How can a Customer Data Platform (CDP) help navigate this new regulation?

Twilio Segment empowers businesses to establish a modern customer data foundation and achieve a complete view of their customers. With Segment, businesses can capture customer data at every touchpoint, enrich customer profiles, unlock customer insights, make data driven decisions, and deliver unified, personalized customer experiences.

Information capture

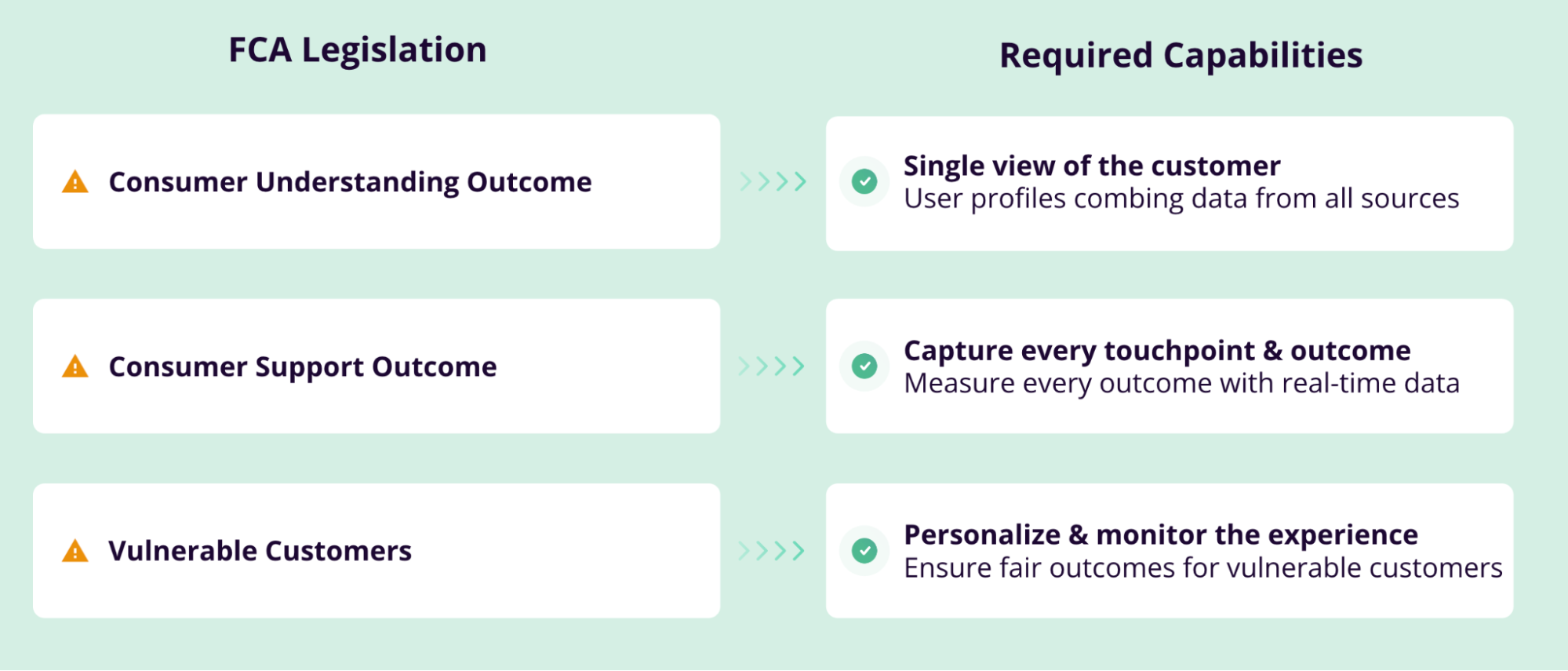

Part of ‘the Duty’ is about knowing who your customers are, so you can tailor communications to them and provide optimal customer support. If you don’t have a solid data foundation in place, this will seem like a tall order. But implementing a CDP, like Segment, enables you to capture customer data from a plethora of sources, centralize that data, and make it available to all downstream tools used by customer facing teams and analytics. This way all relevant teams will have a complete view of your customers, including characters of vulnerability, which is paramount in this new regulation.

Collecting and combining the right data also helps enhance your digital products, especially for vulnerable customers. When you have the full view of all customer touchpoints, you can use the data to answer questions like:

-

How can we identify whether the website or application is supporting vulnerable customers in the best way possible?

-

How do you measure the impact of a change to the website or application on customer outcomes?

Let’s walk through an example. Suppose you want to understand whether vulnerable customers are successful in navigating your app for basic functionality, or whether they frequently call the contact center for support with basic tasks.

In order to understand this, you would need to capture all behavioural data from your application, combine it with data from the contact centre, and look at the relationship between the two. These are often disparate, siloed sources of data, but a CDP can combine these data streams in real-time, to drive analytics and even trigger real-time actions off the back of a sequence of events.

With the data streams combined, you could answer the following questions:

-

Do vulnerable customers tend to call the contact centre more often than others?

-

Is a website user or an app user more likely to call the contact center?

-

Is there a pattern of behaviour we see before they call the contact center?

-

Are there certain topics viewed moments before they call the contact center?

-

Did recent changes to the website or app impact the customer outcomes? What about vulnerable customers?

Uncovering deep, impactful insights is just one case of combining data with a CDP, but it is even more impactful when the data is used to drive real-time actions, to personalize the customer experience and move the needle on customer outcomes.

Personalizing and optimizing communication across the customer journey

Once you have the right data foundation in place, with an understanding of who the customer is, and where they are in their customer journey, you can tailor the communication and customer experience accordingly.

With a CDP, communication can be personalized across all channels, in a joined up, coherent way, regardless of the activation tool used to deliver the message. That is the power of a CDP, to collect data from all sources, use that information to inform communication strategies and distribute audiences and journeys across any tool the business uses.

Let’s continue the example of the vulnerable customer who’s navigating the app before calling the contact center. With a complete understanding of the customer, such as their vulnerability status, and their behaviour across all digital touchpoints, such as whether they currently have a case open, you can personalize the app experience to ensure sure the information and overall experience enables them to make well-informed decisions, and increase the likelihood of positive outcomes.

You can do this with Twilio Engage to deliver unified, personalized customer experiences at scale. To optimize and tailor communication, you can use Journeys and randomized splits, within Engage, to experiment with different communication channels, content and timing, ensuring you achieve the best possible outcomes for your customers.

Track customer support

Customer support is often offered across a variety of channels — in-app, live chat, Email, contact centers, text message, or in branches. By capturing data from all of these channels, companies can better understand the customer support needs and relationship between the channels. For example, how frequently users follow the in-app support channel, only to call the contact center the same day. Having all this information available to your analytics team ensures you can better understand these relationships. It can also help you identify which channels are sufficient or working well for vulnerable customers.

Recognize, observe, and assess

An important element of centralizing the collection of customer data is democratizing it to your customer support teams so that they can provide the best possible support. For example, using Profiles Sync you can display relevant information that may be in your data warehouse, such as vulnerability status, to your customer support team in your contact center, like Flex. Outside of vulnerable customers, you can also anticipate customer needs through their interaction with your help center or website. For example, if a customer has read the claims process in your customer portal, the CS agent can anticipate when they call next that it might be to make a claim. And lastly, by capturing every touchpoint and customer outcome with Segment, you can better understand which customers are experiencing negative outcomes and take action.

Conclusion

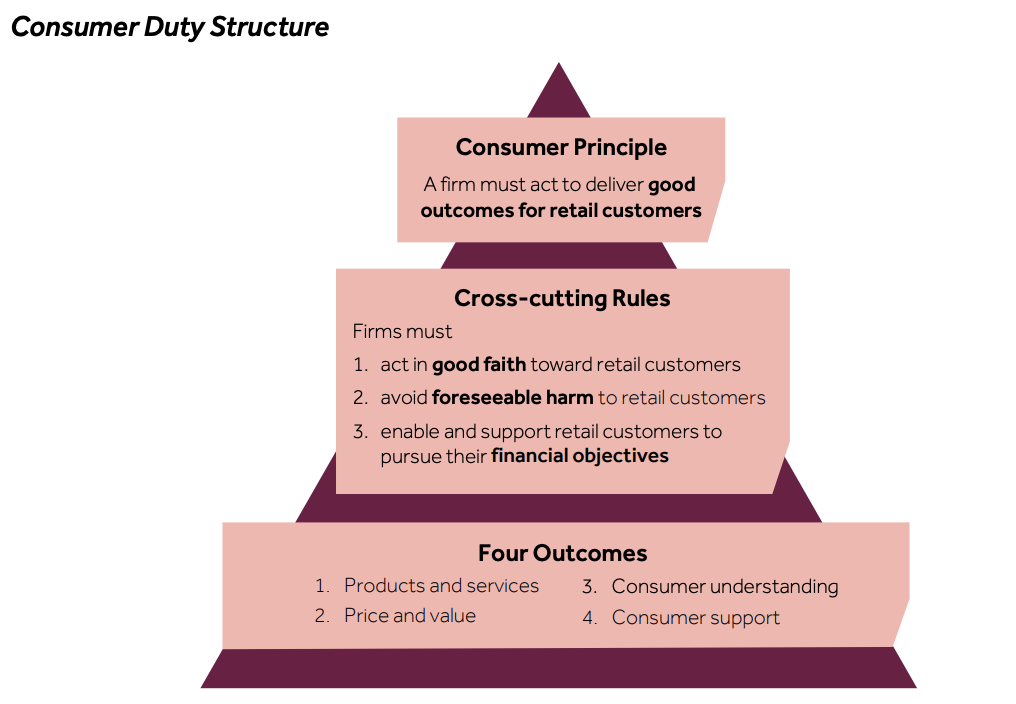

With the introduction of the Financial Conduct Authority's new Consumer Duty, companies must take a more proactive approach to meeting the regulator's high standards. And a CDP can be a powerful tool to help navigate the new rules by helping you capture customer data, personalize and optimize communication, track the health of your customer support, and provide the best experience for customers, particularly those who are considered vulnerable.

Book a demo of Segment