A Guide to Data Management

This guide explains what data management is and how it lets organizations capture their data’s upside while removing the downsides of unmanaged data.

This guide explains what data management is and how it lets organizations capture their data’s upside while removing the downsides of unmanaged data.

By 2025, the world's connected devices should generate 79.4 zettabytes (ZB) of data. That's 79.4 trillion gigabytes, and businesses will be collecting much of that information. Valuable insights await in this raw data, but so do security breaches, compliance risks, and IT troubles.

Data management is the term for the set of business processes and practices that let modern organizations capture the upside of the mountains of data they collect while removing the downsides of unmanaged data, like duplicate records, outdated information, and capturing useless data.

In this guide, we'll cover the following topics that every manager should be familiar with because of the growing importance of data as a corporate asset:

What is data management?

Challenges of data management at any scale

Data management processes and systems

Five tips for improving your data management

Make the most of your customer data

FAQs on data management

Data management is the policies and processes that ensure all data your business deals with is accurate, standardized, safe, and accessible for the entire organization. The ultimate goal is to help organizations extract as much value as possible from their data assets.

Imagine unmanaged, raw data as crude oil and actionable business intelligence as gasoline. Getting from oil to gasoline is a process that involves extraction, refining, quality assurance, transportation, and several other steps. Data management is the equivalent process for raw data. It helps turn raw data into actionable business intelligence for your business.

Companies need to actively manage data throughout its lifecycle—from creation to disposal. Actively managing enterprise data helps gives companies more control over the information they collect and store, which benefits them in several ways:

Decreased chance of security breaches

Reduced legal risks because of intended or unintended non-compliance

Improved ability for all teams to make better business decisions and extract more value from data in less time because it’s cleaned and standardized

More accurate market and customer insights for teams like marketing, sales, and product with less involvement from engineers and analysts

The types of data and the amount of information even small businesses deal with increases every year, and so does data's value as a corporate asset. This means customer data management is an increasingly important responsibility for companies with a continuously evolving scope that involves technical, legal, strategical, and operational challenges.

When it comes to data storage and scaling, in most cases, you’ll do well to think beyond big. Forecast more than you expect when estimating equipment, data warehousing storage space, and processes your business will need in the coming years.

Pay attention to data inconsistencies as you scale, as those usually increase along with the amount of data sources and tools you use. Teams tend to track too many events, with each of them naming events differently and sometimes tracking duplicate ones.

Third-party cloud services and platforms like Segment's Customer Data Platform (CDP) can help you scale quickly with less effort. A CDP allows you to grow as fast as necessary without having to plan exact storage and database system performance requirements for data volumes that are hard to fathom and predict. You also don't have to manually enforce data privacy and other standards, which can be tricky to do in a fast-growing company.

Regulators are paying more attention to data management practices than even just a few years ago. Regulations like the GDPR in Europe and the CCPA in California aim to give consumers more control over their data and counter privacy malpractices. There are also industry-specific protections like HIPAA for medical data and PCI for credit card data.

Such laws force businesses that deal with customer data to monitor constantly changing compliance requirements in different regions. You'll need to make sure you only capture and store the kind of data the law and consumers allow you to.

Ensuring compliance at scale is practically impossible without automation. With a CDP like Segment, you can automatically classify your customer data, enforce your privacy policy, and provide your customers with privacy controls.

Your data needs to be actionable for all teams if you want to maximize its value for your business. To achieve action-readiness, information always needs to be up to date and accessible in real time for the entire organization.

In too many companies, each department captures and manages its own data, creating silos no other teams can access.

For example, the marketing team might store email addresses in a newsletter tool, the salespeople might put contact information in a CRM, and the product team might collect customer usage and account data in application databases. Teams often store this data in different formats, so it can only be exchanged after engineers or analysts manually clean up and prepare the information.

With a CDP as the storage point for your data, you create a central source of truth for your customer information that every team can connect to independently. A CDP like Segment ensures all data is always up to date and stored in the same format without requiring any clean-up work.

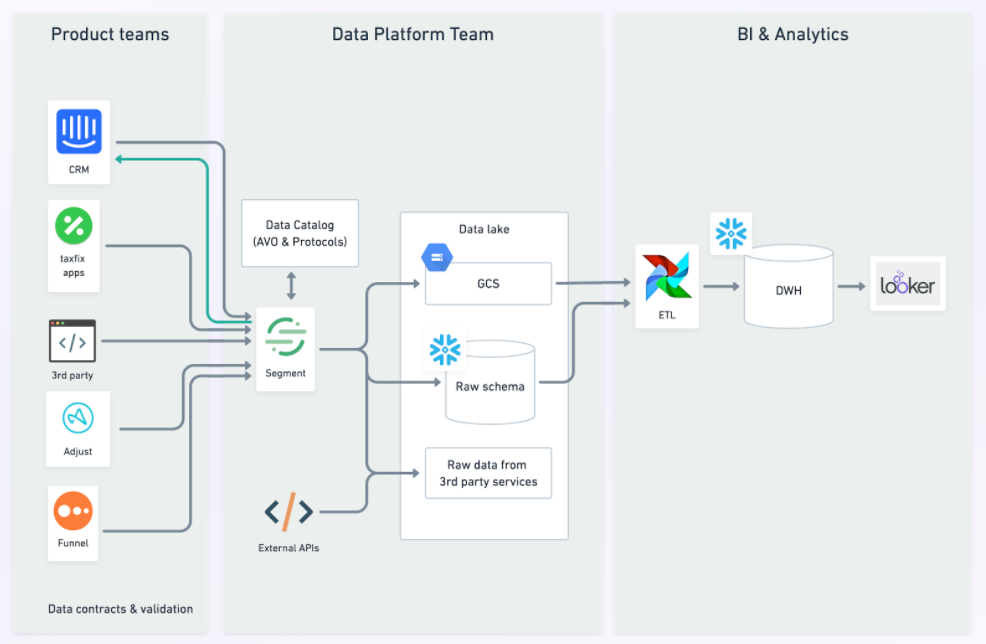

You need to choose a stack of tools for your data management, but the number of solutions that exist to store, manage, and analyze your data almost rivals the volume of data itself. There are CDPs, Customer Relationship Management systems (CRMs), Data Management Platforms (DMPs), and data science platforms. For storage, you have data warehouses and data lakes, as well as numerous data dashboards and tools for analytics and data modeling.

To make tool selection even more complex, every organization's data needs are different, so it's impossible to provide a clear-cut guide or complete selection process for picking the right tools. Still, here are some essential pointers plus links with more detailed guidance to get you on your way:

CDPs versus DMPs: CDPs help you deal with first-party data—information you collect directly from your customers. DMPs primarily handle third-party data.

CDPs versus CRMs: CDPs capture customer data across all channels and platforms. CRMs focus primarily on sales teams and their client information. CRMs' technical architecture also makes them less suitable to form a single source of truth for the entire organization.

Data warehouses versus data lakes: Raw data—often without a clear, immediate use case—goes into a data lake, whereas a data warehouse holds information that's ready for use or analysis.

For most businesses, starting with a CDP like Segment to manage first-party data is a great starting point. You ensure you capture and standardize valuable customer data across all your touchpoints. At the same time, you still have the flexibility to research and test other tools and slowly build out your data infrastructure as your needs become more apparent.

To deliver accurate, standardized, safe, and accessible information to all teams in your business, you need a broad set of processes, systems, and resources that span your organization.

Data governance involves planning, creating, implementing, and enforcing policies that outline how your organization manages its data. Its ultimate goal is to ensure the widespread availability of high-quality data—information that's standardized, secure, compliant, and up to date.

Data architecture deals with designing the infrastructure required to meet your company's data management objectives and standards.

Data modeling and data design are concerned with the organization of data, such as the layout and design of the databases and the programming languages to use for managing data in your databases, for example, SQL.

Data storage covers the implementation and maintenance of the physical hardware or cloud-based infrastructure you use to collect, store, and manage your data, such as servers, data management platforms, data warehouses, and data lakes. Data integration practices ensure raw data is organized and maintained in a structured form in a database.

Essentially, you use data storage to implement your data architecture and data integration to implement your data models.

Data quality looks after the information you're capturing, storing, and distributing to ensure it's complete and up to date. It helps prevent problems like duplicate records, inconsistent versions, missing information, and corrupt data.

Data security deals with the protection of your data through encryption and other methods. Its purpose is to ensure your organization's information is only accessible to authorized users and to prevent issues like losing data through unintended moving or deletion.

Data analytics often forms the endpoint for the information that went through your data management process. It's where the data gets mined for its golden by data scientists in the form of business intelligence and insights to inform and enable things like decision-making, personalization, marketing campaigns, and intelligent customer support.

To expand your collection of data management best practices right away, add these five tips.

To extract business value from your data, you need to plan your data management activities. In our guide for CDP success, we've outlined an approach you can use to plan why and how your organization will manage its data:

Envision the outcome. Form a clear picture of what you want to achieve with data in your organization.

Map out the requirements. Make an overview of the business and technical requirements for your data, and connect those to the desired outcomes.

Create focus with the CDP Value Generation model. The Value Generation Model helps you map use cases for your data to outcomes, stakeholders, and KPIs.

These three steps can form the basis for documenting the more detailed policies and processes of your data governance. You'll want to store these documents in a central knowledge management system, where they're easily accessible to the entire organization using a tool like Confluence or Notion, for example. You'll also need to define procedures for keeping the information up to date since people and their knowledge might leave the organization, and your data management needs will undoubtedly evolve.

You're not done with the standardization of your data when you've defined your standards; you'll need people to implement and uphold them. As Seth Familian, principal of advisory services at Segment, likes to say: "Behind every piece of good data is a great person who adopted a great standard."

You'll need to teach and train people to manage data following your data governance policies and processes.

Include data management topics in the onboarding of new employees.

Add information on data management to an internal wiki or knowledge management system.

Develop and distribute data management courses through an e-learning platform.

Make updates on data management policies a part of recurring meetings like town halls or quarterly updates by the organization's leadership team.

Data security and compliance are like insurance against the enormous financial and reputational damage your business will suffer from data breaches and intended or unintended non-compliance. Like insurance, you might get away without it for some time, but one day it's likely going to be your undoing. By prioritizing security and compliance practices across the organization, you'll minimize risks and be able to deal with threats, breaches, and other such challenges promptly and effectively.

Regular data audits ensure the reality on servers and databases matches the theoretical standards and policies you've documented as part of your data governance. Such audits should include the following:

Ensure there are no data silos by reviewing what data each team is storing and where and making sure it's accessible and usable by all departments.

Review the intended use of the data that your teams are storing. When there's no clear use case in the foreseeable future, consider deleting the information, moving it to a data lake, or not capturing it in the first place.

Run technical performance tests on all data-related infrastructure. This should include stress tests based on forecasted data volumes for the months and years ahead.

Review compliance and security checks, such as whether encryption is used, unauthorized access is prevented, and so on.

The frequency of your audits depends on the size of your organization, the amount of data you deal with, and the nature of your industry. For example, a SaaS or eCommerce business might find bi-annual or annual data audits sufficient, whereas banks might run checks quarterly or monthly.

You can now automate many aspects of data management. In fact, some tasks are practically impossible to handle without automation, like enforcing standardization and privacy compliance across large datasets.

Some tasks you should consider automating are testing performance levels of infrastructure, enforcing standardization and compliance, doing parts of audits, generating predictive analytics reports, measuring data quality at the source, and running regular security checks.

For example, Hydra.ai offers an integration with Segment that creates predictive analytics reports with minimal input from the user and no need to write any code. Another Segment feature, Protocols, helps enforce data standards across your organization by creating a global, standardized Tracking Plan for your organization.

Segment Academy defines customer data as "any piece of data that indicates who your customers are and how they are using your product or service." For most companies, such information has become one of the most valuable pieces of data they're managing. It helps you better understand your customers and improve the performance of critical aspects of your business, like operations, marketing, product, and support.

A Customer Data Platform (CDP) like Segment takes the hard work out of managing such information by automating many tasks like real-time capturing, standardization, audience creation, segmentation, and privacy compliance. This, in turn, makes it easier for all departments to access and extract the most value possible from customer data without requiring engineers to do so.

For example, your marketing team can independently try out new tools and launch campaigns using customer data as soon as it's captured. Support agents can see the entire customer journey in real time while they're serving a client. And executives can look at fully up-to-date dashboards instead of making decisions based on reports that are days or even weeks old.

Our annual look at how attitudes, preferences, and experiences with personalization have evolved over the past year.

Data Management Platforms (DMP) collect and manage large, anonymized datasets of audiences. DMPs usually work with second- and third-party data collected from partners or data sellers. CDPs help you do the same but instead with first-party data—customer information you've collected from your own platforms and sources.

A Database Management System (DBMS) is software that lets you work with the data in a database by allowing you to edit the data itself, as well as elements like its format, structure, and field names.

There are many different roles within the field of data management. Generally speaking, anyone working within this area needs to understand computer science, database programming, business intelligence and analytics, and machine learning.

As data is now seen as a valuable corporate asset and managing it involves technical expertise, there are different ways to assign responsibility for data across an organization. Often, a chief data officer or chief technical officer takes responsibility for the technical aspects of data management, while the business aspect—generating value from the data—might rest with a chief marketing officer or even chief financial officer.