next cohort of users. This means looking step-by-step at your user journey and mapping them to discrete actions. The final cohort then "becomes" the next base cohort from which the actions in the loop start again.

After identifying the feedback loop, then it's time to mathematically define each step. Note that the final total number of users in the first time period will become the starting number of users in the next time period. We start by keeping things as simple as possible and using percentages in the spreadsheets below.

Lastly, you can deduce key metrics with sensitivity analysis on the mathematical model. Due to the compounding nature of the growth feedback loop, some assumptions have a greater amplifying force on growth over time (e.g., conversion to sign ups vs conversion to paid). We'll illustrate this in our examples below.

A user-generated content loop is a popular self-reinforcing growth model used by companies like Yelp, Genius, Stack Overflow, Quora, etc. The step-by-step user story here is:

users sign up

% of the users create new content

Google indexes the content

non-users search and find the content

% of those non-users eventually sign up

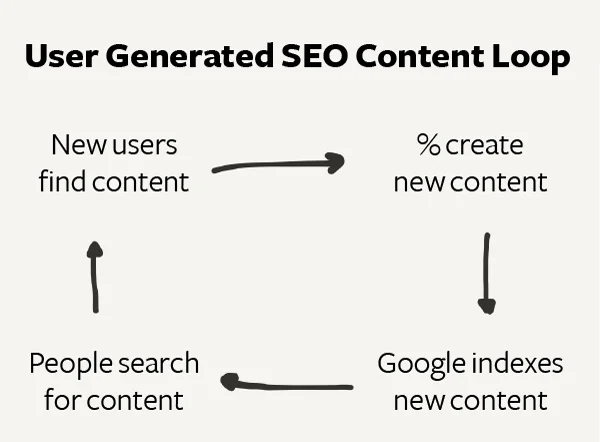

Here is a mathematical model in Google sheets to represent the user generated content functions. With this model, we can identify areas of high leverage by adjusting assumptions and seeing their impact on the growth trajectory of the company. For example, we can see if improving the conversion rate of users who generate content or focusing on acquiring new users would generate more money.

The graph above is taken from the aforementioned Google spreadsheet.

The "2x generate content" case assumes the % of users who generate content is twice as much as the base case, whereas the 2x signup case assumes the conversion to sign up is doubled. This model suggests improving the signup conversion has more compounding effects than content generation conversion.

So, if you're running this type of business, the key metrics you should be watching are:

% of existing users who generate content

% of visitors from search who are new

% of sign ups who are new visitors

When we remove ourselves from the mathematical model to do a quick gut check, we can see that these are the key metrics that'll move the needle the most. If we can incentivize users to generate more content or optimize the conversion from visitors to signups, we can see compounded growth over time.

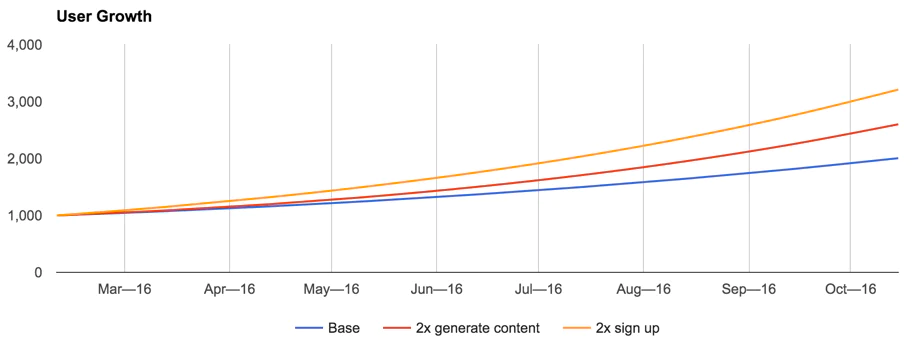

This is a popular model for many social games or apps (e.g., Snapchat, Venmo) that asks users to invite friends via importing their address books. Many companies experienced massive growth leveraging this viral loop. When Facebook launched their graph API, users could suddenly ask all their friends to help harvest their Green Wheat in Farmville, and the game took off overnight. It's worth noting that the best viral loop examples are almost always found with consumer companies.

The step-by-step user story here is:

user signs up

% of the users invite their friends

% of those friends sign up

Here's a mathematical model in Google sheets to represent this growth model. Again, we use this model to see which assumptions move the needle the most. For example, we can see the impact on growth if we improve each percentage point of number of users who invite their friends.

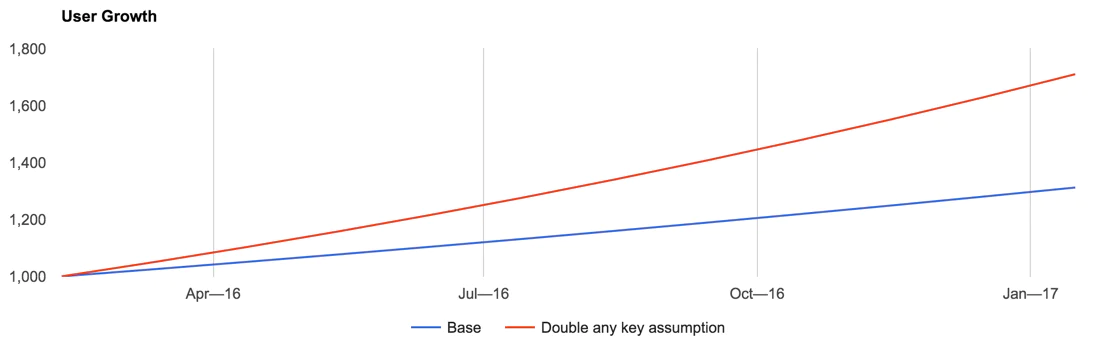

The graph above is taken from the aforementioned Google spreadsheet.

The second "Double any key assumption" is the case where either the % of users invited or the % of invited users sign up are doubled. The math happens to work out that way.

For this model, "amplifying" metrics are:

% of users who invite friends

% of sign ups per invitee

It makes sense that these are the metrics that can significantly add growth over time. If users were more incentivized to invite their friends, then that leads to a greater pool of users who can convert to registration. Seeing that these areas are higher leverage, it makes sense to optimize for those metrics so you can reap the growth benefits later.

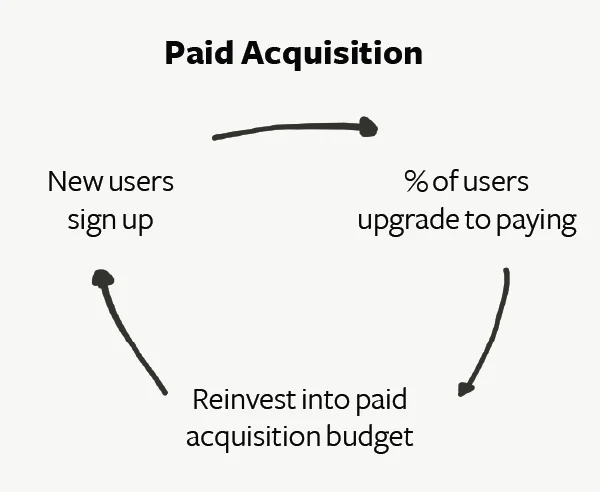

The paid acquisition growth model is slightly less exciting, but it's how many companies scale efficiently. Existing users don't directly help you acquire new users, but they generate revenue that you can reinvest in paid marketing. For example, for a company that earns $100 reinvests that money into acquiring new users. From that cohort, the company makes $80 to reinvest again. This model assumes that the cost of acquiring the user is less than the lifetime value of each user (most VC's and founders say that the acquisition cost should be ⅓ of the lifetime value).

The step-by-step user story here is:

company uses money to get X users

% of X users upgrade and pay total of $Y

company reinvests $Y to get next cohort of users

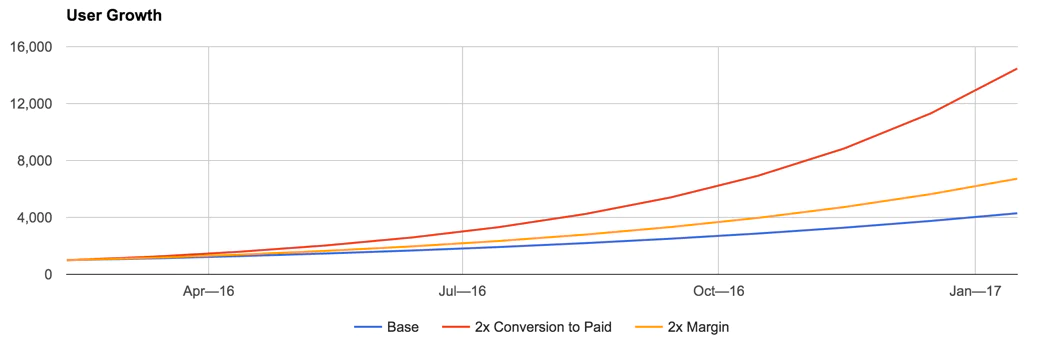

Graph above is taken from the aforementioned Google spreadsheet.

We see that doubling the conversion rate to paid has a higher impact than doubling "margin" (calculated as LTV - CAC).

You can see in the model that the main assumptions for this are:

% of customers convert to paying

LTV: Customer Lifetime Value

It's not trivial to optimize any of these three metrics (it probably will take resources across several teams within a company). However, each KPI can significantly improve the effectiveness of a single marketing dollar spent. Higher LTVs and lower CACs can make the dollar work for acquiring more users, and a higher percent of paying customers leads to a larger marketing budget.

The two-sided marketplace model has become more and more popular, as technology helps buyers and sellers transact more easily with one another. For example, Uber, Etsy, Segment, and Grubhub all represent marketplaces.

Growth in a two-sided marketplace relies heavily on the increasing value one side gets from the other. What value do drivers get from more riders and riders from more drivers? Each network effect can be modeled out. If you want to dive deeper in how we do marketplace growth analysis at Segment, check out our post on modeling two-sided marketplaces.

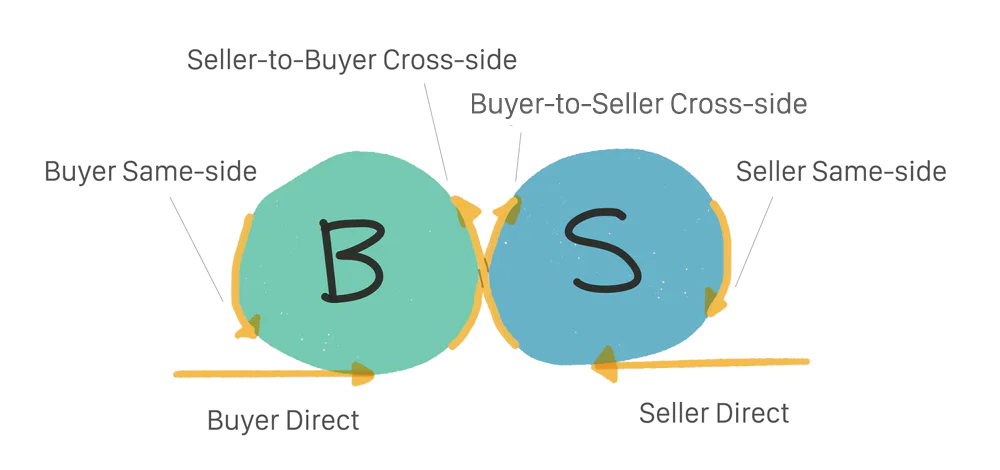

To illustrate the reinforcing nature of growth for two-sided marketplaces, here is the set of the six key growth dynamics (ideas heavily borrowed from this HBR article):

Buyer-to-seller cross-side: Prospective buyers tell prospective sellers that they prefer to do business on the platform. "It was hard to find your place. How come you don't list on Airbnb?"

Seller-to-buyer cross-side: Prospective sellers expose prospective buyers to the platform. "Buy my adorable elephant mittens on Etsy."

Buyer same-side: Buyers love the new transaction experience, and tell other prospective buyers to use the platform. "Why would you use a taxi? You should check out Lyft."

Seller same-side: Sellers love the new transaction experience, and tell other prospective sellers to use the platform. "I made a good chunk of change while I was on vacation, renting my place on Airbnb. You should try it out!"

Direct to buyers: The marketplace tells buyers about itself directly. "Wow, Uber has a lot of billboards here."

Direct to sellers: The marketplace tells sellers about itself directly. "I searched for jobs in Cincinnati and found Lyft."

You have a few more metrics to focus on in this model:

direct acquisition of buyers

direct acquisition of vendors

average # of buyer signups driven by each new vendor

average # vendor signups driven by each new buyer

Often the highest contributors to growth depend on your company's stage. For example, if it's too early for any of the cross-side or same-side marketplace growth dynamics to be a major contributor to growth, then you should focus on growing one side of the marketplace. For example, at Segment, we started by building up our catalog of integrations partners ourselves to attract customers. Then, as we gained more traction and had a critical mass of integrations, we started to think about how we could better work with our partners to drive more customers to Segment.

Using a growth model makes it easier to derive a set of metrics to track and set goals against. The model, when represented mathematically in a spreadsheet, enables you to easily adjust the assumptions to determine which focus area can lead to the most compounded growth.

And remember, this model is not for financial planning and projections about what will happen. They're to be used as strategic tools to understand what the business could do so you can see the bounds of what strategy you can invest in.

That being said, once you identify the set of metrics that are most impactful, it's a matter of holding teams accountable to one or two metrics and really focusing on tasks and experiments that can move these numbers. What we've found to be most effective is to hold each team accountable to one (or two, max) of these metrics, then prioritize experiments that can improve those metrics.

While we covered four common growth models in this lesson, there are many others! If you have any ideas, please share them by tweeting at us!

The primary purpose of growth models is to help businesses understand how they can grow and sustain their customer base. The models can also help identify which methods are more effective at acquiring new customers and generating growth.

The growth model is important because it helps to guide and prioritize business efforts. The model can be used as a framework for product, growth, and customer development teams to identify which areas to focus on in order to improve growth.

Grow using data

Enter your email below and we’ll send lessons directly to you so you can learn at your own pace.