The CDP Report 2020: The Rise of Customer Data Platforms

Everything you need to know about customer data platforms but were afraid to ask.

Everything you need to know about customer data platforms but were afraid to ask.

To read The Customer Data Platform Report 2021, head this way.

We’re delighted to bring you Segment’s inaugural Customer Data Platform Report. In this report, you will get a comprehensive overview of how the customer data platform market is evolving, real life examples of how people are using customer data platforms, an overview of what’s being tracked (and what’s not), and much more.

For those short on time, you can watch a summary of the report, or check out the quick highlights below.

Segment is processing 500 billion events through its customer data platform every month. And it’s growing. In 2019, the overall volume of events that customers have tracked through Segment’s CDP increased by 60%.

CDPs are being adopted by companies big and small. But enterprise companies are sending data to 20% more destinations than SMB and MM companies.

The most popular data points being tracked show an increasing focus on behavioral data. Product added, checkout started, order completed are amongst the most popular events tracked.

CDP is becoming an essential tool for all lines of business, not just marketing. 26% of customers connect customer success tools, 15% connect CRM, and 31% connect data warehouses.

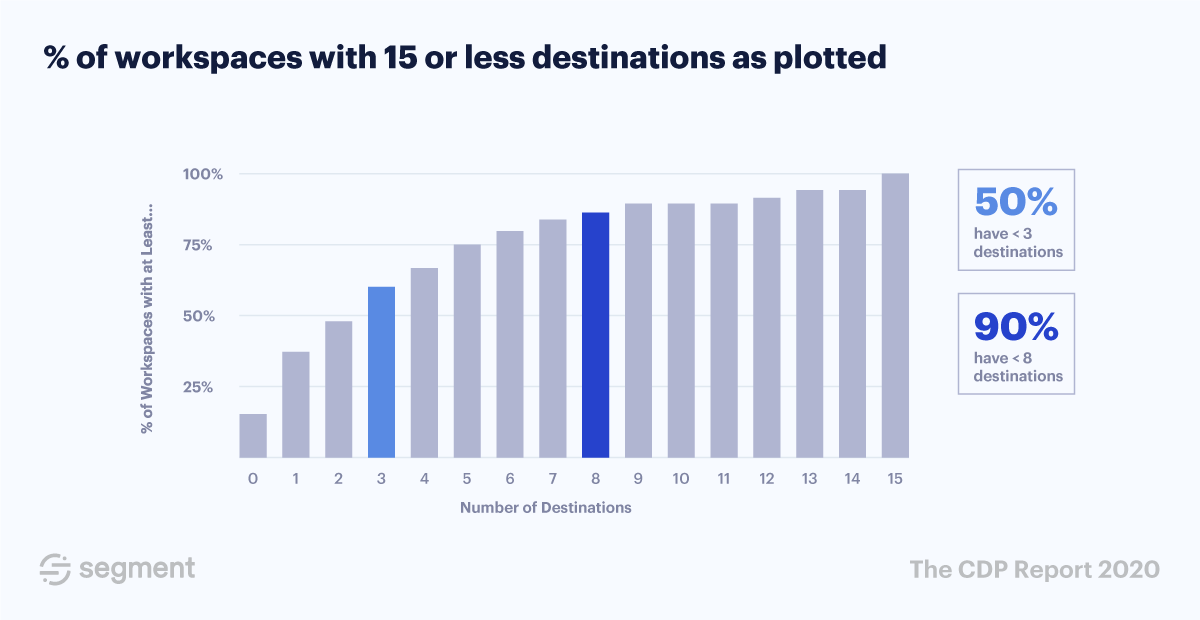

The average user of Segment’s customer data platform is sending data to eight destinations.

Remember those halcyon days when companies had one piece of software – perhaps a CRM – to manage their customer data? Well, those days are well and truly behind us.

With the number of tools growing every year (the average SaaS company uses 80+), businesses are having to invest more and more resources to keep their tools and customer data in sync.

It’s like a version of Brooks’s Law. If adding more people to a software project only makes it more complex for your team, then adding more tools to your tech stack only makes it more complex too.

It’s somewhat unsurprising then that Customer Data Platforms (CDPs) are on the verge of shifting from a “nice-to-have” technology to a “need-to-have.” Businesses are feeling the very real effects of fragmented customer data every day. IBM estimates that bad data costs the US $3 trillion each year. Bad data caused Delta to cancel hundreds of flights last year and cost the company $150 million.

Customers are becoming equally tired of these fragmented and impersonal experiences.

Check your email inbox right now, and it’s almost a sure bet that you’ll find emails that call you by the wrong name, asking you to purchase something you literally just bought, or that clearly was meant for someone else.

To avoid this, businesses are doubling down on software that gives them a unified customer record, which helps explain the explosive growth in the CDP category over the past few years.

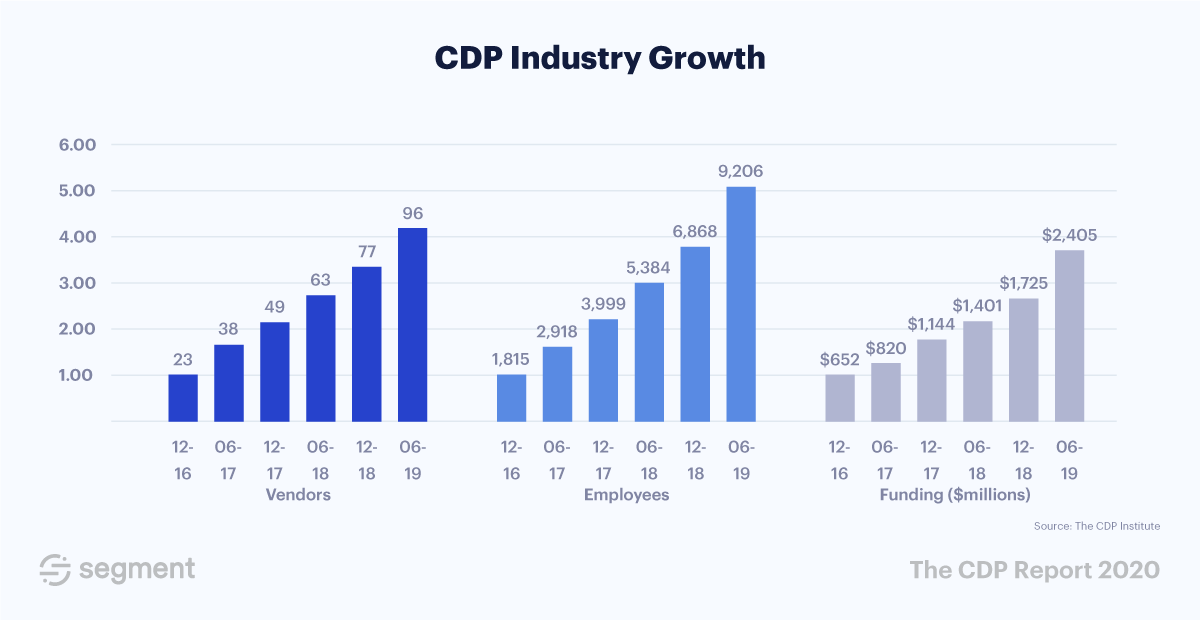

Just take a look at this research from The CDP Institute. Over a thirty-month period, from December 2016 to June 2019, the number of CDP vendors increased from 23 to 96.

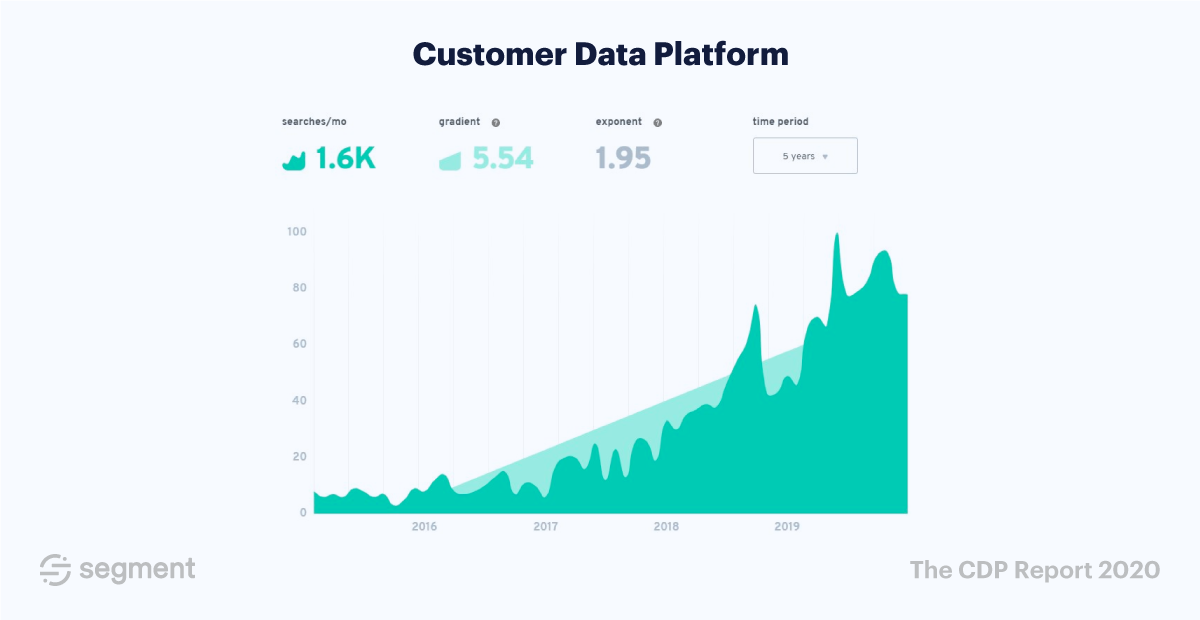

Buyer interest is growing equally fast. Data from Exploding Topics, a company that analyzes how popular search topics are, shows that interest in the customer data platform category is increasing at a steep rate.

Data and chart from Exploding Topics

Our own data corroborates this.

Over the past year, the overall volume of events that our customers have tracked through Segment’s CDP has increased by 60%.

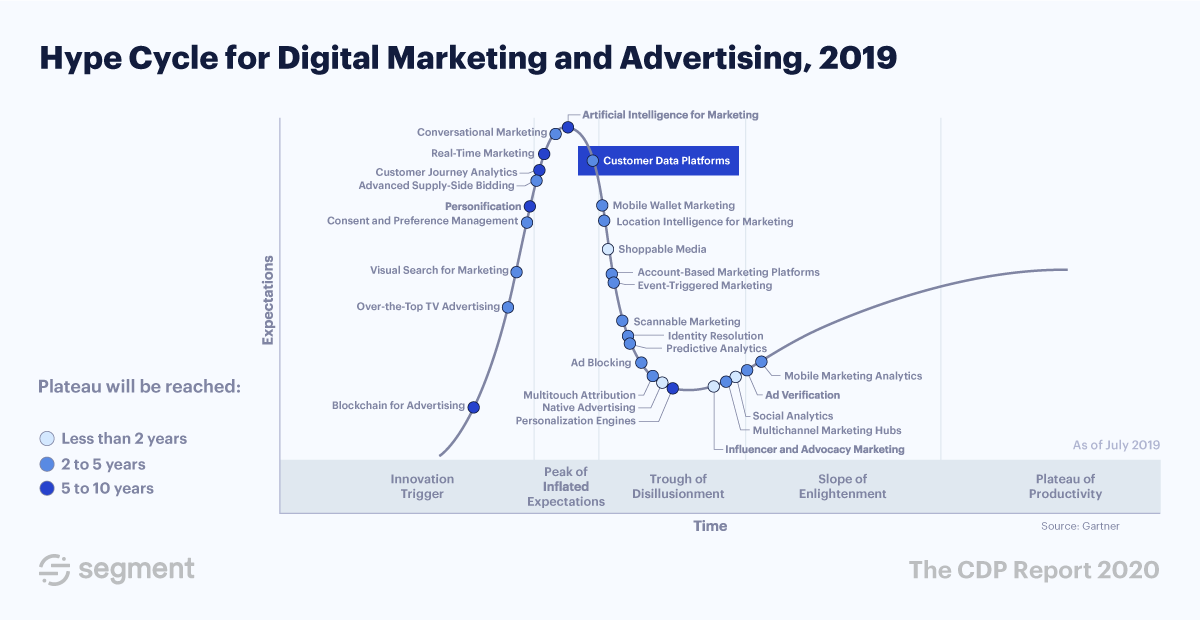

The rapid growth of CDP as a category, however, hasn’t been without its growing pains. In the annual hype cycle, Gartner recently placed CDPs in the peak of “inflated expectations.” It means that CDP buyers are expecting this technology to do more than it’s actually capable of.

This confusion is in part because of how flexible CDPs are. The technology can do a lot – implementations and use cases vary widely, which makes it hard to define exactly what a CDP is.

It’s like the story of the blind men and the elephant. Everyone is feeling around for exactly what it is and drawing their own conclusions.

A marketer thinks a CDP is one thing, a product manager thinks it’s something else, and an engineer might have a completely different idea.

The inflated expectations of CDPs are also due to the fact that some companies selling CDPs aren’t honest about the capabilities of their technology.

Research from The CDP Resource shows that over 25% of companies selling CDPs are not actually selling Customer Data Platforms. Instead, their products are CRMs, DMPs, and other data technologies passed off as CDPs.

When a company buys one of these “non-CDPs,” they’re understandably let down when their investment doesn’t do what they thought it would do.

With so much conflicting advice out there, it’s critical for businesses to educate themselves on what a real CDP really is, how it works, and how they can get the most out of this technology in 2020. (Sign up for a Segment demo here to get our take 👉)

To help, we’ve put together a comprehensive guide to help you understand the CDP landscape in 2020.

Our hope is that by understanding why customer data platforms have evolved and how they are used, you can avoid the trough of disillusionment (as Gartner would call it) when it’s time to implement a CDP for your company.

But before we do that, let’s get our definitions straight. Once we’re all on the same page, everything that follows will make a lot more sense.

At its most basic, Fisher-Price level, a Customer Data Platform is a tool that helps you bring reliable data to every team. That means it helps you with one or ideally all of the below:

Data collection - taking customer data from a number of tools.

Data processing and consolidation - combining that data to create unified profiles of your customers.

Data activation and execution - deploy those profiles to other tools to improve your customer’s experience.

Let’s dig into each of those components.

A Customer Data Platform enables you to capture complete customer data from wherever your customers interact with your brand. This includes your “owned” platforms like your website and mobile apps. It also includes your advertising channels, your email, CRM, and payment systems. Most importantly, your CDP should enable you to collect customer data from your servers for greater reliability and accuracy.

Once collected, a CDP will be able to join together all these disparate strands of data into unified customer profiles. The ability to put individual customers into related groups gives CDPs a bit of a superpower – you can see all the activity of a user, from any channel, online or offline, in one place.

A good CDP will also be able to create “anonymous” (i.e. prospects who are visiting your website but you don’t know yet) customer profiles. Once these visitors become “known” (i.e. they have identified themselves through a website form), you can stitch them together into a single customer profile. With a CDP, no data point falls between the cracks.

Finally, a CDP can apply common data standards to make sure the data you’re collecting is correct and compliant. This means you can diagnose data quality issues and get it production-ready before you decide to act on it. Which brings us nicely onto our next point…

A core competency of a CDP is the ability to easily route data to the tools you use every day. It’s like the plumbing that ties everything together.

In some cases, a CDP may provide some basic functionality to allow you to execute on the customer data that it collects. But in most cases, customer data platforms are the pipes that help your clean, unified customer data flow – from its point of collection into the tools that you use to drive engagement, loyalty and lifetime value.

Get a Segment demo here to see how a CDP works 👉

The business goal of a CDP is to bring your customer data together in one central location so that you can improve the decisions you make, your speed in delivery, and ultimately your customer experience.

But businesses don’t buy software. People do.

And since so many different teams across your company are going to use the CDP in different ways, here’s a taste of how people are using a CDP day-to-day.

With a CDP, executives can easily access data to fuel better outcomes, understand customer journeys, and make data-driven decisions.

For example, when Bonobos, the e-commerce driven apparel company, began to branch into their first bricks and mortar stores, it became increasingly apparent to Micky Onvural, their CEO, that they needed to understand all customer touchpoints, both online and offline.

A customer data platform enables executives like Micky to understand the omnichannel user experience and how online spend influences offline behavior.

→ Learn how Bonobos use Segment’s customer data platform

Since CDPs break down data silos, product teams can access the data they need to measure and improve crucial KPIs. They can also quickly scale their growth stacks and get new processes working in days, not months.

For Imperfect Food’s VP of Product, Patti Chan, who leads a small team of designers and engineers, the challenge was finding new growth opportunities, while still keeping up the day-to-day demands of the business. She needed a scalable way to run experiments and measure results without stretching her team too thin.

Today, they rely on a customer data platform to collect and deliver clean customer data to quickly run tests and evaluate results.

→ Learn how Imperfect Foods use Segment’s customer data platform

CDPs make it easier to connect all of your digital assets – from advertising campaigns to websites to email marketing. That helps marketing teams build accurate advertising audiences, better understand attribution, and prove their direct impact.

DigitalOcean wanted to use its data to create highly targeted, personalized advertising campaigns. But since their data was segmented on so many platforms, building these complex audiences was too time-consuming. It meant they defaulted to the basic, generic audiences the advertising platforms built for them, which didn’t convert.

That’s why DigitalOcean introduced a CDP to automate the manual process of creating advertising audiences. By connecting data from Tray.io, Customer.io, Google Analytics, Amplitude, and Optimizely, they were able to create highly targeted advertising audiences and decrease cost per conversion by 33%.

→ Learn how Digital Ocean use Segment’s customer data platform

CDPs offer a way to save one of the engineering team’s most precious resources – time. With a CDP, they can use one API for all customer data collection. They don’t need to spend weeks building integrations for specific tools.

For example, at IBM, the engineering team struggled with the complexity of their data feeds. Without one consolidated data pipeline, engineers would spend unnecessary time patching together disparate different sources, all of varying quality, to get a complete picture.

With a customer data platform, there’s just one API endpoint for analytics. It doesn’t matter what tool or what data source is being integrated – they can quickly and clearly understand the data lineage and trust the information displayed across the business.

→ Learn how IBM use Segment’s customer data platform

This is by no means an exhaustive list. Amongst the thousands of companies using Segment’s CDP, we’ve seen everyone from data scientists to sales directors using and benefiting from a customer data platform.

And while all of the above use CDP in different ways, they are all joined together by a common interest – understanding and using their customer data more quickly.

Venture capital money is pouring into the CDP category (reaching $2.4 billion in the last half of 2019), and established companies are buying up CDPs at a fast pace.

Just take a look at the high-profile acquisitions in the space over the past 18 months:

Acquia, the Digital Experience Platform, acquired AgilOne

Microprocessing company, Arm, acquired Treasure Data

Dun & Bradstreet, the data company, acquired Lattice Engines

Radius Intelligence was acquired by Kabbage

The business planning company, Anaplan, acquired Mintigo

Informatica, the enterprise cloud manager, acquired Allsight

Mastercard acquired SessionM

These funding rounds and acquisitions aren’t speculative. They reflect underlying changes happening in the software industry.

Let’s go deep into examining why CDPs have become a “must-have” technology:

A few years ago, we regularly heard predictions that the current technology landscape is reaching saturation point and that consolidation is inevitable.

In fact, the opposite has happened.

The latest edition of Scott Brinker’s Martech Supergraphic records 7,040 different marketing technology tools on the market and shows that the landscape is becoming more fragmented, not less.

Since most, if not all, of the tools in your tech stack are collecting some amount of customer data, it follows that having a product that brings together all of these scattered sources of customer data is table stakes.

Rather than seeing CDP as some passing fad, we should instead see CDP as a reflection of the vast tsunami of SaaS and martech over the past decade.

In the not too distant past, managing customer relationships was pretty straightforward. As our CEO, Peter, recently commented:

“One person, usually a salesperson, owned each and every customer relationship, and that person manually documented their conversations in their CRM.”

Today, customers are interacting with businesses across more channels than ever before, making this previously simple relationship much more complicated.

Businesses are expected to track all customer interactions, not just those associated with sales. Activity on your website and mobile apps, not to mention email, push notifications, support tickets, are only a fraction of what a business needs to track, store, and unify.

Now that the internet has fragmented the customer relationship across so many different channels, we require new tools that help support these complex and circuitous customer journeys.

With the introduction of the GDPR, the CCPA, and other data privacy laws, protecting your customer data is crucial. Violations to any data privacy laws can lead to massive fines, a loss of consumer trust, and a sharp drop in stock value.

Just ask Equifax. After their 2017 data breach, the company lost $4 billion in market value overnight, were fined $700 million by the FTC, and the company is still trying to gain back consumer trust.

A good CDP will help your company improve data privacy by:

Helping you collect first-party data, which is the key to data privacy.

Monitoring changes to your data inventory with real-time alerts.

Enforcing your company’s data privacy policies with privacy controls.

Giving your company a single access point for data.

Keeping your data clean and accurate.

Your CDP will help your business take a holistic approach to data security and privacy.

The growing interest and adoption of customer data platforms is a byproduct of another macro trend in the industry – the growth in customer acquisition costs.

In the last five years alone, the cost of customer acquisition has increased by over 50%. As a result, businesses have switched their focus from “How do we acquire more customers?” to “How do you grow lifetime value?”

Forbes recently surveyed a number of marketing executives about their CDP-usage. 53% said their CDPs are helping their teams to understand and engage with their existing customer’s needs, increasing the likelihood that customers will become repeat customers.

If your business wants to increase customer retention, drive customer LTV, or understand which customers are ready to upgrade, you need a CDP.

Over the past year, we've seen an incredible increase in the amount of data flowing through Segment.

Each month, Segment processes 500 billion events through our platform. In 2019 alone, the overall volume of events that customers have tracked through Segment’s CDP has increased by 60%.

By analyzing the data in aggregate of how customers are using the Segment platform, we’ve been able to generate a high-level overview of how the CDP market is evolving.

Let’s dive in.

Before you get started, it’s important to understand how we analyzed and interpreted the data.

The data is pulled from a snapshot of data for 1/1/19 to 12/31/19

In the sources section (1), the graphs show the categories of sources currently in use.

In the events section (2), the graph shows some duplication in events tracked. Login, login, logged in all appear in the top 20, and are all intended to track similar behavior. This is due to the vagaries of the businesses we work with and their naming conventions.

In the destinations section (3), each graph shows the top four tools per category, according to how many active workspaces that have enabled a destination in Segment.

Caveats:

This data is sourced from the internal usage behavior of Segment’s customer data platform. We have only included tools that have active integrations in the Segment catalog.

Now that we’ve set some ground rules for interpretation, let’s dive into the data.

The potential of a customer data platform is that it lets you collect and unify all of your customer touchpoints, not just what’s happening on your mobile apps and websites.

Our data bears this out.

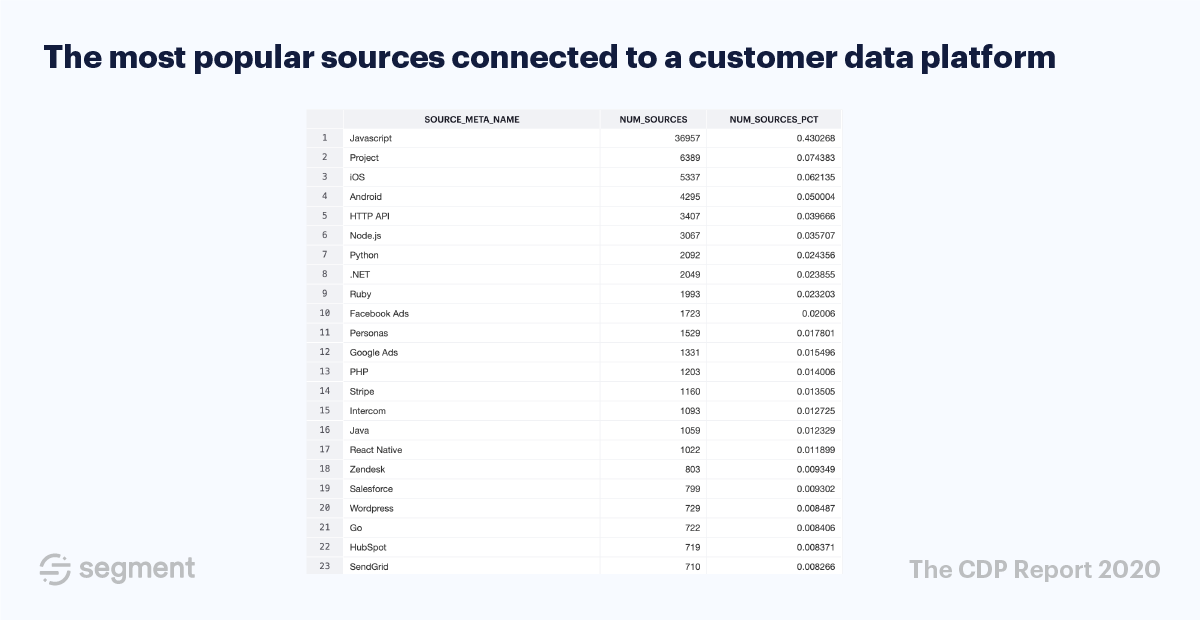

If we examine the data sources connected to Segment’s customer data platform, we see five main types of sources: Web (Analytics.js), Mobile (iOS, Android), Server (HTTP API, Node.js, etc.), and Cloud (Stripe, Intercom, etc.).

This is a reflection of customers wanting to understand the entire customer journey. In times gone by, most companies would simply analyze what was happening on their websites and mobile apps.

But that’s just a fraction of the customer experience.

Customers today aren’t just using clicking around your website or app. They’re chatting to support via live chat, talking with your sales team via email, clicking on ads on Facebook, and much more.

The data above shows us that customers are bringing a wide variety of data into customer data platforms to give them a complete picture of all customer interactions with a business.

You can use Segment to get a complete picture of your customers 👉

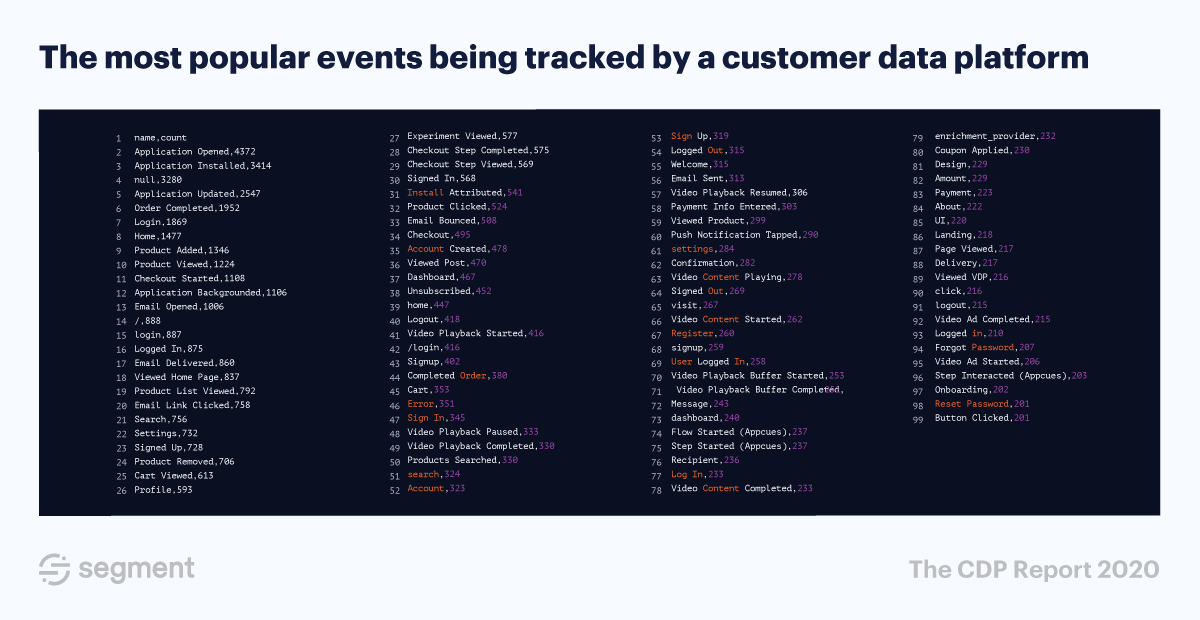

Bearing in mind the fragmentation we discussed earlier, the list of events tracked by customer data platforms is long and varied.

Perhaps unsurprisingly, the top events tracked are the core customer lifecycle events. For a B2B product, that’s things like signed up, logged in, and account updated.

For a B2C product, that’s things like product added, checkout started, order completed, etc.

However, businesses are getting way more granular than that – tracking everything from push notification tapped to password reset.

Does this mean that to adopt a CDP, you need to track every single one of these events? Absolutely not. It’s a mistake to think that tracking more metrics will help you understand your customers better. More often than not, you end up rich in data but poor in insight.

Some of Segment’s most successful customers limit themselves to tracking a handful of important events that help them answer equally important business questions.

Simply having a unified customer database isn’t enough; you need to be able to use that database effectively. A CDP is most useful when it’s used as your central nervous system and pipes clean, accurate, and consolidated data to where you need it most.

We’ve found our customers connect anywhere from three to twenty-three data destinations to their CDPs.

[Editor’s Note: What’s a data destination, you ask? It’s simply the application to which you’re sending data. An email marketing platform, for example, could be a data destination.]

Across all customers who are actively sending data, we see the following:

Unsurprisingly, the number of tools businesses are connecting to their CDPs has much to do with the specifics of their business. Enterprise customers are likely to connect more tools than, say, a small emerging startup.

This data is interesting at an aggregate level (we’ll explain why a little later), but, naturally, you might also wonder what kind of destinations people are sending data to.

We’re glad you asked.

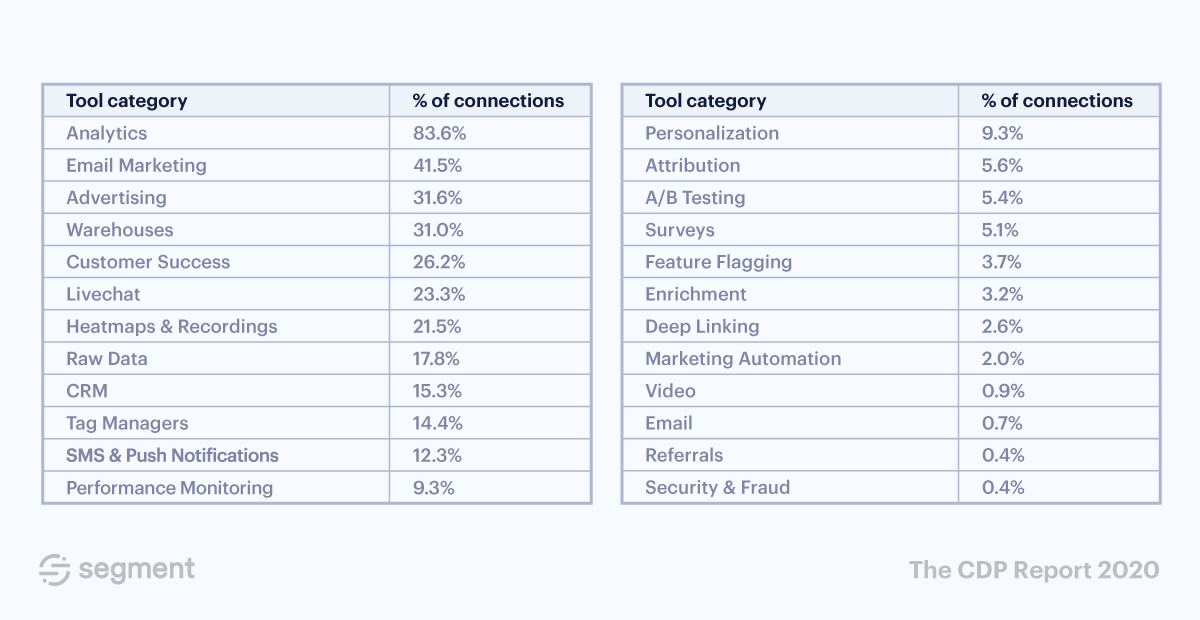

Below, we can see the most common categories of tools that businesses are sending data to.

Since each category solves a different problem or appeals to different functions within a business, this data helps us understand what teams or business units are seeing the most value of a CDP.

If we drill down even further into some of the categories, we can see in granular detail the most popular tools where people are activating their customer data. In doing so, we’ve been able to generate an in-depth view of how the SaaS market is evolving for analytics, marketing, and growth.

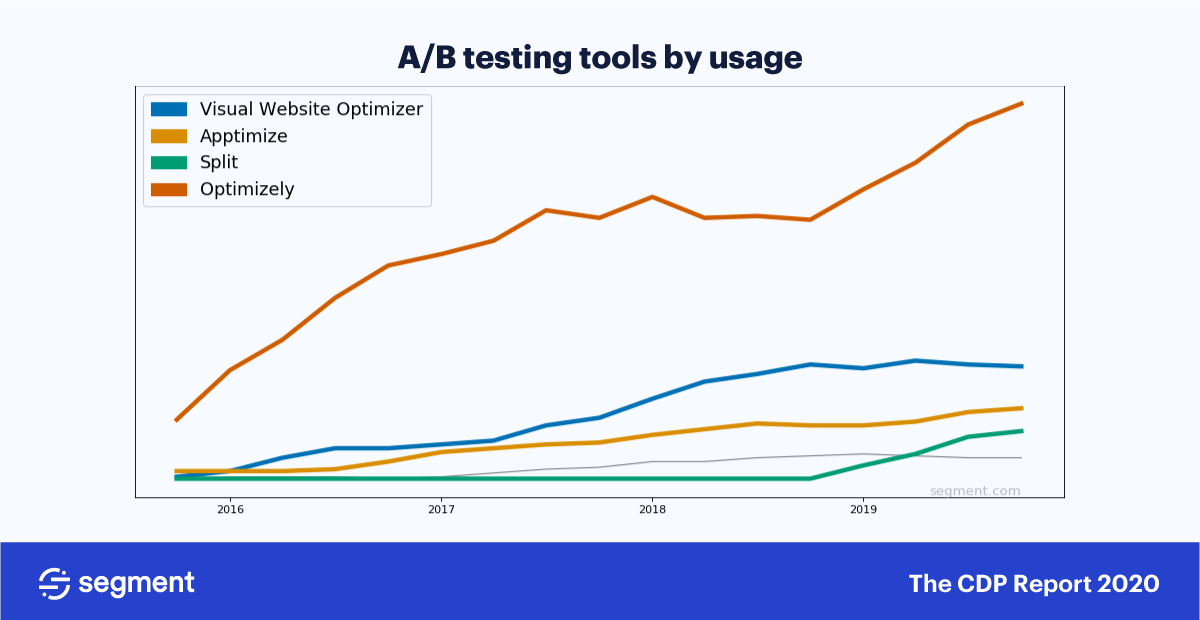

In the mid-2000 and early 2010s, having a quantitative understanding of how your marketing efforts was a relatively novel concept.

Optimizely was one of the first companies to seize on this gap in the market and, since then, have continued to own the lion’s share of the market.

However, if we examine A/B testing as a percentage of the overall categories of tools businesses are sending data to (see the preceding graph), only 5% of Segment’s customers are sending data to A/B testing tools.

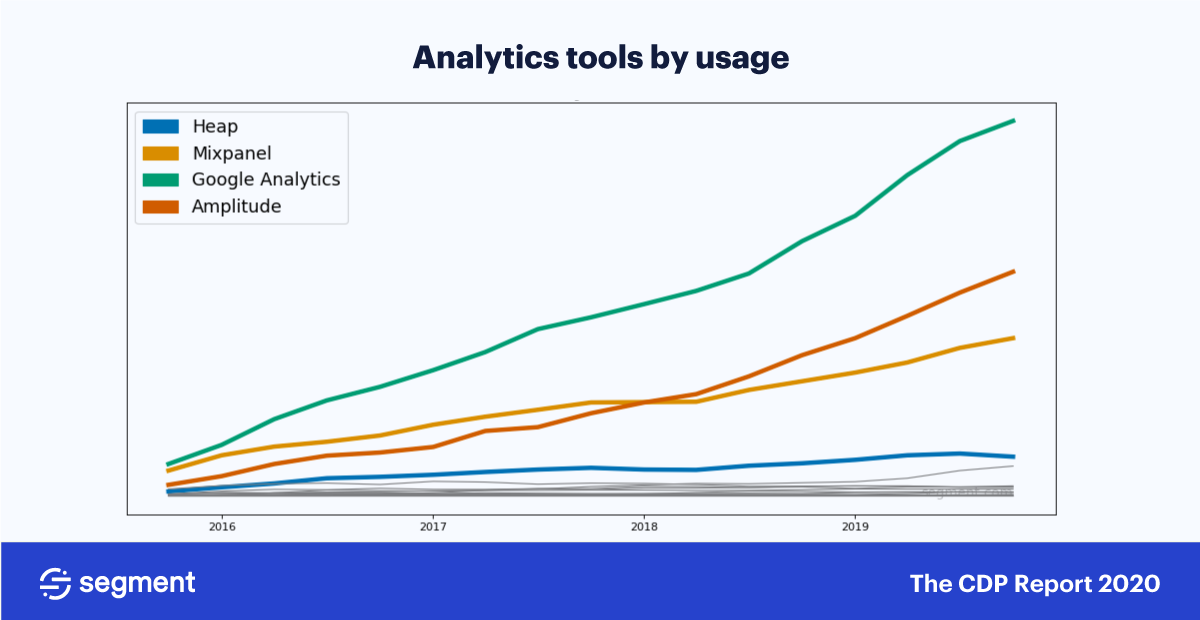

In the analytics category, Google Analytics is the most popular data destination by a wide margin. That’s not surprising, considering almost 85% of the top 100,000 websites in the US use Google Analytics.

What is surprising is that 2019 was a year of huge growth for GA amongst users of Segment’s CDP. Just look at that spike! This growth can partially be explained by a year of significant customer growth in the Segment Startup program. It makes sense that a free tool like Google Analytics is popular with bootstrapped startups.

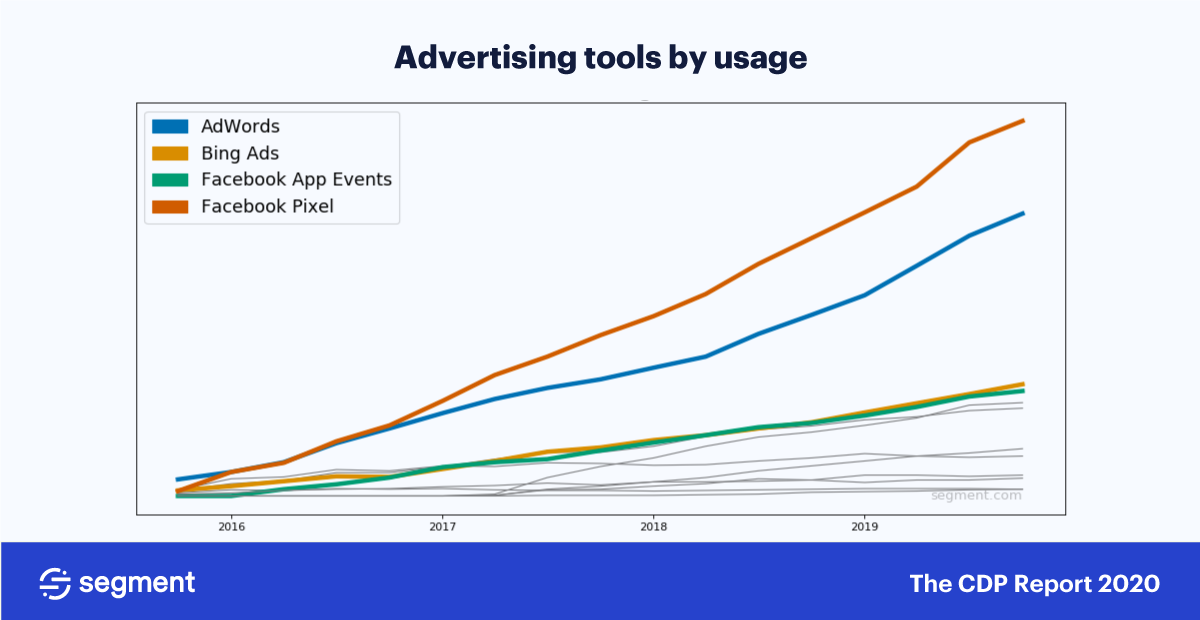

In the advertising category, the Facebook Pixel is the most enabled data destination with Google Ads coming in second. All other advertising tools are holding relatively steady, with a smaller percentage of our users connecting them.

This tallies with broader industry data that shows Facebook ads as being a particularly efficient channel for paid advertising, with the lowest median CPC.

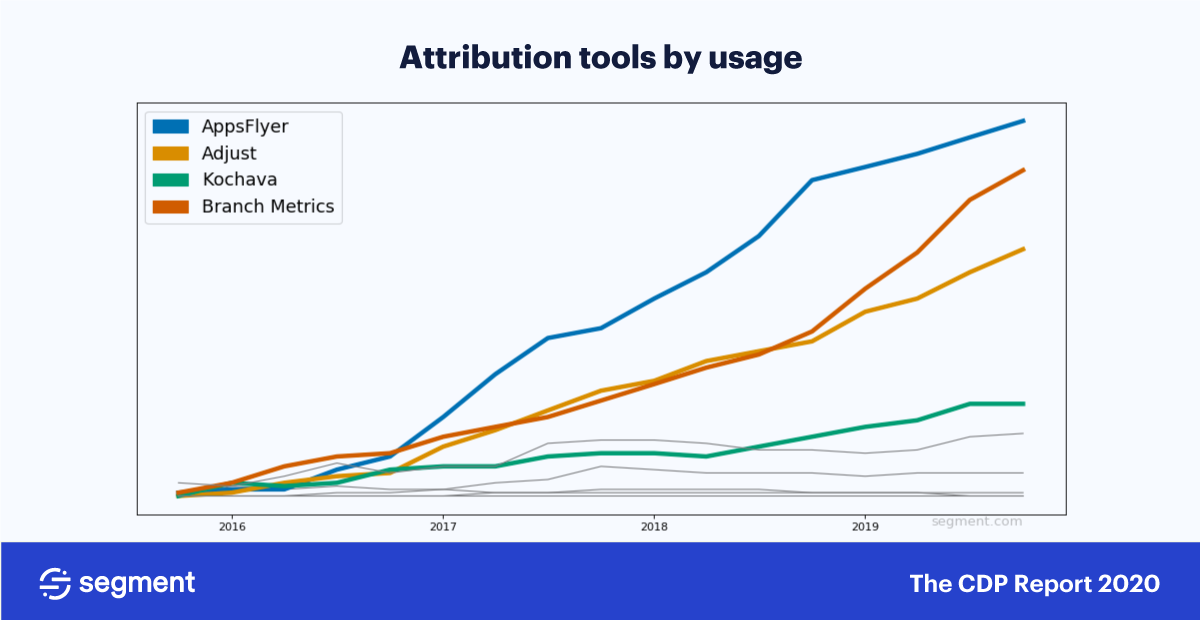

Given the power of CDP in giving users a complete view of your campaign performance, it should come as no surprise that attribution is a popular destination to send data to. AppsFlyer and Branch Metrics are the two most popular attribution tools used by our CDP customers, but Adjust has also seen a lot of usage with Segment’s customers.

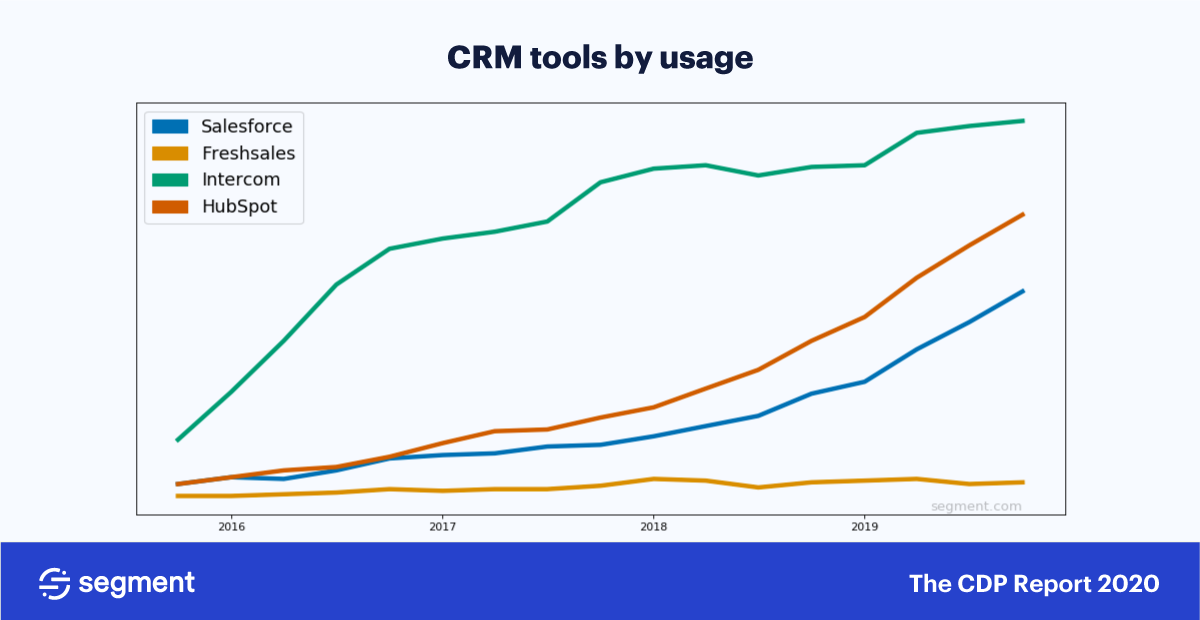

Examining which CRM tools that data is sent to provided some interesting insights. Salesforce, the longtime industry leader, is a less popular destination amongst Segment’s customers than turnkey CRMs, like HubSpot and Intercom.

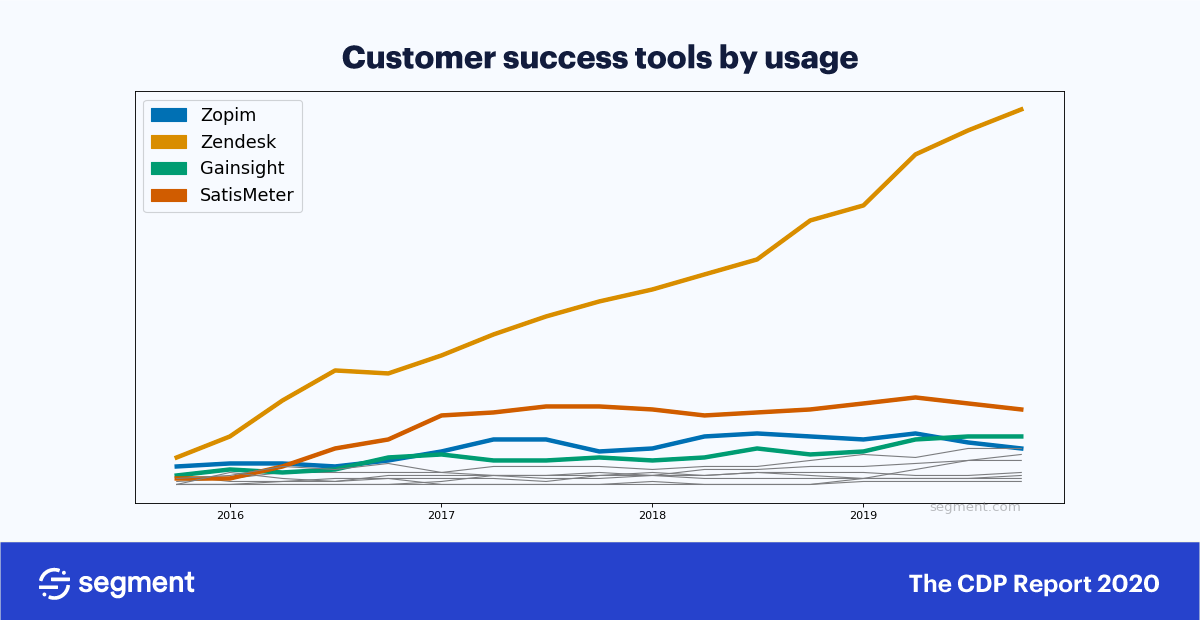

Customer success platforms were among the earliest classes of systems identified as CDPs.

So it was surprising that last year, we observed that the number of Segment customers connecting customer success tools to a CDP was flatlining. Furthermore, the customer success category was without a clear winner who was dominating the market.

This year, the opposite is true, with Zendesk becoming by far the most popular tool in the category. Gainsight, Help Scout, and ClientSuccess come in a distant 2nd, 3rd, and 4th, respectively.

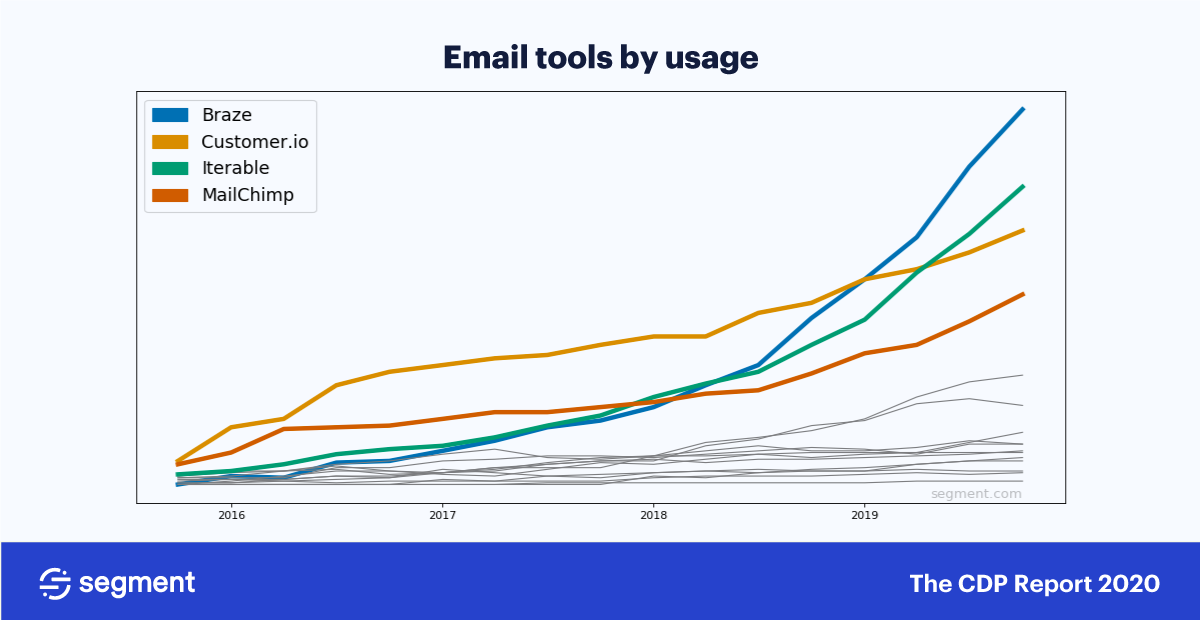

As we saw earlier, one of the most popular use cases for a CDP is to make data available in real-time, so that companies can deliver personalized experiences. It follows that 40% of Segment’s customers are sending data to an email marketing tool.

With recent enhancements to its email marketing functionality and the addition of a visual journey builder called Canvas, Braze has had a breakout year, becoming a truly omni-channel lifecycle engagement platform. It’s notable, too, that bootstrapped companies like Customer.io are continuing to grow fast in this highly competitive market.

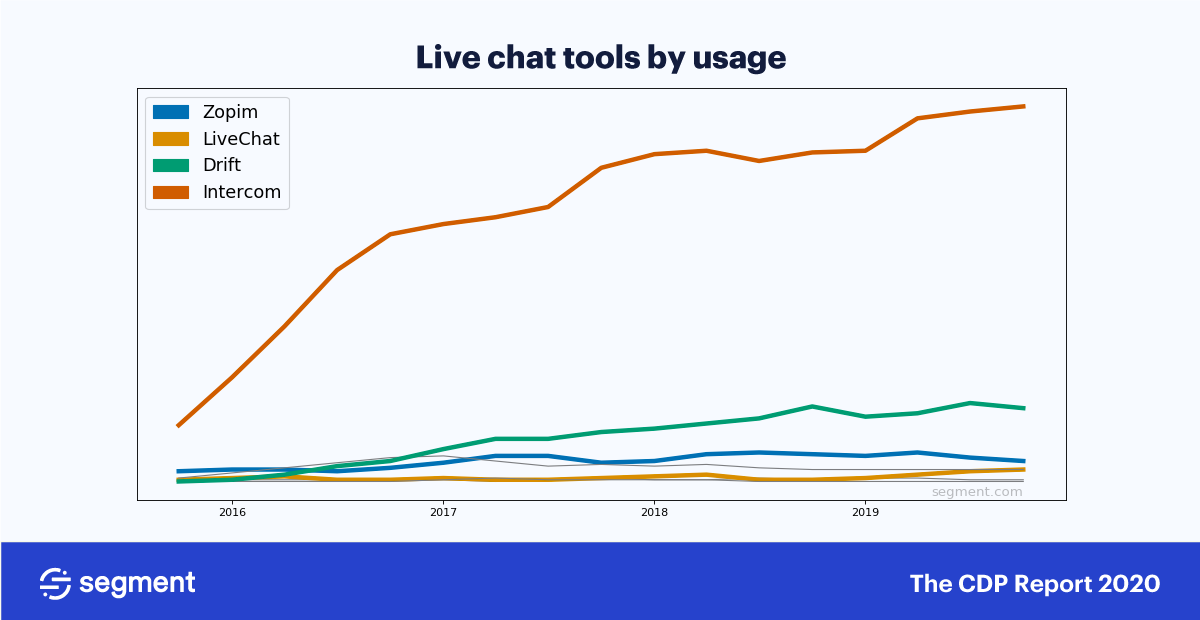

Once synonymous with archaic customer support, live chat has become one of the fastest-growing categories of software. Love it or hate it, it’s now the de-facto way of talking directly with your users on your website.

Intercom, having pioneered the concept of live chat messaging back in 2011, is the most popular live chat destination for Segment users. Still, Drift, who we identified last year as one of the fastest tools in this category, have proven that new entrants can still take market share.

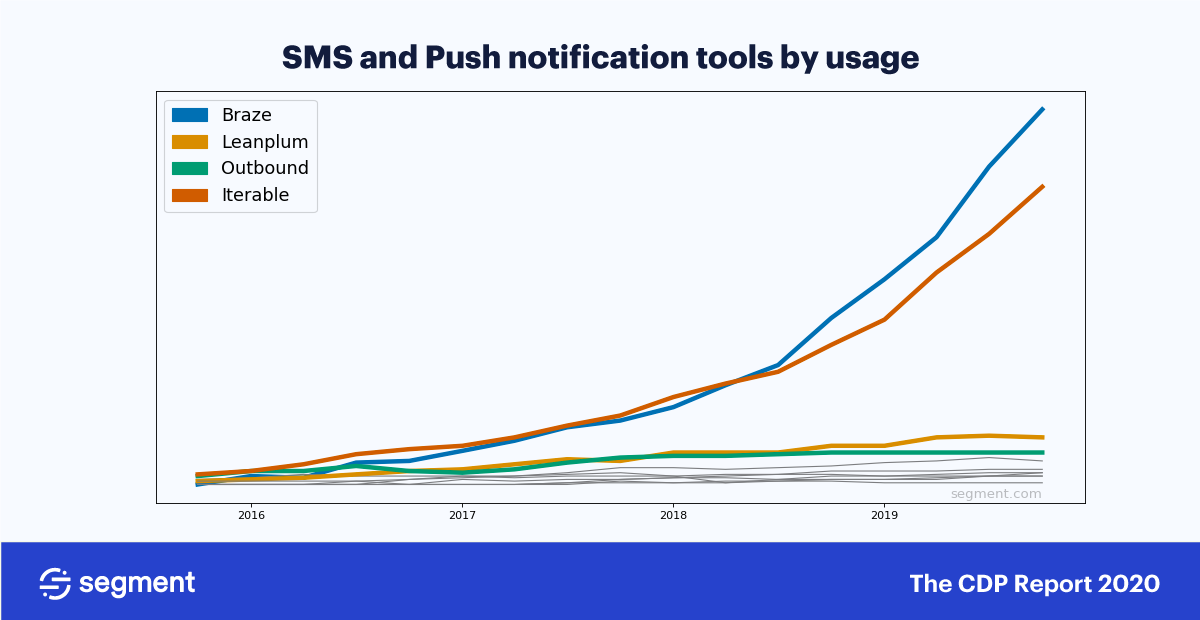

Over the past few years, we’ve seen a significant increase in the number of customers choosing to pair our customer data platform with SMS and push notification technology. In 2019, two tools in particular had a breakout year – Braze and Iterable.

In a world where irrelevant and impersonal marketing is still the status quo, having a CDP that can connect all of the engagement and additional data collected and streamed by tools like Braze and Iterable in near real-time opens up a new world of customer engagement.

(P.S. You can use the Segment API to build your ideal tech stack in a fraction of the time. Get started here 👉)

Zooming in on the usage data can help give us the raw and unprocessed facts about how people are using a customer data platform day-to-day.

But it’s also worth zooming out to look for patterns and causes that may illustrate wider trends affecting the CDP market. Here are some big picture trends we noticed.

With the average number of tools being used by a SaaS company at 80+, conventional wisdom would dictate that the ideal candidate for a CDP was an organization that had a complex, multi-tool technology stack.

While organizations with a multi-faceted tech stack will undoubtedly benefit from a CDP, it was encouraging to see companies finding value with a CDP with as few as three destinations.

As a rule of thumb, the bigger the company -> the bigger the tech stack -> the more destinations they’ll have to route data to.

But even for a growing company with a relatively modest tech stack, they can benefit from the core CDP features of data processing, segmentation, and identity resolution.

CDP is often pigeonholed as a technology exclusively for the marketing department.

However, if we look at the most common destinations that businesses are sending data to, the value of a CDP is going far beyond the walls of the marketing department.

Amongst those using Segment’s customer data platform, 26% connect customer success tools, 15% connect CRM, and 31% connect data warehouses.

As the CDP market matures and hits the mass market, we’ll likely see the user base expand towards more and more functions throughout the business.

There was a time when businesses were happy to collect simple vanity metrics like new signups, downloads, or pageviews. But page views of your homepage are irrelevant when what you actually need are paying, engaged users. Nowadays, the appetite to understand the entire customer journey extends way beyond that.

Amongst the events tracked by users of Segment’s CDP, there is an increasing focus on behavioral data. Behavior-based events like User Logged In or Application Opened are tracked commonly (though with different naming conventions) and are much more indicative of a healthy business long term.

That being said, there’s still work to do for businesses who want to understand the full funnel. For example, we see a lot fewer customers tracking Checkout Started than Order Completed in our customer data platform.

While it’s easy to use a CDP to tracking positive events like signups or goal completions, it was interesting to see customers use Segment to identify negative events too, such as Error, Unsubscribed, etc.

This can partly be explained by the dynamics of SaaS, and heightened customer expectations in general. If a SaaS product doesn’t deliver recurring value, the customer walks away. It’s on the vendor to track as many signals as possible, both positive and negative, to ensure the success of the application.

The above data tells a compelling story about the growth of the customer data platform category over the past 12 months. But to truly understand customer data platforms, we must, like Janus, look forward as well as backward.

To do that, we talked to three individuals who are particularly passionate about the category and who are best placed to predict what might be around the corner.

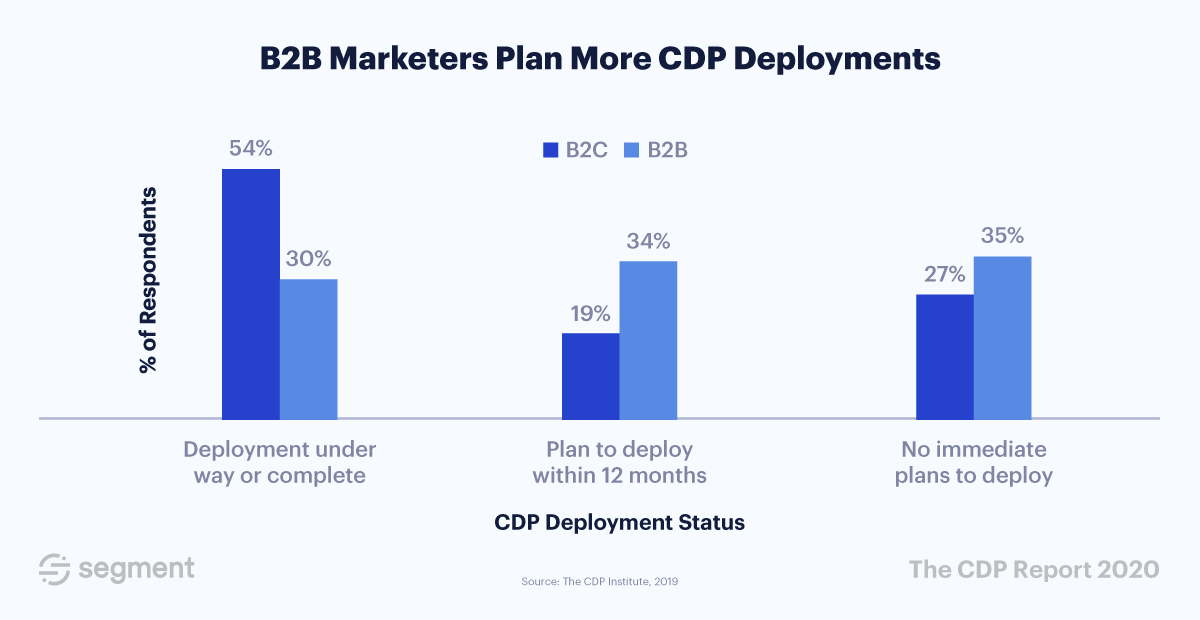

With the dramatic increase in RFPs and customer adoption of CDPs over 2019, David Raab, the founder of the Customer Data Platform Institute, has predicted that customer data platforms will be a clear line item in technology budgets.

“2020 will be a pivotal year for the CDP industry as independent vendors face new competition from large enterprise software companies. We can expect even more confusion over the definition of CDP as new players promote their own vision for the category. With luck, a clearer understanding will emerge of the different functionalities that companies need to manage and use their customer data, and less debate over which particular combination should constitute a CDP.” David Raab, Founder, CDP Institute

Many of those we interviewed for this article highlighted privacy as an area of particular focus for the year ahead. Specifically, they called out the privacy-personalization paradox – how to balance the desire for data-driven personalization with their customers' desire for better data privacy.

At first glance, it might appear that CDP – designed to track customer data – could actually contribute to data privacy problems. In reality, it’s quickly becoming an indispensable part of the solution.

It’s on vendors to educate the market accordingly.

“Education is currently a big hurdle for CDPs. CDPs have gained a lot of traction, but there are still plenty of misconceptions about their potential.

One of the most important benefits of a CDP is being able to keep up with the growing demands of the end consumer by providing them with personalized experiences. But at the same time, the privacy concerns of these are becoming equally critical. I feel like this could slow down the adoption of CDPs.” Rahul Jain, Director of Product, VWO

If 2019 saw consolidation around the core competencies of a customer data platform, 2020 will likely see new ones added. One area we expect to see innovation are purpose-built workflows created on top of CDPs.

On top of the integrations that just share data both ways, it’s possible that CDPs could add additional API endpoints to perform these actions themselves. In moving from intelligence to action, CDP would move further up the value chain.

“Considering the efficiency with which CDPs aggregate and unify customer identity and behavioral data, the next big thing will be automated workflows set up directly within the platform for specific use cases.

That could be marketing purposes e.g. send a specific email based on the customers latest action, such as clicking on an ad or starting to use a competitor tool (tools involved could be Segment, Reply, Outreach, Datanyze). It could be for sales e.g. allocate deals to tier-based AE teams based on incorporated data qualifying the potential value of a deal (tools involved could be Segment, HubSpot, Salesforce). Or it could be for success e.g. prompts to ensure successful onboarding indicators of a successful onboarding (tools involved: Segment, Vitally, HubSpot, Salesforce).

Incorporating machine learning models to predict key behaviors (intent to buy, intent to upgrade/downgrade) or to enrich customer data both at the user and the account levels (probability of closing a given subscription plan) will enable CDP users to dive deeper, and ultimately deliver on what they've advertised.” Axelle Heems, Growth Ops Manager, Gorgias

We’re incredibly excited to see what lies ahead for the customer data platform category. With Salesforce, Adobe, and others entering the market with their own take on a CDP, over the next twelve months, we can expect to see more funding and more acquisitions as customer data platforms become a regular line item in annual martech budgets.

This is a big win for the vendors involved, but an even bigger win for the customer.

The growth and evolution of the customer data platform is an acknowledgment that data quality, governance, privacy, and integration are key to the customer experience today, something Segment has been championing for the past eight years.

We can’t wait to see what’s next.

See why Segment is the top rated CDP on G2 and how we can help with the use cases from this post. Catch a demo here 👉

Our annual look at how attitudes, preferences, and experiences with personalization have evolved over the past year.