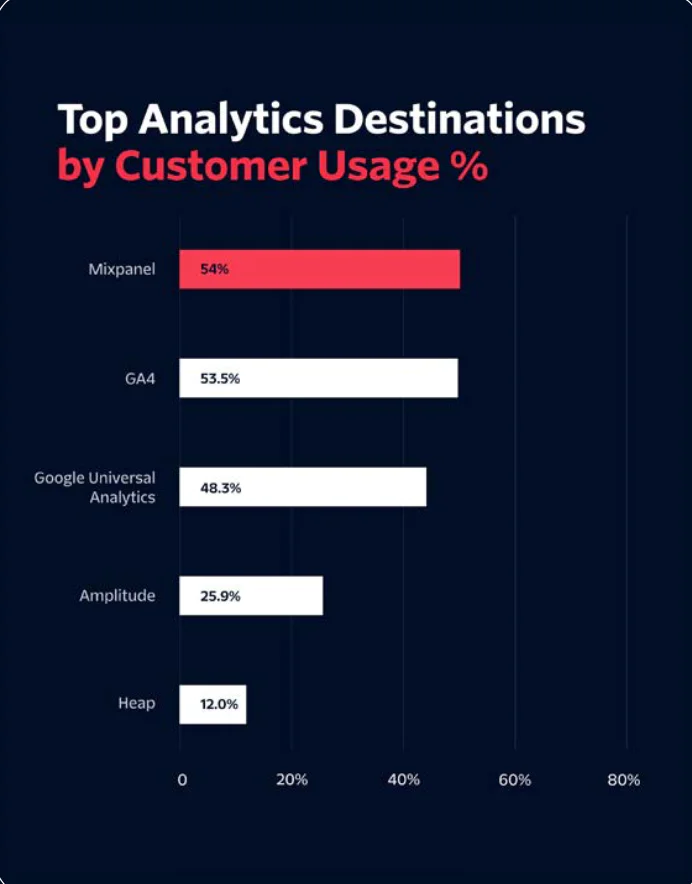

Analytics remains the most widely adopted destination category on the Twilio Segment platform, underscoring its critical role in modern customer engagement strategies. This year, Mixpanel leads the pack, connected by 66.2% of Twilio users, solidifying its dominance as a top choice for businesses focused on product analytics and behavioral insights.

Meanwhile, Google Analytics 4 (GA4) continues its rapid adoption, now used by 53.5% of Twilio customers, as businesses adapt to an event-based, privacy-first approach to tracking. While GA4 is gaining ground, Google Universal Analytics (UA) is still actively connected by 48.3% of users—though its phase-out has pushed many companies to accelerate their migration strategies.

Further down, Amplitude (25.9%) and Heap (12.0%) maintain strong footholds in product and digital experience analytics.

A CDP enriches analytics platforms with unified, real-time customer profiles, allowing businesses to go beyond passive reporting—enabling smarter audience segmentation, real-time activation, and continuous experimentation to drive growth.

.png/_jcr_content/renditions/compressed-1600.webp)

.png/_jcr_content/renditions/compressed-1600.webp)

.png/_jcr_content/renditions/compressed-1600.webp)