How to measure B2B growth with Twilio Segment and Dreamdata

Attributing marketing tactics to revenue is a major headache. But not when you use Segment and Dreamdata.

Attributing marketing tactics to revenue is a major headache. But not when you use Segment and Dreamdata.

It's nice to know your business is growing, but it's essential to know why your business is growing. Unfortunately for B2B SaaS businesses, answering “why” is no small task.

B2B transactions not only take a long time — time to revenue is often 6 to 12 months or longer — but they also require the coordination of multiple teams, advertising channels, campaigns, and more. And that’s not mentioning all the nuances of the SaaS business model, like the cost of spinning up a new business, that makes attributing marketing tactics to revenue a major headache.

Despite these difficulties, it’s not impossible to figure out the secret of B2B growth. If you can own, gather and study your first-party data with platforms like Segment and Dreamdata, you will gain tools to establish a formula for consistent B2B growth.

The first step to measuring B2B growth is establishing ownership of your first-party data. When you control the flow of your user’s information, you will gain the tools to determine who your users are and why they’ve chosen to do business with you.

Many businesses still rely solely on platforms and tech stacks that make it difficult to gather data, let alone transfer that data between teams and other platforms. In the past, customer relationship management platforms (CRMs) were treated as the panacea, but they are simply not enough — while useful, CRMs become yet another silo that traps your data in its own proprietary system.

You need a customer data management platform (CDP) that provides open access to your first-party data and the freedom to move that data around however you wish. In addition, you’ll need your own database to store the data you gather for further analysis.

Once you have these capabilities in place, you can start gathering first-party data with an identification funnel.

The identification funnel is the process of learning more about your users as they learn more about your product. What you know about your users starts very broad and gets more specific the more they interact with your brand.

There are four general stages of the identification funnel where you need to make sure you gather as much data as you can. The information these stages provide will form the foundation for understanding what drives B2B growth.

If you’re spending money on ads to drive traffic to your website, you should make sure you’re measuring the traffic those ads bring in. Once you know if you’re driving traffic and where it comes from, you can start to figure out how much that traffic is worth.

Urchin tracking module parameters (UTMs) are the perfect tool for this because they’re the “Swiss Army knife” of advertising attribution. They appear as strings of code at the end of URLs, and they provide information on the source, medium and campaign that’s driving traffic.

Here’s an example:

utm_source=facebook&utm_medium=paid-social&utm_campaign=podcast

In this case, the source is Facebook, the medium is a social media ad, and the campaign is the one promoting your podcast. Add this string to the URL associated with your podcast-focused Facebook ad, and it will act as a beacon letting you know every time a visitor lands on your site because of that ad.

The more specific your UTMs are, the better. You should apply them to any effort that drives traffic to your site, whether that’s email, organic social media, etc. Applying them to ad platforms, though, is particularly useful for allocating future ad spend because you can compare the return on Facebook ads versus return on Google ads and much more.

For example, say a CMO clicks your Facebook campaign targeting marketing executives in New York City. All you would know at this point is that someone clicked that ad and browsed your site.

Once you have a user on your site, it’s important to gather information on what they do. If they fill out a form, you have a golden opportunity to tie UTM data to behavioral data, so you can learn more about your users’ journey and what they’re looking to gain from you.

To do this, we’ll have to dip our toes into some code. Segment has two identification events that are particularly useful for linking identity with behavior, analytics.identify and analytics.track. They live as JavaScript code snippets you can embed in your form’s code.

Analytics:identify assigns traits (like first name and email) and ties a user to their actions.

Analytics:track allows you to record actions your users take (like subscribing to a newsletter) as well as properties that describe that action.

For analytics:track, you’ll want to name your form’s event (i.e., the action the user takes), assign the properties to that event, and tie it all to what you know about the user already.

For example, an event might be,

"event": "Newsletter Subscription"

If you’re A/B testing, the property might be,

"experiment_name": "Homepage headline two"

Using analytics:identify, all of this is tied to either an anonymous ID for users you don’t know yet or a User ID for users who are already in your system.

Following the example of our CMO from NYC, say she subscribes to your newsletter after clicking the Facebook ad. You now know her first name, work email, and that she reached the form by clicking on one of your ads.

In emails like monthly newsletters, you can gain insight into what kinds of content resonates with your users by utilizing more advanced UTM strings. Once you know what’s resonating with a specific user or a cohort of users, you can start to personalize the rest of their customer journey.

In one of our recent newsletters, we included this link:

It looks like a pretty standard UTM structure until the end. The “ajs” sections are triggers for Segment’s track and identify events explained above. What they mean is that if we know the user ID of the person who clicks this URL, Segment will associate them with the action “emailClicked.”

OK, so what if our NYC-based CMO clicks a link in the first email you send her? You may not have a user ID for her yet, but you can set up ajs to associate “emailClicked” with her anonymous ID. Now you know her email, first name, that she clicked an ad, subscribed to your newsletter, and is interested in a specific type of content.

Now we’re getting somewhere.

Logins and registrations sync the user’s journey with their behavior within your product. At this point, you know who your users are, how they became users, and what they’re doing now that they are users. The better you understand this process, the better equipped you are to create a formula to repeat it.

Once a user registers for the first time, you can assign them a unique user ID. This ID will follow them throughout their time as your customer.

Maybe our CMO in NYC decides to create a free account to test out your product after reading the article you linked in your newsletter. Later, she upgrades to a paid account and works with sales and customer success to onboard her team. Now you know her entire customer journey and can tie it all to her user ID.

But along this whole journey, which was the most valuable touchpoint for driving the revenue created by this new client? Was it the Facebook ad that kicked the whole thing off? Was it the last piece of content she read? Or was it the newsletter that kept her engaged? This is where attribution models come in handy.

Attribution models use complex statistics to determine how much credit marketing tactics should receive for bringing in new business. By aggregating many user journeys (i.e., what ads and content they saw and when) and linking them to revenue, attribution models can help you understand the return on investment of each tactic. With that information, you will have the tools to measure and prove how your marketing efforts impact B2B growth.

Attribution platforms, like Dreamdata, hook up to CDPs, like Segment, to make sense of all the identity funnel data you’ve gathered.

There are many different types of modeling you can do with attribution platforms, but they all fall into a few categories:

First-touch attribution is where you attribute conversions to the user’s first interaction.

Last-touch attribution is where you attribute conversions to the user’s last interaction before converting.

Multi-touch attribution is where you take into account all the user’s interactions.

Linear multi-touch attribution is where you attribute credit to each interaction equally.

Custom attribution is where you use historical customer journey data to weigh each interaction differently. A common custom model is W-shaped, where the first, middle, and last interactions carry the most weight.

Some businesses choose one model and run with it. But because one model alone doesn’t paint the whole picture, platforms like Dreamdata allow you to compare many models at once to understand the role each ad plays in bringing in new business

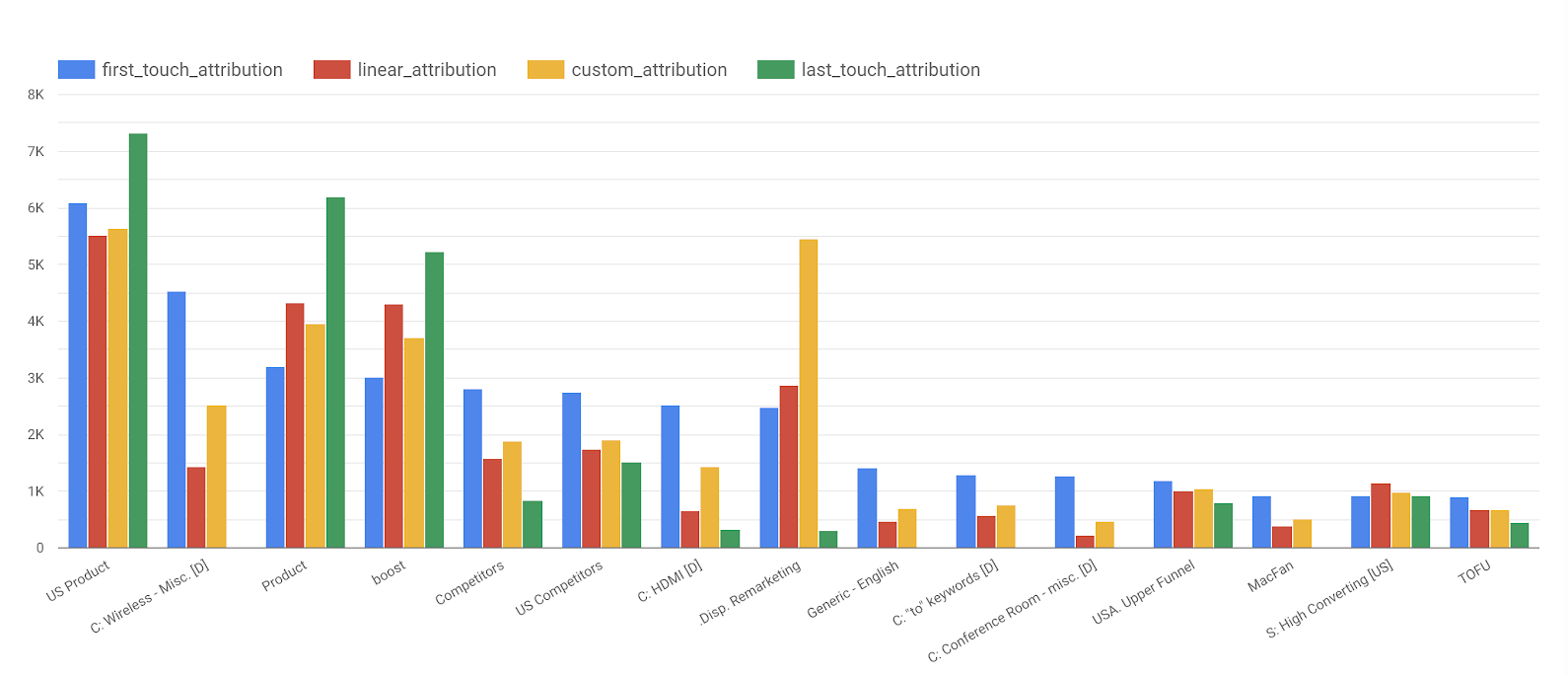

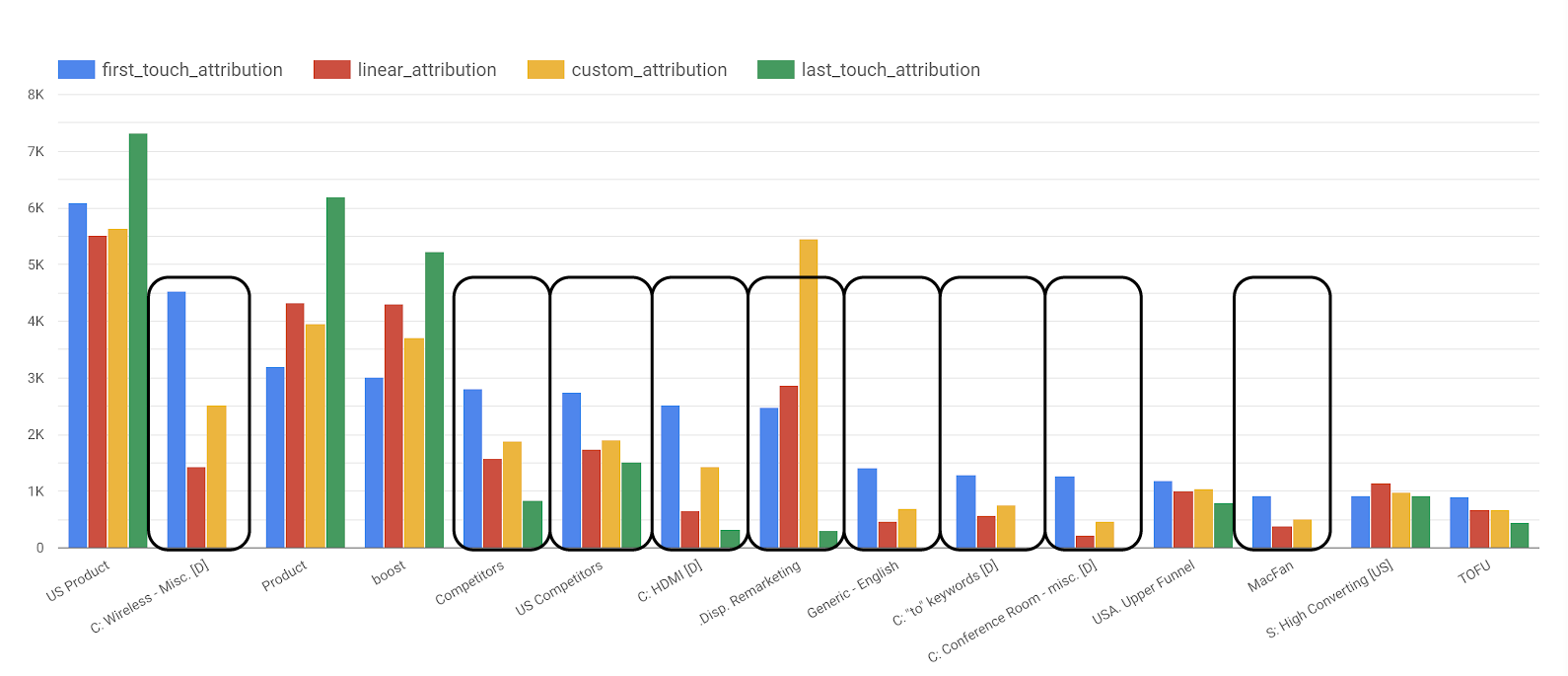

Here’s an example of how you can prove certain ads contribute differently to B2B growth. In Dreamdata, we can pull up the following charts comparing first-touch, linear, custom, and last-touch attribution models across 15 campaigns. These charts were made from historical data from Segment over a few months of gathering identification funnel data.

If you were to focus solely on last-touch attribution (the green bars), you might think the nine highlighted campaigns aren’t performing very well at all.

You might think about shutting them down. But, if you look at first-touch attribution (the blue bars), most of them are doing fairly well. They’re also performing well for custom attribution (the yellow bars).

The insight you can draw from this is that while those campaigns are not good at closing new business, they are good at kicking off the customer journey and keeping your users engaged. As you move forward, you might use these nine campaigns to drive interest and rely on other campaigns to close.

All of this is possible thanks to the identification funnel data you’ve gathered with your CDP. You can now prove that while those campaigns don’t directly drive new business, they have an important role in keeping the growth engine turning.

Now, let’s run through some specific examples of how you can prove advertising and content drive B2B growth.

With a B2B attribution platform like Dreamdata, you can get granular with your data to understand the ROI of specific ads. Often the insights you draw may seem counterintuitive at first, but they prove invaluable as you hone your formula for consistent B2B growth.

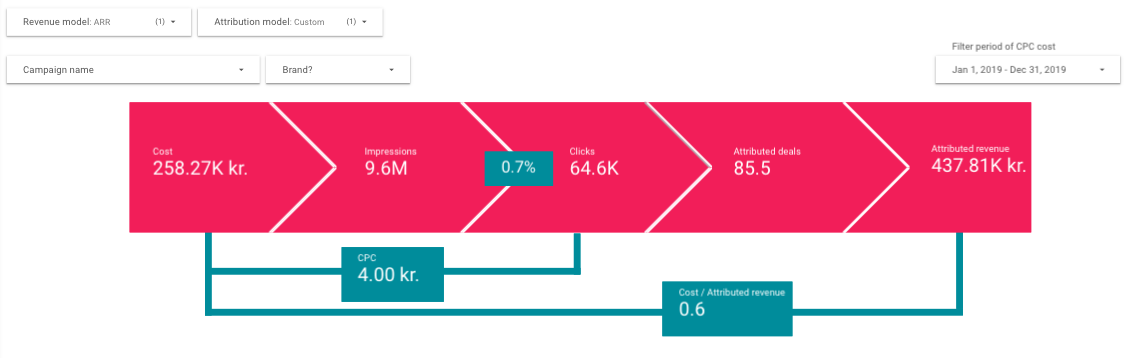

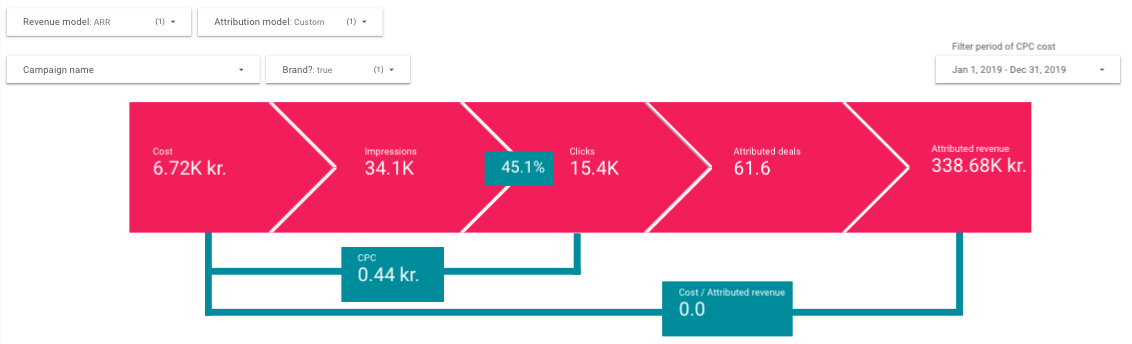

An example of this seemingly counterintuitive insight can be found in a paid search campaign. Say you’re an up-and-coming Danish bookstore for business executives called Bjorn’s Business Books. You hook up all your ad platforms, like Google Ads, to Segment, then funnel that data into Dreamdata to contextualize it.

At the end of the month, you decide to check in on how your Google ads are performing. You bucket all your Google ads into three categories: blended (all the ads), branded (ads with “Bjorn’s Business Books”), and non-branded (any ad that doesn’t have "Bjorn’s Business Books").

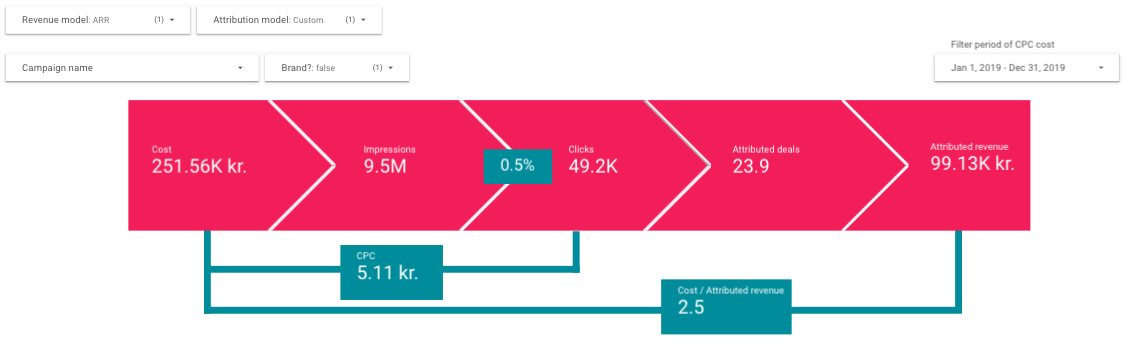

From left to right, you see how much money you spent, how many impressions you received, how many clicks your ads got, how many deals came from those clicks, and what all those deals are worth. Also, since you’re Danish, the currency we’ll measure results in is the krone (kr.).

Here, you can see that you spent around 258,000 kr. to drive 437,000 kr. of revenue. Essentially, every 1 kr. you spend becomes approximately 2 kr. in revenue. This campaign is successful in driving new business.

Here, you can see that for around every 6,000 kroner you spend on ads that mention your brand name of “Bjorn’s Business Books,” you gain around 338,000 kr. in revenue. That’s a return of over 50x!

Now things get serious. Here, you notice that for every 251,000 kr. you spend, you only make 99,000 kr. That’s a loss of more than 50% on every krone spent. Time to shut this part of the campaign off and focus only on branded ads, right? Wrong. Let’s go deeper.

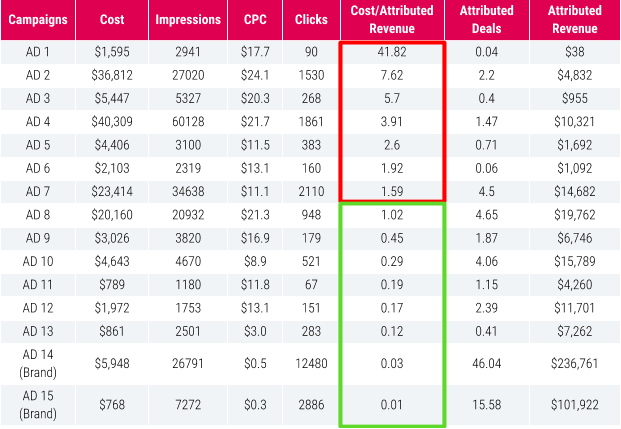

Instead of looking at each category in aggregate, we can break down performance by individual ads. Here is a table view in Dreamdata of each individual ad sorted by attributed revenue.

Starting at the top, you have the ads that cause the biggest losses. As you move down the table, you see some are performing very well, with the two most successful ads being your two branded ads.

It’s a safe bet that if you continue to run the ads in the red square, you will lose money. It’s also a safe bet that if you continue to run the ads in the green square, you stand to make money. In fact, the non-branded ads in that square drove $65,520 of revenue from an investment of $31,451.

That is demonstrable B2B growth from ads that, at first glance, seemed to be losing you money.

Once you shut off the poor performers in the red box, your blended ad performance will skyrocket. From there, you can look at these successful ads and replicate what makes them work, so your whole table becomes fit for the green square.

This is great, but what about something a little more ambiguous like content marketing?

Content is more of a slow burn than performance-based advertising, often taking months to gain traction. If you’re keeping an eye on your company’s bottom line, investing in writers and research to produce a library of content may seem like a waste of resources compared to the example above, where potentially every dollar spent on ads returns two.

The role of content in B2B growth really shines when you look at the lifetime value each piece helps create. You can start by using attribution models in much the same way we did above with paid search ads.

Bringing back the example of Bjorn’s Business Books, say you decide to invest in two categories of content: blog articles and comparison pages between you and your competitors.

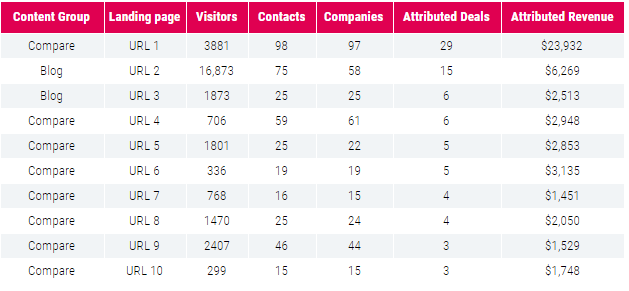

Instead of pulling from ad platforms, this time, you use Segment’s analytics.track to see what pieces of content your users interacted with, when and for how long. Combining that data with your identity funnel data in Dreamdata will allow you to pull up a table like this that lists each individual piece of content by performance.

Most of these are performing fairly well, but this table only shows a snapshot. Content, especially evergreen content, is meant to live on your website for a long time. We have to take a step deeper, so you can get the full picture of how your content is driving revenue.

Say you have a client at Bjorn’s Business Books who’s been a subscriber for two years. In that time, she’s upgraded twice — from your “basic” plan to your “pro” plan and finally to your “expert” plan. She’s also a frequent consumer of your blog content.

This is where Segment’s ability to sync many sources of data comes in handy. In your customer relationship management platform (CRM), you can gather data on how much your client has spent with you, when she upgraded and what interactions led up to those upgrades.

From your CRM, you learn that she’s spent $30,000 at Bjorn’s Business Books over the last two years. If the last article she read was the blog post with “URL 2” in the table above, not only has that piece of content-driven $6,269 in revenue, but it’s also played a major role in retaining a happy client who has spent $30,000 with you so far.

Moving forward, every time that client pays her monthly subscription, that blog post is to thank at least in part. With this insight, you can create a content plan specifically designed to bring in and retain new business.

Owning, gathering, and studying your first-party data takes time. Even then, some of your most important insights won’t surface for six months to a year (or even longer) because B2B SaaS transactions take a long time to complete. Considerations, negotiations, and approvals all have to take place before revenue starts flowing.

This means three things:

Begin storing your own first-party data correctly ASAP.

Start building out your formula.

Be flexible and make decisions based on data, not your gut.

With the technology available to you today, you don’t need to guess. You can get granular with each ad, each blog post, and each user. Then you can pull out and look at macro trends over a long period of time.

By basing your decisions on what you see in those ads, posts, users, and macro trends, you will create a B2B growth formula specifically tailored to your business. Now you know how to get started.

Our annual look at how attitudes, preferences, and experiences with personalization have evolved over the past year.